Galaxy Digital’s Stock Tokenized on Solana, Paving the Way for Institutional Adoption

Galaxy Digital, a leading cryptocurrency company founded by Mike Novogratz, has taken a significant step towards bridging the gap between traditional finance and decentralized finance (DeFi). The company has announced that its Class A shares, listed on both Nasdaq and the Toronto Stock Exchange under the ticker GLXY, can now be tokenized and fractionalized on the Solana Blockchain through Superstate’s Opening Bell. This move is expected to increase institutional interest in tokenization, providing a new avenue for investors to access traditional assets in a decentralized manner.

The tokenization process, facilitated by Superstate, a fintech company acting as a Sec-registered transfer agent, allows for the actual shares of Galaxy Digital to be represented on the blockchain, rather than synthetic products or derivatives. This means that trades executed on the Opening Bell platform create immediate ownership of the underlying assets, providing a more direct and transparent way of investing in traditional stocks.

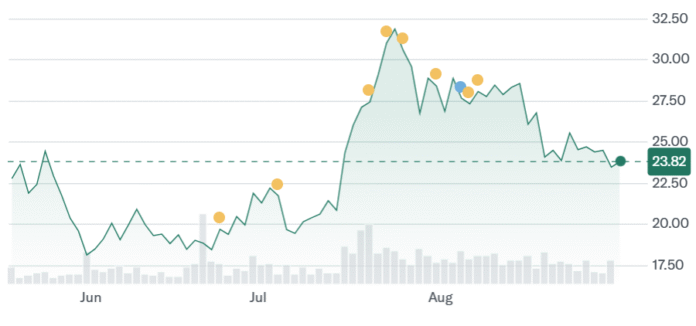

Galaxy Digital’s stock has been listed on the Toronto Stock Exchange since 2018 and expanded to the Nasdaq Global Select Market earlier this year, with a current market capitalization of nearly $9 billion. The company’s decision to tokenize its shares is a significant development in the growing trend of tokenizing traditional assets, with dozens of other stocks already available in tokenized form on various platforms.

For example, the Xstocks platform from Backed Finance has tokenized over 60 public companies on Solana, BNB Chain, and Tron, including major names like Netflix, Meta Platforms, and Nvidia. These tokenized assets can be traded on various exchanges, such as Octopus and Bitbit, as well as on decentralized stock exchanges built on Solana.

The Growing Trend of Tokenization

The tokenization market has experienced significant growth in 2025, with a 380% increase since 2022. Initially, the focus was on private loans and US financial bonds, which offered attractive returns and institutional demand. However, the trend is now extending to other asset classes, such as real estate and money market funds, as investors seek access to traditionally illiquid assets or returns.

The total value of tokenized shares has reached approximately $341 million, according to industry data. While the market is still in its early stages, the growth of tokenized stock offers has been particularly notable this year. However, some industry observers have raised concerns about the regulatory gray area surrounding tokenized shares, highlighting the need for greater clarity and understanding of these products.

John Murillo, Chief Business Officer of FinTech company B2Broker, noted that investors should understand that they do not actually own the underlying stocks when investing in tokenized shares. Instead, they hold tokens issued by intermediaries, which may entitle them to receive payments if the underlying shares increase in value or are sold.

As the tokenization trend continues to grow, it is essential for investors to educate themselves on the benefits and risks associated with these products. With the increasing adoption of tokenized assets, regulatory clarity and oversight will be crucial in ensuring the integrity and stability of the market. For more information on Galaxy Digital’s tokenized stock and the growing trend of tokenization, visit https://cointelegraph.com/news/galaxy-digital-stock-tokenized-solana?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound