Bitcoin’s recent price movements have been closely tied to macroeconomic factors, particularly the US jobs market. The cryptocurrency’s value rose briefly to $113,000 before dropping after weaker-than-expected US salary statements were released. Despite this volatility, onchain flows indicate a positive outlook, with stable coin inflows reaching $2 billion and open interest rates nearing all-time highs.

Bitcoin’s Bullish Dynamics

Bitcoin’s price increased by 4.75% this week, rising from $109,250 to $113,384, driven by bullish dynamics in the lead-up to the non-farm payroll (NFP) report on Friday. The data showed a significant slowdown in job growth, with only 22,000 jobs added in August, compared to forecasts of 75,000 and 73,000 in July. The unemployment rate also rose to 4.3%, higher than the previous month’s 4.2%, while wage growth slowed from 3.9% to 3.7% year-over-year.

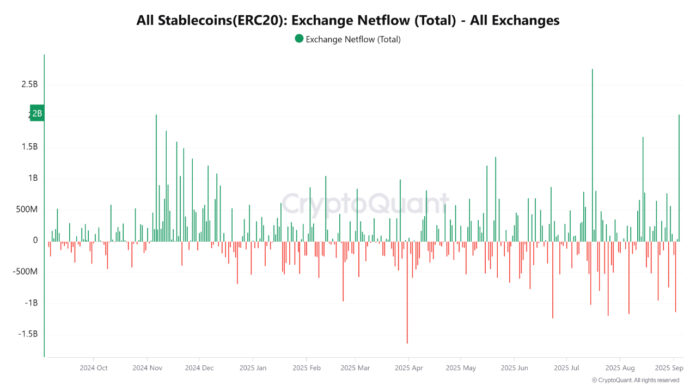

The weaker labor market data strengthens the case for a reduction in interest rates by the Federal Reserve, which could lead to increased liquidity injections and a weaker US dollar. These factors typically serve as a tailwind for cryptocurrency markets, including Bitcoin. Onchain data signals suggest that the market was preparing for this outcome, with stablecoin inflows into exchanges rising to over $2 billion, indicating that traders were positioning themselves for a potential price move.

Stablecoin Exchange Netflow. Source: Cryptoquant

Is the Bitcoin Floor In?

Historically, such onchain activity reflects “dry powder” waiting to be deployed into BTC and ETH as soon as a catalyst emerges. Meanwhile, Bitcoin’s open interest rates have increased to over $80 billion, nearing all-time highs, despite price consolidation around $110,000. This suggests that leveraged positions are being built up rather than unwound.

The combination of macroeconomic pressures and bullish onchain positioning sets the stage for volatility. However, the structural pretension remains upward, and with liquidity ready to be deployed, Bitcoin may be preparing to break out and ignite its next leg up. A weekly close above $112,500 would confirm a permanent market floor, providing a meaningful strengthening that a base is near $107,500.

Bitcoin one-hour chart. Source: CoinTelegraph/Tradingview

The structure remains constructive on the one-hour chart, with Bitcoin continuing to create higher highs and higher lows, a classic sign of an uptrend. If BTC does not close below $109,500, the short-term bullish structure remains intact, making the dip look more like a liquidity sweep than a real trend shift.

Bitcoin one-day chart. Source: CoinTelegraph/Tradingview

Until a decisive weekly close above $112,500 is achieved, the wider market remains in a transition phase, balancing between macro-driven optimism and local supply pressure. In the short term, the bias remains optimistic, but confirmation of a permanent floor is contingent on the weekly close content above the resistance.

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision.

For more information on Bitcoin’s price movements and market analysis, visit https://cointelegraph.com/news/bitcoin-breakout-fizzles-after-weak-us-jobs-data-raises-alarm?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound