Gold, a traditional store of value, has experienced a significant decline in value, with a $2.5 trillion drop in market capitalization over a 24-hour period. This sharp correction has surprised investors, who had turned to gold as a hedge against inflation and market volatility. The 8% decline has sparked panic among investors, with some drawing comparisons to the volatility of Bitcoin, often referred to as “digital gold” due to its limited supply.

Unprecedented Decline in Gold Value

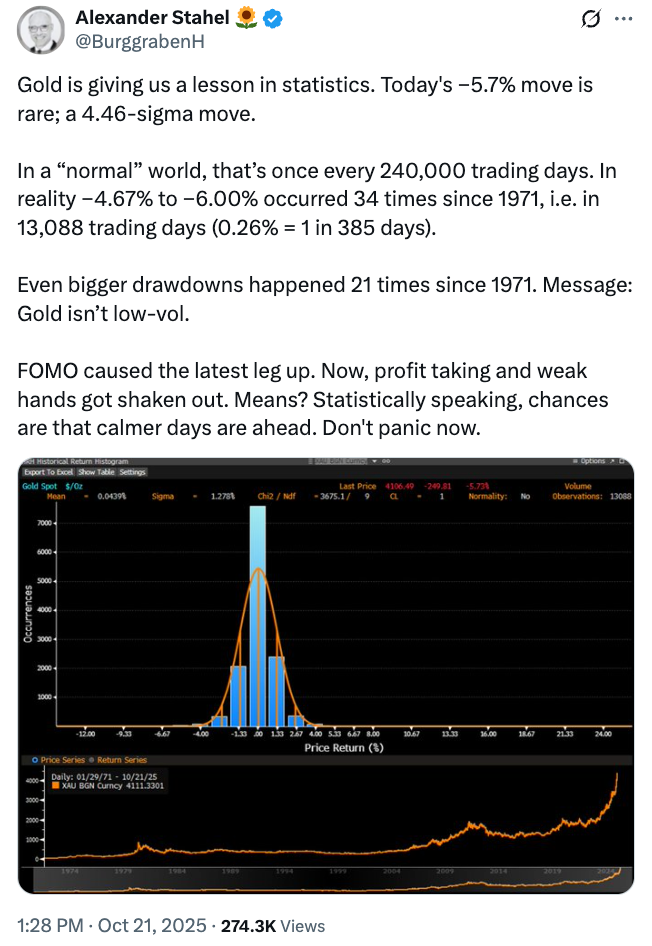

The scale of the correction is highly unusual, with Alexander Stahel, a resources investor in Switzerland, noting that such an event would only occur “once every 240,000 trading days.” Stahel pointed to the growing fear of missing out (FOMO) as a key factor in the gold frenzy, which led to increased exposure to gold equity, physical gold bars, and tokenized gold. The resulting profit-taking and weak hands being shaken out have contributed to the decline.

Source: Alexander Stahel

Comparison to Bitcoin Volatility

The $2.5 trillion decline in gold’s market capitalization surpasses the entire market capitalization of Bitcoin, which stands at $2.2 trillion. Veteran trader Peter Brandt noted that the decline in gold is equivalent to 55% of the value of every cryptocurrency in existence. Bitcoin, which has faced criticism for its volatility, has also experienced a decline, with a 5.2% drop from its intra-day high of $114,000.

The Crypto Fear & Greed Index. Source: Alternative.me

Crypto Market Sentiment

The Crypto Fear & Greed Index has plummeted to levels not seen since December 2022, indicating “Extreme Fear” in the market. Despite this, Bitcoin spot exchange-traded funds (ETFs) saw $142 million in inflows, suggesting that some investors remain bullish on the cryptocurrency. The correlation between gold and Bitcoin has increased, with some analysts noting that Bitcoin could potentially become an appealing store of value.

Deutsche Bank’s macro strategist Marion Laboure has observed parallels between gold and Bitcoin, which could make the crypto asset an attractive store of value. However, the ongoing volatility in gold and cryptocurrency markets serves as a reminder that even traditional stores of value can be subject to significant fluctuations.

For more information, visit the original source: https://cointelegraph.com/news/gold-worst-day-decade-wipes-2-5-trillion-bitcoin-dips?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound