Introduction to AI-Powered Romance Scams

A recently divorced Bitcoin investor lost his entire retirement fund, a full Bitcoin, to an AI-powered romance scam orchestrated by a sophisticated criminal using deepfakes. This incident highlights the growing threat of relationship-based scams that rely on emotional manipulation and AI-generated deepfakes to build trust before providing maximum financial benefit to victims.

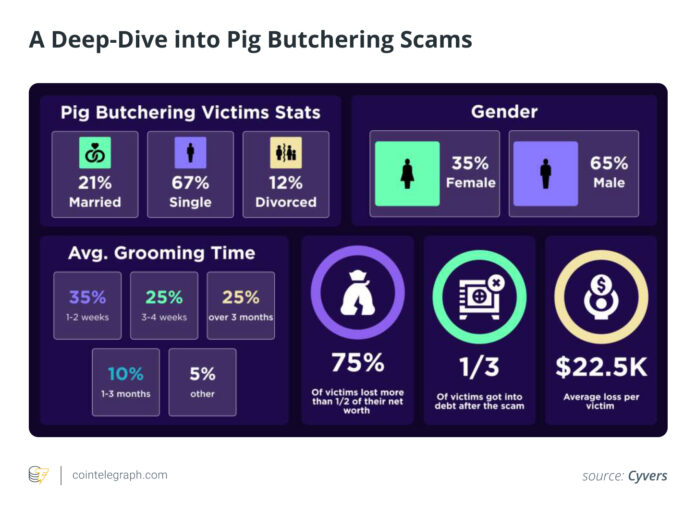

According to a report by Cyvers, a blockchain security platform, the average grooming time for victims is between one and two weeks in about a third of cases, while about 10% of victims endure grooming times of one to three months. This extended time frame highlights the complexity of these operations. Fraudsters know that patience and consistency are far more effective in building credibility than rushing the process.

Understanding Pig Slaughter Scams

Security experts call these scams “pig slaughter” scams, which are relationship-based scams that rely entirely on psychological manipulation. The term is borrowed from the agricultural practice of fattening an animal before slaughter, and describes how fraudsters gradually build trust and emotional connection with their victims before reaping the maximum benefits.

The fundamental difference is crucial. Victims willingly send their money because they believe they are making a worthwhile investment or supporting someone they love. This consent-based manipulation makes it extremely difficult for fraud detection systems to identify these systems because the transactions themselves appear legitimate at first glance.

The Role of AI in Romance Scams

In the case of the recently divorced Bitcoin investor, the fraudster used a sophisticated, multi-layered approach that leveraged AI. The victim was initially approached by an unsolicited message from someone claiming to be an attractive dealer. The scammer offered to help the investor double his Bitcoin holdings, a promise that was intended to appeal to both greed and a desire for financial security, especially for someone recently going through a divorce.

The scammer used AI to create fully synthetic portraits that looked convincingly realistic. To the untrained eye, these AI-generated identities are almost indistinguishable from real people. For video calls, the scammer used even more sophisticated technology, including live deepfake video generation that involved superimposing an artificial face on the impostor’s actual body in real time.

Vulnerability and Living Conditions

The targeting of a recently divorced person was not accidental. These were calculated raids. Divorce leads to acute vulnerability, including emotional isolation, reduced self-esteem, and a psychological emptiness that cheaters are trained to exploit. Scammers actively recruit victims who fit certain profiles, such as the elderly, recent divorcees, widows, widowers, and those who express their loneliness online.

This case highlights a critical blind spot in modern fraud prevention. Traditional bank fraud detection systems are designed to flag unusual transactions rather than detect psychological coercion. The victim’s Bitcoin transfers appeared to be completely normal for automated systems and consisted of regular amounts over an extended period of time rather than a single large withdrawal.

The Scale of the Problem

According to Chainalysis, in 2024, pig slaughter scams cost victims $5.5 billion in about 200,000 individual cases, an average of $27,500 per victim. The company has also classified these scams as a national security risk. Losses from romance scams exceeded $1.34 billion in 2024 and 2025, with the Federal Trade Commission reporting that 40% of online dating scammers were targeted by romance scams.

AI has made these systems exponentially more scalable. To protect yourself from these scams, it is essential to verify identity across multiple channels, be skeptical about rapid relationship development, consult trusted advisors before moving funds, recognize that reputable traders don’t date customers, and understand the irreversibility of cryptocurrency transactions.

Conclusion and Protection Measures

The loss of a full Bitcoin for the investor represents not only a financial setback, but a deep emotional trauma that goes far beyond the financial aspect. Beyond the devastating financial impact, he experienced the psychological shock of discovering that the romantic relationship was entirely fabricated, the emotional intimacy false, the future plans imaginary, and his trust completely violated by a criminal operating across multiple time zones.

To protect yourself from AI-powered romance scams, it is essential to be vigilant, skeptical of unwanted contact, emotionally aware, and consult with trusted advisors. Technical security is just a protective layer, and human judgment, informed and based on healthy skepticism, remains the most effective defense against scams that seek to exploit deep human needs for connection and security.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. For more information, visit https://cointelegraph.com/news/how-an-ai-fueled-romance-scam-drained-a-bitcoin-retirement-fund?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound