Introduction to HashKey’s Historic IPO

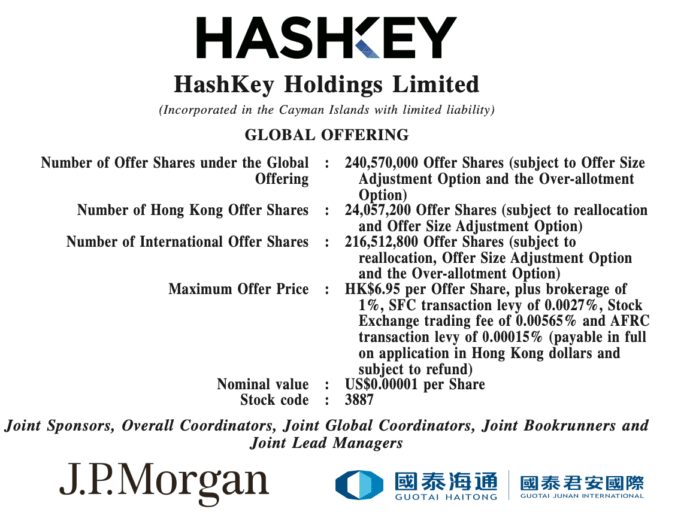

HashKey, a leading cryptocurrency exchange, is on the verge of making history by becoming Hong Kong’s first fully crypto-native Initial Public Offering (IPO). The company has filed for an IPO, offering 240.57 million shares, with a portion reserved for local retail investors. This move is expected to not only bring in significant revenue but also pave the way for other cryptocurrency exchanges to go public in the city.

The shares are being marketed in a range of 5.95 to 6.95 Hong Kong dollars, which could rise to HK$1.67 billion, about $215 million, and would represent a multi-billion dollar valuation if the offering is fully subscribed. Trading is expected to begin on December 17 on the Hong Kong Stock Exchange. HashKey already operates what it describes as Hong Kong’s “largest licensed platform,” a broader stack that includes custody, institutional staking, and tokenization.

Key Insights into HashKey’s Business Model

HashKey’s business model goes beyond a traditional spot exchange by combining trading, custody, institutional staking, asset management, and tokenization into a single regulated platform. The company has reported tens of billions of Hong Kong dollars in staked assets and platform assets under management. HashKey Cloud offers institutional staking and node services, and the company says it has received approval to support staking for Hong Kong’s spot Ether exchange-traded funds (ETFs).

The group also operates an asset management division that offers crypto funds and risk strategies. According to the filings, the company had approximately HK$7.8 billion in assets under management as of September 30, 2025. Additionally, the company is engaged in tokenization through HashKey Chain, a network focused on real-world assets (RWAs), stablecoins, and institutional use cases.

Why HashKey’s IPO Matters for Hong Kong

HashKey’s IPO is a significant milestone in Hong Kong’s efforts to rebuild its status as a hub for digital assets after years of regulatory uncertainty. The city has introduced a special licensing system for retail and institutional crypto platforms, enabled tightly controlled staking services, and tightened custody requirements and stablecoin oversight. HashKey offers an early, detailed look at what a fully regulated, multi-tier crypto business can look like under this framework.

The IPO could serve as a real-time test of investor interest in compliance-focused crypto infrastructure, especially as mainland China maintains strict restrictions on many digital asset activities. The way HashKey trades after its debut can be seen as the first indication of whether these restrictions still leave enough room for the success of a profitable, publicly traded crypto exchange.

Financial Performance and Future Plans

HashKey’s revenue has increased quickly, but the company continues to incur losses as it invests in expansion, licensing, and compliance. Total turnover rose from around HK$129 million in 2022 to HK$721 million in 2024, more than a 4.5-fold increase in two years. However, net losses almost doubled over the same period, from HK$585.2 million in 2022 to HK$1.19 billion in 2024.

The company plans to use the proceeds from the IPO to fund infrastructure and international growth, with approximately 40% earmarked for technology and infrastructure modernization, 40% for market expansion and ecosystem partnerships, and 20% for operations and risk management, and working capital and general corporate purposes.

Conclusion and Future Outlook

HashKey’s IPO is a historic moment for Hong Kong’s cryptocurrency market, and its success could pave the way for other exchanges to go public in the city. The company’s focus on compliance and regulation could provide a model for other cryptocurrency exchanges to follow. As the cryptocurrency market continues to evolve, HashKey’s IPO is an important step towards greater mainstream acceptance and regulation.

For more information, please visit https://cointelegraph.com/news/how-hashkey-plans-to-become-hong-kong-s-first-crypto-ipo?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound