Key Insights:

-

The Federal Reserve’s potential pause on interest rate cuts could exert downward pressure on cryptocurrency markets, but the implementation of “stealth QE” may help mitigate these risks.

-

Liquidity is expected to play a more significant role than interest rate cuts in determining the direction of Bitcoin (BTC) and Ether (ETH) in the first quarter of 2026.

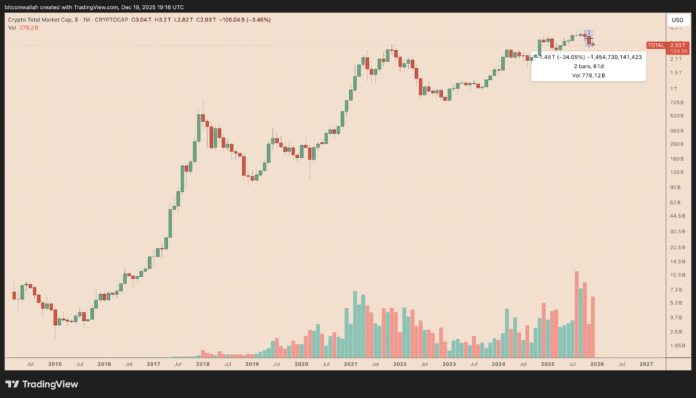

The Federal Reserve implemented three consecutive 0.25% interest rate cuts in 2025, primarily in the final quarter, as unemployment rose and inflation exhibited clearer signs of slowing down. However, the cryptocurrency market reacted counterintuitively, with Bitcoin (BTC), Ether (ETH), and major altcoins experiencing a significant decline, resulting in a total market capitalization drop of over $1.45 trillion from its record high in October.

Source: TradingView

To better understand how the central bank’s policies may impact the broader cryptocurrency market by March 2026, it is essential to examine the potential effects of the Fed’s decisions on BTC and ETH.

Impact of Fed’s Interest Rate Cuts on Bitcoin and Ether

Despite the recent interest rate cuts, most Fed officials, including New York President John Williams, emphasized the dangers of inflation and data dependence, providing no clear indication of further easing. Williams stated, “I personally don’t feel any urgency at the moment to act further on monetary policy because I think the cuts we’ve made have positioned us really well,” adding, “I want inflation to fall to 2% without unduly hurting the job market. It’s a balancing act.”

Source: Bureau of Labor Statistics/Bloomberg

The record-breaking U.S. government shutdown disrupted data collection by the Bureau of Labor Statistics, potentially distorting annual inflation readings for November. This uncertainty may contribute to the cryptocurrency market’s failure to recover in recent months despite the interest rate cuts.

Source: X

According to Jeff Mei, Chief Operating Officer of crypto exchange BTSE, if the Fed maintains stable interest rates in the first quarter of 2026, BTC could decline to $70,000 and ETH to $2,400.

The Fed’s “Stealth QE” and Its Potential Impact on Crypto Prices

On December 1, the Federal Reserve officially ended quantitative tightening and initiated full rebalancing of maturing Treasury bonds and mortgage-backed securities to prevent further reserve outflows. The introduction of Reserve Management Purchases (RMPs), short-term purchases of government securities worth around $40 billion, aims to stabilize bank reserves and alleviate money market stress. Some analysts consider this move a form of quantitative easing or “stealth QE.”

In comparison, during the 2020-2021 quantitative easing period, the Fed’s balance sheet increased by approximately $800 billion each month, coinciding with a $2.90 trillion growth in cryptocurrency market capitalization.

Source: TradingView

If RMPs progress more slowly in the first quarter of 2026, they could quietly inject liquidity, encourage risk-taking, and stabilize crypto prices even without aggressive interest rate cuts. Mei predicts that Bitcoin could rise to $92,000-$98,000, supported by sustained ETF inflows of over $50 billion and institutional accumulation, while Ethereum could rally towards $3,600, benefiting from recent improvements in Layer 2 scaling and redistribution of yields that attract DeFi users.

This article does not contain investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making decisions. For more information, visit https://cointelegraph.com/news/fed-q1-2026-outlook-potential-impact-on-bitcoin-crypto-markets?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound