Uncovering the Mass Liquidation Event in the Crypto Market

The recent crash on October 10th sent shockwaves through the crypto market, resulting in the largest liquidation event in history. According to CoinGlass data, a staggering $19 billion was liquidated, leading to a $65 billion drop in open interest. This unprecedented event surpasses other notable liquidation cascades, such as the COVID-19 crash and the FTX plunge, which saw $1.2 billion and $1.6 billion in liquidations, respectively.

Investigations into the cause of the crash have revealed that vulnerable price oracles on the Binance exchange played a significant role. The collateral value of three pegged crypto tokens, namely USDE, bnSOL, and wBETH, was determined using Binance’s internal order book data, rather than an external oracle. This vulnerability put users of the Unified Accounts feature at risk of liquidation in the event of market irregularities, highlighting the importance of robust price oracles in maintaining market stability.

Analysis of the USDE/USDT Trading Pair

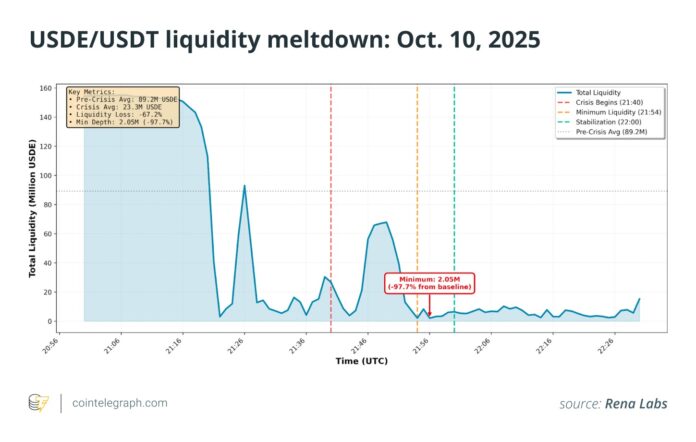

Cointelegraph Research has analyzed the unusual activity in the USDE/USDT trading pair using exclusive data from AI-driven market analysis firm Rena Labs. The data reveals a massive liquidity collapse, with the average total liquidity for USDE plummeting from $89 million to just $2 million in a matter of minutes. This sharp decline in liquidity led to a significant increase in trading volume, with the number of trades per minute rising from 108 to almost 3,000.

The market lost its structural integrity as a result of the crash, with bid-ask spreads exploding by up to 22%. The price of USDE on Binance’s spot market fell to $0.68, while it remained relatively stable on other exchanges. The data also shows that many of the orders during this period were due to panic selling, stop loss triggers, and forced liquidations, highlighting the fragility of the crypto market.

Evidence of Abnormal Market Activity

Rena’s anomaly detection engine recorded abnormal activity in the USDE/USDT trading pair long before the liquidity crisis. The engine detected 28 anomalies around 21:00 UTC, a rate four times higher than the previous hour. These anomalies included unusual spikes in volume, prices, and trading intensity, as well as suspicious patterns and fingerprinting activities characteristic of order forgery.

The size profile of the order book revealed three distinct salvos of large orders shortly before the crisis, which were placed when BTC had already started to fall on major exchanges, but before USDE faced a liquidity crisis. This evidence suggests that the crash may have been triggered by a coordinated attack, although the evidence is not yet conclusive.

Conclusion

The USDE crash highlights the fragility and leverage that still exists in the crypto market, where cascading liquidations can wipe out supposedly safe trades. The event also shows that the market for many tokens has little organic demand to support it, and that the absence of large market makers can lead to a lack of resilience in the order books of many crypto assets. As the crypto market continues to evolve, it is essential to prioritize robust price oracles and market stability to prevent such events from occurring in the future.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/exclusively-obtained-orderbook-data-reveals-details-about-usde-crash?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound