US Federal Reserve Explores New Payment Accounts for Fintechs and Small Companies

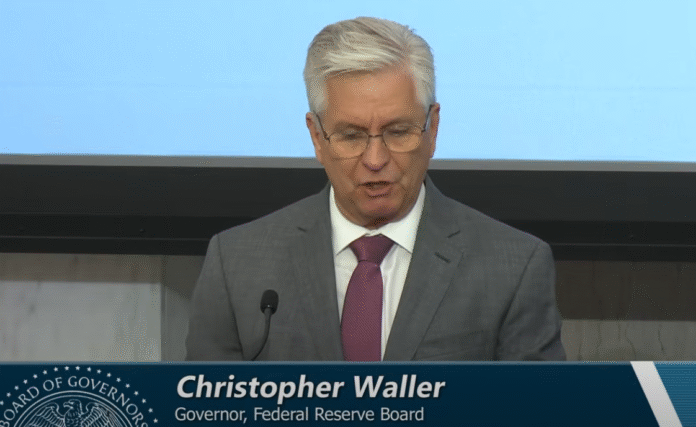

The US Federal Reserve is considering introducing a new type of payment account that would enable smaller businesses to participate in the central bank’s payments system, potentially signaling the end of banking access challenges for the crypto industry. This development is seen as a positive step towards integrating fintech and crypto payment companies into the traditional financial system (TradFi). According to Fed Governor Christopher J. Waller, the newly created “payment accounts” would provide full access to fintech companies that want to use the Fed’s payment services, which are currently reserved for large banks and financial institutions through the Fed’s “master accounts.”

Waller announced the idea of “payment accounts” during his speech at the Payments Innovation Conference on Tuesday, stating, “I believe we can and should do more to support those who are actively transforming the payments system.” The payment accounts would be available to all institutions authorized to have an account that currently process payment services through a third-party bank. The “slim” master accounts would provide access to the Fed’s payment channels while “controlling various risks to the Federal Reserve and the payments system,” Waller explained. Federal Reserve Governor Christopher J. Waller speaks at the Payments Innovation Conference. Source: YouTube

Positive Development for the Crypto Industry

Industry observers view the news as a positive development for the crypto industry, as many companies have faced debanking challenges in the past. During former US President Joe Biden’s administration, at least 30 tech and crypto founders were denied banking access in what some insiders described as an orchestrated operation dubbed “Operation Chokepoint 2.0.” Source: Caitlin Long

Custodia Bank founder and CEO Caitlin Long welcomed the news, writing in a Tuesday X post, “THANK YOU, Governor Waller, for recognizing the terrible mistake the Fed made in blocking payment-only banks from Fed principal accounts and reopening the access rules the Fed put in place to keep @custodiabank out.” Long added, “The Fed told the courts that such companies would threaten financial stability because they were inherently uncertain and uncertain. Thank you for admitting that’s not true – it was never true!”

Fed’s Hands-On Approach to Tokenization, Smart Contracts, and AI-Based Payments

The Fed has been experimenting with blockchain technology for payments and is now exploring both blockchain and artificial intelligence for payments-related use cases. Waller stated, “We are also looking ahead and conducting practical research into tokenization, smart contracts, and the interface between AI and payments for use in our own payment systems.” The central bank aims to understand innovations in the payments system and assess whether these technologies could provide opportunities to modernize its own payments infrastructures.

For more information on the US Federal Reserve’s plans to introduce new payment accounts for fintechs and small companies, visit https://cointelegraph.com/news/fed-mulls-payment-accounts-fintechs-small-companies?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound