Grayscale Submits Polkadot and Cardano ETF Registration Forms to SEC

Grayscale Investments has submitted extensive S-1 registration forms to the SEC for Spot Dab and Cardano stock market traded funds (ETF). The grayscale Cardano Trust ETF (GADA) and Greyscale Polkadot Trust ETF are connected to a crowded field of 92 pending crypto-ETF applications that are currently waiting for regulatory review. Both Trusts were recorded on August 12, 2025, as Delaware, according to the defined pattern of Delaware registrations in front of the SEC submissions according to Grayscale.

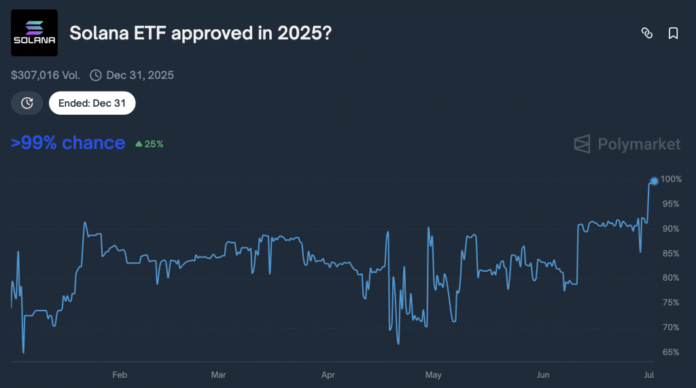

The Cardano ETF would act under Ticker Gada against NYSE Arca, while specific exchange details for the Polkadot Fonds remain the final approval. The submissions come when predictive markets increase with optimism for the approval of Altcoin ETFs. In 2025, Solana has an approval opportunity for polymarket of 99% compared to 72% in May, while XRP holds a probability of 87% compared to 64% in August.

Even speculative Memecoin Dogecoin has 82% approval opportunities and doubles almost 44% in June. Grayscale’s aggressive expansion strategy includes the conversion of five existing trusts into ETF structures that cover Litecoin, Solana, Dogecoin, XRP, and Avalanche.

Altcoin ETF Race Heats Up as Approval Odds Surge

The latest regulatory developments have preferred broader permits for crypto-ETFs. The approval of the SEC of non-benefits for Bitcoin and Ethereum ETFs has expanded the compliance paths. At the same time, the Crypto Collaboration project aims to clarify the classifications for digital assets under US law.

Twenty-one shares and grayscale lead-ether ETF applications after regulatory clarity about liquid stakers. Remarkably, Vaneck’s Jitosol proposal also represents the first completely liquid fund for token back funds, which pursues tokens, which is defined in the Solana network. A wave of XRP ETF changes that were submitted last week probably reacted to second feedback, whereby fund structures were adapted to absorb both token and cash creations as well as money and benefits in kind.

Structured Gray Level Fund to Anticipate Regulatory Uncertainties

Both suggestions for Gradkala-TF indicate significant regulatory risks, in particular the earlier determination of the SEC that ADA is a security. The registration of Cardano warns that a final safety classification of the SEC trigger material effects on the token value and may force the trust.

The trusts do the creation of cash and the redemption mechanisms and process the shares in baskets with 10,000 units by authorized participants and liquidity providers. In-roof transactions with direct token deposits do not remain available until a “regulatory approval in factual child”, which may never come about.

Institutional Demand Drives Altcoin ETF Pipeline Expansion

The 92 outstanding crypto-ETF applications issue an increase of 28% compared to 72 submissions that were recorded in April. The deadlines in October serve for most applications, especially for Solana, XRP, and Litecoin’s proposals, which could trigger considerable market activities.

Bloomberg Intelligence Analysts project the continued growth of the submissions, indicating Eric Balchunas that “quite soon will give more crypto-ETF applications than shares.” If you continue your bullish trajectory, the CEO of Noone, Ray Youssef predicts that large cryptocurrencies, including SOL, XRP, and BNB, will attract huge capital investments.

For Sol, Youssef, who spoke to Cryptoneews, found that Solana Treasury Companies set up funds that are in ten billion to collect SOL. For more information, visit https://cryptonews.com/news/grayscale-submits-polkadot-and-cardano-etf-registration-forms-to-sec/