Ethereum Exchange Traded Funds Face Challenges with Consecutive Losses

Ethereum Exchange Traded Funds (ETFs) have hit a rough patch, recording losses for three days in a row. This trend highlights the contrast in investor interest between Ethereum and Bitcoin, as Bitcoin funds continue to attract steady inflows. According to recent data, Ethereum ETFs experienced a net outflow of $38.2 million on September 3, marking the third consecutive day of decline.

The largest contributor to this outflow was Blackrock’s Etha Fund, which saw a drainage of around $151 million. However, this was partially offset by inflows into other funds, including Fidelity’s Feth ($65.8 million), Grayscale’s Spot ETH Fund ($26.6 million), and Bitwise ETHW ($20.8 million). Despite these recent losses, Ethereum ETFs had previously enjoyed a strong run, with six consecutive days of inflows totaling over $1.8 billion.

Ethereum Price Movement and Investor Interest

The recent decline in Ethereum ETFs coincides with the cryptocurrency’s own price struggles. The ETH price started the day near $4,400 and recovered from an earlier slump to $4,200, according to market data from CryptoSlate. At the time of writing, ETH was trading at $4,414, up about 0.95% for the day, although it remains around 4% lower for the week and 11% below its all-time high.

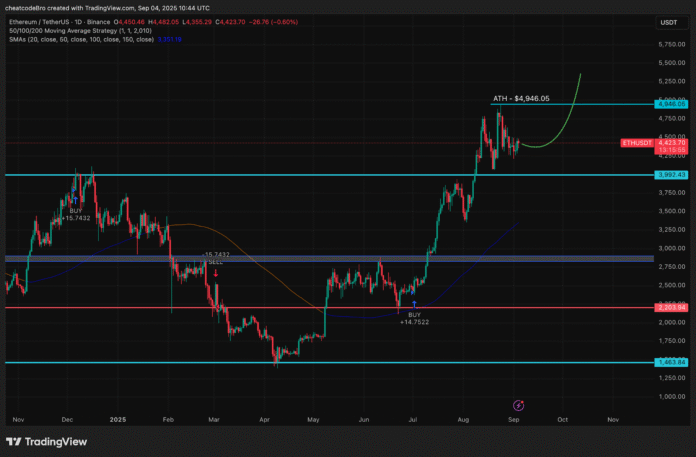

Analysts have identified the $4,500 level as a critical breakout threshold. A break above this could unlock fresh upward momentum, while failure to do so may keep the price range-bound between $4,100 and $4,000. However, the price action over the past few weeks suggests that Ethereum is maintaining an optimistic trend, with the price holding above key moving average values. Some forecasts even suggest a potential move towards $5,000, with a stretch target of $6,000 if momentum builds.

ETH price diagram showing support and resistance levels and moving average values | Source: Tradingview

ETH price diagram showing support and resistance levels and moving average values | Source: Tradingview

On-Chain Data and Institutional Activity

On-chain data shows that several entities are accumulating ETH, which could help stabilize the price and provide a stronger foundation for further gains. Increased activity from whales and institutions also boosts the prospects for Ethereum. If a positive dynamic develops, ETH could be poised for a short-term recovery, which may restore strong inflows into Ethereum Exchange Traded Funds.

For more information on Ethereum ETFs and their performance, visit Crypto.News.