Key Takeaways from the Memecoin Frenzy

The recent hijacking of BNB Chain’s official X account led to the creation of a joke token called “4,” which gained significant attention after Changpeng “CZ” Zhao, co-founder and former CEO of Binance, referred to the incident. This mention turned a niche stunt into a lively market signal, attracting attention to a brand new pool with barely any liquidity. An early buyer put about $3,000 worth of BNB into “4” and saw the value rise to about $2 million within a few hours.

The increase in value was due to capital flow encountering low liquidity, not fundamentals. Some wallets had already purchased from CZ shortly before the post, indicating that the market was already anticipating a potential surge. The trigger was the hack of the BNB Chain’s X account, which created “4” and sparked a wave of interest in the memecoin.

Understanding the Memecoin Phenomenon

The Hijacking and the Birth of a Memecoin

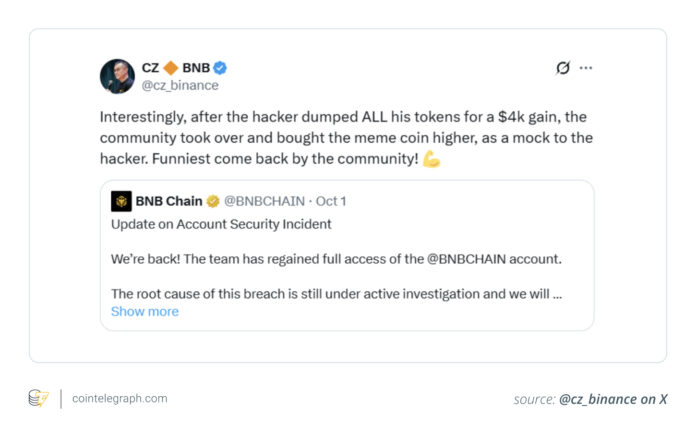

On October 1, 2025, BNB Chain’s official X account was compromised and used to post phishing links to around 4 million followers. The team later regained control and issued warnings, but the chaos gave rise to a running joke that the attacker made off with just “US$4,000.” This joke eventually led to the creation of a new token called “4” on the BNB chain, which became a nod to the “$4k” meme.

CZ’s Mention and the Market Reaction

Changpeng “CZ” Zhao addressed the incident to his 10.3 million followers, citing the hacker’s small profit and how the community “bought the memecoin higher.” This mention turned a joke into a real trading signal, attracting human traders and bots to follow the ticker. Scanners marked the contract, copiers queued up purchases, and retail flowed into the same shallow pool via aggregators, increasing the value of “4” exponentially.

The First Wave of Orders and the Wallet’s Fortune

An address labeled “0x872” was purchased early with approximately $3,000 worth of BNB. As attention flooded the pool and liquidity diminished, that small stake grew to about $2 million in a matter of hours. Onchain traces show only slight profit-taking, with the address retaining over 98% of its portfolio in “4,” still around $1.88 million after the initial surge.

Lessons from the Memecoin Frenzy

The memecoin frenzy serves as a reminder that contributions create flow, not value, and the exit door is narrower than it looks. Reviewing the contract and pool size, writing an exit script in advance, and treating screenshots as suggestions until a fill occurs are crucial steps for traders. The outcome of the wallet depended on two options: intervening absurdly early and resisting the immediate urge to cash out.

As the market continues to evolve, it’s essential to stay informed and adapt to changing circumstances. The memecoin phenomenon highlights the importance of staying vigilant and being prepared for unexpected market movements. For more information on this story, visit https://cointelegraph.com/news/how-a-crypto-trader-turned-3k-into-2m-after-cz-mentioned-a-memecoin?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound.