Cryptocurrency Markets Experience Consolidation After Recent Rally

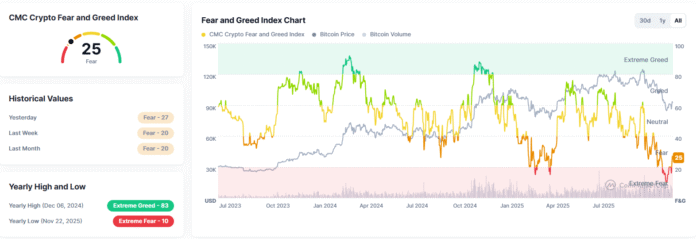

Following last week’s highly anticipated market rally, cryptocurrency markets have entered a period of consolidation. Despite Bitcoin (BTC) maintaining its position above the crucial psychological level of $90,000, investor sentiment remains dominated by fear, with a slight improvement from 20 to 25 over the course of the week, as indicated by CoinMarketCap’s Fear & Greed Index.

In the broader crypto landscape, Ether (ETH) treasury trading appears to be weakening, with monthly purchases by Ethereum digital asset treasuries (DATs) down 81% over the past three months from the August peak. Nevertheless, BitMine Immersion Technologies, the largest Ether company holder, continues to accumulate ETH, while other financial companies persist in their fundraising efforts for future acquisitions.

Investors are eagerly awaiting the key interest rate decision during the upcoming Federal Reserve meeting on Wednesday, which is expected to provide further guidance on monetary policy through 2026. Markets are currently pricing in an 87% chance of a 25 basis point rate cut, up from 62% a month ago, according to CME Group’s FedWatch tool.

Ethereum Treasuries Trading Plunges 80% as Whales Dominate Buying

Ethereum treasury trading has experienced a significant decline, with monthly acquisitions continuing to decrease since the August high, even as major players continue to capture large portions of the Ether supply. According to Bitwise, an asset management firm, investments in Ethereum DATs fell 81% in the last three months, from 1.97 million ETH in August to 370,000 ETH in November.

Despite the slowdown, companies with stronger financial backgrounds have continued to build up their holdings of the world’s second-largest cryptocurrency or raise funds for future purchases. BitMine Immersion Technologies, the largest corporate Ether holder, accumulated around 679,000 Ether worth $2.13 billion last month, reaching 62% of its goal of accumulating 5% of ETH supply, according to data from Strategicethreserve.

BitMine has $882 million worth of additional cash, which could indicate greater Ether accumulation. The data aggregator also reveals that BitMine has been actively accumulating ETH, while other financial companies continue their fundraising efforts.

Citadel Calls for Stricter DeFi Regulations

Market maker Citadel Securities has recommended that the U.S. Securities and Exchange Commission tighten decentralized finance regulations regarding tokenized stocks, sparking backlash from crypto users. Citadel Securities told the SEC in a letter that DeFi developers, smart contract coders, and self-custody wallet providers should not be granted a broad exemption for offering trading in tokenized U.S. stocks.

Citadel’s letter, written in response to the SEC’s request for feedback on how it should approach regulating tokenized stocks, has drawn significant backlash from the crypto community and organizations committed to innovation in the blockchain space. The company argued that DeFi trading platforms likely fall under the definitions of an exchange or broker-dealer and should be regulated by securities laws if they offer tokenized stocks.

Arthur Hayes Warns of Monad’s Potential Collapse

Crypto veteran Arthur Hayes has issued a warning about Monad, saying the recently launched Layer 1 blockchain could collapse by up to 99% and become another failed experiment driven by venture capital hype rather than real adoption. Speaking on Altcoin Daily, the former BitMEX boss described the project as another high-FDV, low-float VC coin, arguing that its token structure alone puts retail traders at risk.

Hayes said most new Layer 1 networks ultimately fail and only a handful are likely to remain relevant in the long term. He identified Bitcoin, Ether, Solana (SOL), and Zcash (ZEC) as the small group of protocols that he expects to survive the next cycle.

Crypto Lending Market Reaches $25 Billion

The crypto lending market has become more transparent than ever, led by companies like Tether, Nexo, and Galaxy, and has reached nearly $25 billion in total outstanding loans in the third quarter. According to Galaxy Research, the size of the crypto lending market has increased by more than 200% since the beginning of 2024.

Alex Thorn, head of research at Galaxy, said the main difference is the number of new centralized funding platforms and much more transparency. Thorn expressed pride in the chart and the transparency of its contributors, adding that it was a big change from previous market cycles.

Portal to Bitcoin Raises $25M and Launches Atomic OTC Desk

Native Bitcoin interoperability protocol Portal to Bitcoin has raised $25 million in funding as part of the launch of what it calls an atomic over-the-counter (OTC) trading desk. The company has raised $25 million in a round led by digital asset lender JTSA Global, according to a Thursday announcement shared with Cointelegraph.

Alongside the new funding, the company launched its Atomic OTC desk and promised instant, trustless cross-chain settlement of large block trades. What sets Portal to Bitcoin apart is its focus on the Bitcoin-anchored cross-chain OTC market for institutions and whales, as well as its technology stack.

Overview of the DeFi Market

Most of the top 100 cryptocurrencies by market capitalization ended the week in the red, according to data from Cointelegraph Markets Pro and TradingView. The Canton (CC) token fell 18%, marking the week’s largest decline in the top 100, followed by the Starknet (STRK) token, which fell 16% on the weekly chart.

For more information on the cryptocurrency market and DeFi developments, visit https://cointelegraph.com/news/bitcoin-90k-whales-eat-ethereum-dip-finance-redefined?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound