Introduction to Cryptocurrency’s Risk Conundrum

The world of global finance operates on calculated probabilities, yet the Web3 ecosystem continues to be shrouded in uncertainty, primarily due to a lack of trust. This mistrust is not unfounded; the crypto space suffered losses exceeding $3 billion in 2022 due to hacks, scams, and project failures. Until the risk associated with cryptocurrency can be accurately measured and mitigated, it remains a largely uninvestable asset class for institutional capital.

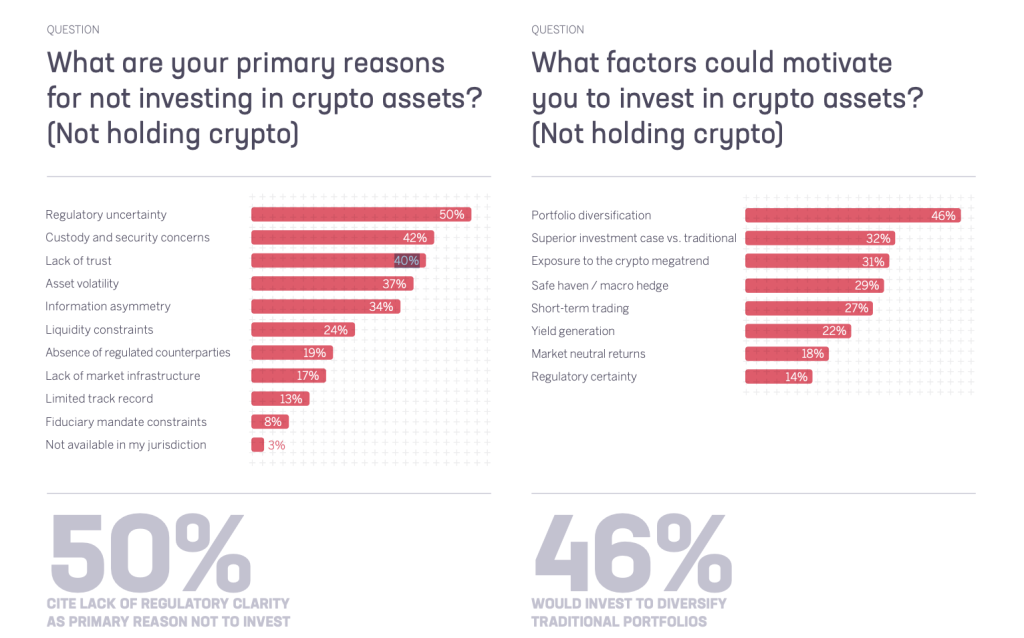

According to a report by Sygnum Bank in 2025, a significant 40% of companies are hesitant to engage with cryptocurrencies due to trust issues, and 50% of respondents cited a lack of clear regulation as a major concern. This hesitation comes at a substantial cost, with the fintech market attracting $44.7 billion in global investments in the first half of 2025, while global VC investments in blockchain startups were about five times lower, at around $8 billion during the same period.

Understanding the Risk Language Barrier

The disparity in risk perception between Web2 institutions and the Web3 ecosystem is stark. Traditional financial institutions view cryptocurrency as unstable and volatile, with the concept of “too big to fail” not applying in the crypto space. High-profile incidents such as Mt. Gox, FTX, Terra Luna, and Anchor Protocol have highlighted the potential for even the largest players to be hacked, mismanaged, or collapse rapidly, casting a long shadow over the entire ecosystem.

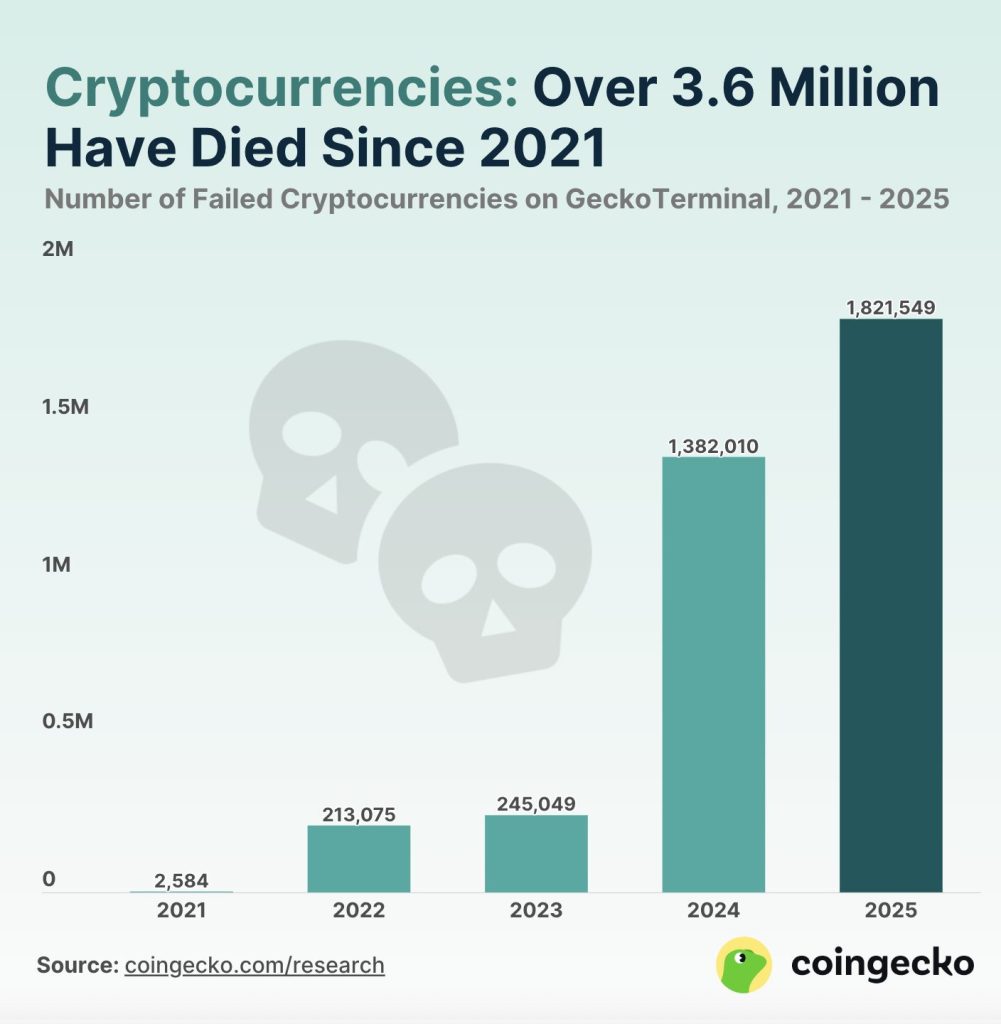

Over half of the projects initiated since 2021 have permanently disappeared, making it a risky investment for institutions. The lack of a common risk language hinders the ability of governments and institutions to work confidently with projects whose longevity is uncertain. The nascent crypto insurance market, which provides only about 9% coverage of total assets locked in DeFi, further underscores the issue of unpriced risk.

The Current State of Regulation and Trust

Despite the introduction of national reserves and ETFs, the crypto space remains in a gray area, akin to the digital Wild West. The recent wave of Bitcoin ETFs, while indicative of some level of institutional engagement, does not signify widespread trust. ETFs provide a safe entry point for investors by allowing them to invest in blue-chip assets without directly interacting with the underlying technology, thus avoiding operational, smart contract, and team risks.

The regulatory landscape is fragmented, with different jurisdictions adopting varying approaches. Singapore aims to capture economic value through regulation, while countries like China and India restrict access to maintain financial control and stability. The EU is developing a comprehensive framework to attract businesses, and the US has shifted its enforcement policy to support industry growth. This fragmentation leads to a lack of global trust and a conflicting incentive structure for developers and institutions, with compliance complexity being a key reason for avoidance.

The Path Forward: Self-Regulation

The solution to breaking the ceiling and fostering growth in the cryptocurrency space lies in credible self-regulation. It requires a mature and serious player to develop a fair and efficient framework that both regulators and developers can trust. This framework must translate the industry’s complexities into a language that is understandable and workable for all parties involved.

Without such a change, the growth of cryptocurrency will stall. The potential of crypto to redefine banking, investment, and value exchange is vast, but this potential will not be realized without responsibility, security, and trust. The industry is at a crossroads, with the choice being between self-regulation and the imposition of external regulations that may not fully understand the nuances of the Web3 ecosystem.

For more insights into how crypto’s unpriced risk is keeping institutional capital on the sidelines, visit https://cryptonews.com/exclusives/how-cryptos-unpriced-risk-is-keeping-institutional-capital-on-the-sidelines/