Harvard University Increases Investment in BlackRock’s Bitcoin ETF

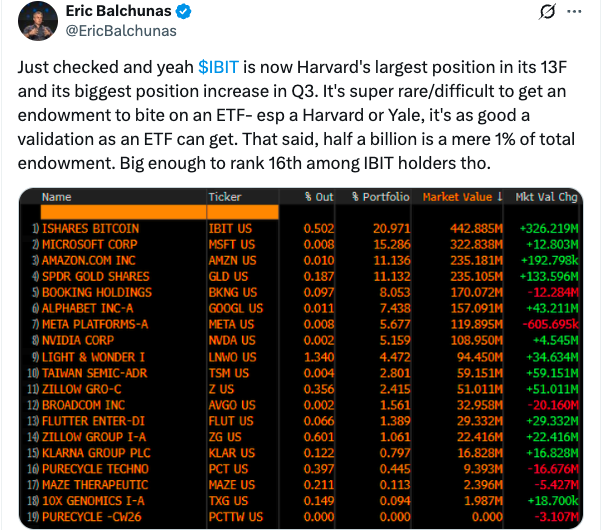

Harvard University has significantly boosted its investment in BlackRock’s Bitcoin exchange-traded fund (ETF) by over 250% in the third quarter. This substantial increase comes after the university first invested in the fund earlier this year. According to a regulatory filing, Harvard Management Company, which manages the university’s $57 billion endowment fund, held over 6.8 million shares in the iShares Bitcoin Trust ETF (IBIT) worth $442.8 million as of September 30.

The university’s initial investment in IBIT was disclosed in August, with a position of around 1.9 million shares worth $116.6 million. This recent increase in investment demonstrates Harvard’s growing interest in the cryptocurrency market. Bloomberg ETF analyst Eric Balchunas noted that it is “super rare” for a university to invest in an ETF, making Harvard’s investment a significant validation for the fund.

Validation for the ETF

Balchunas stated that Harvard’s IBIT investment, although only a mere 1% of the university’s total endowment, is a substantial endorsement for the ETF. He also mentioned that endowments are typically “notably anti-ETF” and are the “hardest institution to hook” when it comes to ETFs. The university’s investment in IBIT is now its largest holding and biggest position increase in the third quarter, ranking it as the 16th-largest holder of the ETF.

Source: Eric Balchunas

Diversification of Investments

Harvard’s investments are not limited to the Bitcoin ETF. The university has also invested in major US technology companies, including Amazon, Meta, Microsoft, and Alphabet, Google’s parent company. Additionally, Harvard has bought a new $16.8 million position in the buy-now, pay-later fintech Klarna and $59.1 million worth of shares in the Taiwan Semiconductor Manufacturing Company. The university has also nearly doubled its exposure to gold, boosting its share ownership in the gold-backed ETF, SPDR Gold Shares (GLD), to 661,391 shares worth $235.1 million.

According to SoSoValue, Bitcoin (BTC) ETFs saw net outflows of $1.11 billion in the trading week ending on Friday, as the price of Bitcoin fell below $100,000. Bitcoin is now trading under $95,000 after falling to a low of $93,029 in the past 24 hours, which briefly erased the gains it had made so far this year.

Conclusion

Harvard University’s increased investment in BlackRock’s Bitcoin ETF demonstrates the growing interest in cryptocurrency among institutional investors. As the cryptocurrency market continues to evolve, it will be interesting to see how universities and other institutions navigate this space. For more information, visit the original source link: https://cointelegraph.com/news/harvard-university-triples-stake-blackrock-bitcoin-etf-filing-shows?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound