Global Crypto Laws and Regulations: What to Expect in 2026

The landscape of cryptocurrency laws and regulations is undergoing significant changes in 2026, building on the momentum gained in 2025. These developments will have a profound impact on crypto users in the United States, the United Kingdom, and the Asia Pacific (APAC) region. As governments and regulatory bodies strive to create a more structured and secure environment for cryptocurrency transactions, it’s essential for investors and users to stay informed about the evolving legal framework.

In the United States, the Federal Deposit Insurance Corporation (FDIC) has proposed a framework that would allow banks to issue dollar-pegged stablecoins under the GENIUS stablecoin framework, which was passed by Congress in mid-2025. This proposal outlines that banks must issue stablecoins through a subsidiary, with both the bank and the subsidiary being subject to FDIC reviews and financial soundness checks. Furthermore, the U.S. Federal Reserve has lifted its guidelines that previously barred banks from engaging in crypto activities, paving the way for banks to hold customer assets and offer various crypto services in 2026.

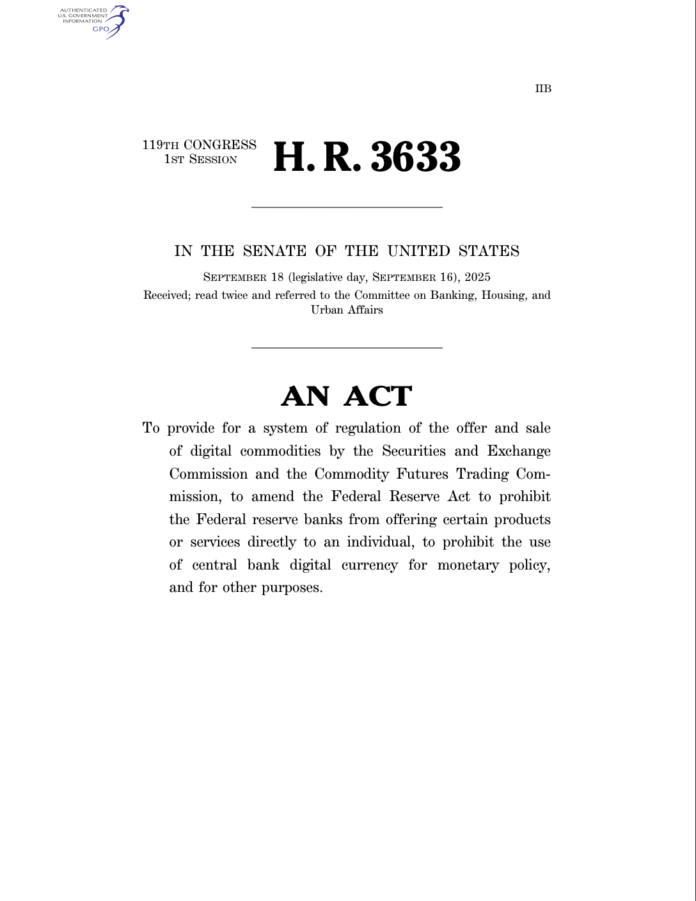

Crypto investors in the U.S. can also anticipate the passage of the CLARITY Act in 2026, a comprehensive regulatory framework designed to provide clear guidelines on taxation, asset taxonomy, and underwriting for cryptocurrencies. The CLARITY Act aims to bring clarity and stability to the crypto market in the USA.  The CLARITY Act, a law governing the structure of the crypto market in the USA. Source: US Congress

The CLARITY Act, a law governing the structure of the crypto market in the USA. Source: US Congress

In terms of taxation, crypto assets in the U.S. are taxed as ordinary income when exchanged or sold. The tax rate varies depending on the holding period, with assets held for over a year being taxed at a rate of 0-20%, while those held for shorter periods are taxed at 10-37%. Additionally, centralized crypto brokers and service providers will be required to report the cost basis (the initial value of the crypto when purchased) to the IRS starting in January 2026. However, these new reporting rules do not apply to decentralized exchanges, as clarified by Coinbase.

US Crypto Laws and Policies to Watch Out for in 2026

Several key developments are expected to shape the crypto landscape in the United States. The introduction of the CLARITY Act and the expansion of banking services into crypto are just a few of the significant changes on the horizon. As the regulatory environment evolves, it’s crucial for investors to stay abreast of these developments to navigate the market effectively.

UK to Introduce Final Crypto Rules and Tax Policy in 2026

The UK Financial Conduct Authority (FCA) is set to publish its final rules regulating the crypto industry in 2026. These rules will include Anti-Money Laundering (AML) and Know Your Customer (KYC) provisions, consumer protection measures, and licensing requirements for digital asset providers in the country. The UK, along with the EU, has also launched the Crypto-Asset Reporting Framework (CARF), which standardizes the collection of data on users’ transactions for tax reporting purposes. Under CARF, crypto service providers must collect advanced customer data and submit annual reports on account balances and transactions to local tax authorities.

Hong Kong and China: Diverging Paths in Crypto Regulation

Hong Kong lawmakers have introduced a stablecoin regulation bill that is expected to come into force in 2026, paving the way for a comprehensive regulatory framework for stablecoins in the region. This move is significant, as Hong Kong operates with its own financial system, regulations, and currency, distinct from mainland China. In contrast, China’s central government has reversed its stance on crypto policy, issuing another crypto ban in December and focusing on the development of the digital yuan, a central bank digital currency (CBDC). The People’s Bank of China has begun allowing commercial banks to pay interest to digital yuan holders, expanding the role of the digital yuan beyond a simple fiat replacement.

For more information on how crypto laws changed in 2025 and how they will evolve in 2026, visit Cointelegraph to stay updated on the latest developments in cryptocurrency regulations and laws around the world.