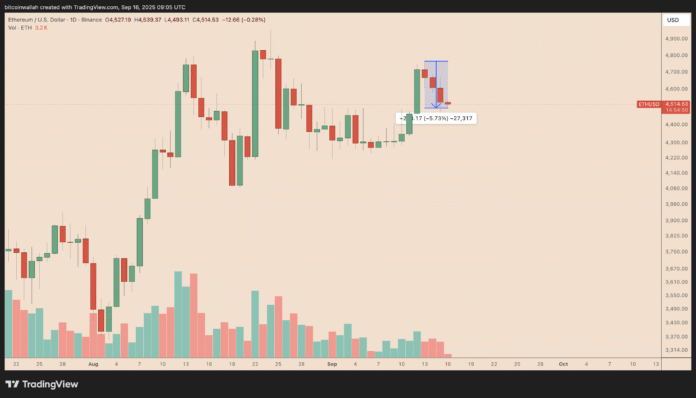

Ethereum’s native token, Ether (ETH), has experienced a significant drop of 5.73% from its weekend high near 4,766, as traders adopt a risk-off approach ahead of the Federal Reserve’s meeting on Wednesday. This withdrawal reflects caution in the market, but the larger question remains whether a potential postponement of the Fed’s decision could reignite Ethereum’s rally and how far the next leg could extend.

ETH/USD Daily Price Diagram. Source: Tradingview

The ETH price has been defending the 20-day exponential moving average (20-day EMA; the green wave) near $4,450, which demonstrates resilience as a market price in a 96.1% probability of a Fed rate cut this week, up from 85.4% a month ago.

ETH/USD Daily Price Diagram. Source: Tradingview

Potential Breakout Scenario

Consolidation has formed a bull pennant, a continuation pattern that typically resolves higher to a different leg. During this formation, volumes have been steadily decreasing, a trademark of a ripening bull setup. The diagram pattern will project a move towards $6,750 by October, more than 45% above the current level if ETH closes significantly above the upper trend line of the pennant.

This ETH upward destination is similar to the projections presented by Tesseract CEO James Harris and analyst Donald Dean.

Source: Donald Dean

Analyst Predictions

A failure to defend the 20-day EMA could open the door to a further decline towards the area defined by the lower trend line of the triangle (~$4,350) and the 50-day EMA (the red wave) near $4,200. However, many analysts believe that these declines will likely lead to a stronger dip buy, which would drive the ETH price higher.

This includes chartist Ash Crypto, who suggested that a drop below the lower trend line of the pennant would not invalidate the upward problems but instead would lead to a distribution above $5,000 in the coming weeks.

ETH/USD Daily Price Diagram. Source: Tradingview/Ash Crypto

Chartist Thebullishtrader shares a similar view, indicating that Ethereum could still return to the zone between $4,100 and $4,000, the “Super Trend Support,” before a more extensive reversal higher.

Analyst Luca notes that ETH has reclaimed the golden pocket (0.5–0.618 Fibonacci retracement lines), whereby the price now matches this zone and the Daily Bull Market Support band.

ETH/USD four-hour price diagram. Source: Luca

The chart sees this as a classic “Breakout → Retest Setup” when the price runs above the resistance and then withdraws to test it as support before continuing. He added: “As long as the price is above the golden pocket, I believe the most likely outcome is on the upside.”

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision.

For more information on Ethereum’s price movements and market analysis, visit Cointelegraph.