Uncovering the Hidden Force Behind Bitcoin and Ether Price Swings: Options Expiry

The cryptocurrency market, particularly Bitcoin (BTC) and Ether (ETH), is known for its notorious volatility. However, beneath the surface, a complex mechanism drives these price swings: options expiry. As large quantities of derivative options approach their expiration date, it sends ripples across the crypto market, affecting the underlying asset prices. Understanding this phenomenon is crucial for navigating the market and anticipating potential price movements.

What are Options in Bitcoin and Ether?

To grasp the concept of options, it’s essential to understand the basic principle. An option is a more sophisticated trading method than spot trading, giving the owner the right to buy or sell BTC or ETH at a predetermined strike price before the contract expires. As the expiry date approaches, the price at which the option can be exercised becomes more volatile. If a large number of option contracts are set to expire at the same time, it can create a ripple effect in the traditional BTC and ETH markets, leading to sharp price movements.

Types of Option Contracts

There are two primary types of option contracts: call options and put options. Call options grant the owner the right to buy, while put options give the right to sell an asset at a specified price before expiry. The balance between calls and puts provides an indicator of the overall market sentiment, showcasing future bets on where the market believes prices will move. If one type of option dominates the other, it can influence the direction of price movements.

How Do Options Expiry Prices and Volatility Influence Crypto Market Prices and Volatility?

Let’s consider an example. If options worth $5 billion are set to expire at the same time, even a small percentage of this amount being exercised or hedged could move the entire market. Remember, option holders have the choice to exercise their contracts, and the full $5 billion in crypto wouldn’t necessarily be sold or bought. A large options expiry can lead to increased trading activity, triggering a surge in market activity as traders reposition and create a backlog of volume. This concentrated time window of trading amplifies price fluctuations beyond normal market conditions.

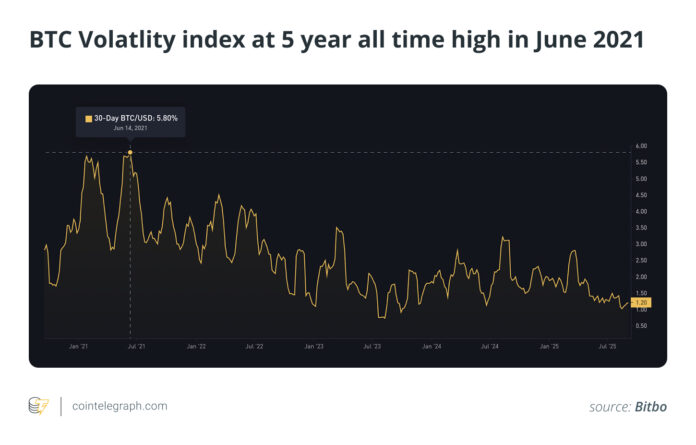

Analyzing markets reveals a clear correlation between options expiry and crypto price fluctuations. Significant changes in market prices can be observed, especially when it comes to BTC and ETH. For instance, the BTC Volatility Index showed a 5.80% increase on June 14, 2021, the highest peak in the past five years, as BTC and ETH options expired in June 2021.

Understanding Put-Call Relationships and Market Psychology

As options expiry approaches, trading volatility increases as traders close positions to lock in profits or reduce losses. This creates a feedback loop that triggers further position adjustments, reinforcing volatility. To gauge market sentiment, put-call ratios can be used. These ratios provide insight into institutional and retail feelings, indicating potential price movements. A ratio above 1 suggests more bearish betting, while a ratio below 1 tends to be bullish, signaling potential price increases.

Max Pain Theory

The max pain theory is akin to a war of wits in the options market. An option buyer wants the stock to move in their favor, while an option seller wants the opposite. The max pain point is the price at which most options would be worthless. This is crucial because large market participants and whales may attempt to push crypto prices toward the max pain point, influencing prices as they approach expiry. It reveals short-term price movements and offers potential support and resistance levels.

Managing Options Expiry Events

Options expiry can send cascading waves through the BTC and ETH markets, directly affecting the underlying assets if traders are caught off guard. To navigate these events, it’s essential to monitor key metrics, such as open interest, put-call ratios, and max pain, to receive early warning signals for volatility and directional strain. Position protection using options can help safeguard spot positions during high volatility, while diversification can minimize realized losses in the event of expiry events.

Marking key dates can help prepare for and avoid losses during volatile periods. Utilizing advanced data analysis platforms, such as Coinglass and CME group calendars, can offer insights into option markets, providing a decisive advantage over simple spot traders. Understanding trading volume patterns and liquidity can help manage risk as options expiry approaches.

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision. For more information on the hidden force behind Bitcoin and Ether price swings, visit https://cointelegraph.com/news/the-hidden-force-behind-bitcoin-and-ether-price-swings-options-expiry?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound