Streamlining Crypto Oversight: Understanding the SEC’s Revised 2025 Plan

The US cryptocurrency industry has long operated in a regulatory gray area, with various authorities such as the Securities and Exchange Commission (SEC), the Federal Trade Commission (FTC), the Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Network (FinCEN) overseeing different aspects of the crypto ecosystem. However, the SEC’s revised 2025 plan aims to bring clarity and structure to the regulatory framework, supporting innovation and investor protection.

For years, crypto firms have navigated overlapping rules from multiple agencies, making it challenging to determine what is allowed and what is not. The revised plan signals Washington’s intention to create a more flexible and structured framework tailored to digital assets. The SEC seeks a model focused on innovation, capital formation, market efficiency, and investor protection, recognizing that crypto requires specific rules rather than adaptations of older regulations.

Key Insights into the SEC’s Revised Plan

The plan may result in exemptions, safe harbors, DLT-specific rules for transfer agents, and changes to the crypto market structure, helping integrate digital assets into traditional market infrastructure. The success of the plan will depend on interagency coordination and international coordination among regulators. Strong implementation could encourage other jurisdictions to adopt more uniform global standards for crypto.

New Regulatory Approach

The SEC’s new agenda reflects a change in approach, focusing on innovation, capital management, market efficiency, and investor protection. This shows the SEC’s recognition that cryptocurrencies require tailored rules and not adjustments to existing rules. Industry representatives have highlighted the lack of clear compliance guidelines and inconsistent interpretation of existing rules, which the SEC’s 2025 Agenda aims to address.

Did you know? After the collapse of the Mt. Gox exchange in 2014, Japan became the first major economy to pass a dedicated crypto law in 2017, recognizing Bitcoin (BTC) as a legal payment method and encouraging exchanges to adopt bank-level security standards.

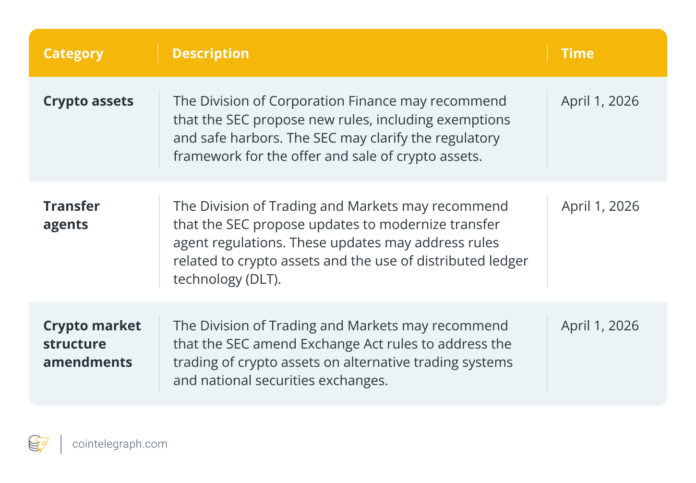

Key Elements of the SEC 2025 Plan

The comprehensive agenda outlines key areas and initiatives the SEC will pursue to protect investors, including new rules for issuing and selling digital assets, permission to trade crypto on national securities exchanges, simplified disclosure requirements, and clearer rules for crypto intermediaries.

New Rules for Digital Assets

The SEC intends to establish clear guidelines for the issuance of digital assets, which may include exemptions or safe harbor provisions for token projects. This would help determine when a token is considered a security and when it is not, and what information issuers must provide.

Permission to Trade Crypto on National Securities Exchanges

The SEC is considering changes that would allow direct trading of digital assets on registered national exchanges and alternative trading systems, aiming to bring crypto assets closer to regulated infrastructure for traditional stocks, improve oversight, strengthen investor protection, and reduce reliance on less regulated offshore platforms.

Benefits of the SEC’s Revised 2025 Plan

The SEC’s 2025 Plan aims to improve protection for individual investors, promote fair competition for issuers and financial institutions, and strengthen the integrity and efficiency of capital markets. Clearer regulations could reduce legal risks and speed up product development for cryptocurrency startups, allowing them to stay and grow in the US instead of relocating overseas.

Traditional financial institutions, such as banks and asset managers, would be given regulated opportunities to participate in digital assets while ensuring full compliance. Investors would benefit from better disclosures, safer trading venues, and more consistent monitoring of platforms, reducing risks such as hidden leverage or manipulative trading practices.

Open Questions, Risks, and Possible Global Impacts

While the SEC’s revised 2025 plan looks promising, its success depends on several factors, including interagency coordination and international cooperation. The SEC must strike an appropriate balance between encouraging innovation and protecting investors, determining whether Agenda 2025 will be successful or remain a declaration of intent.

If the plan fails to deliver tangible results, market participants will continue to face uncertainty, and the US could lose innovation to other countries, jeopardizing its leadership in digital asset financing. However, clearer rules in the US will encourage similar regulatory changes in the European Union, the United Kingdom, and Asia, promoting international cooperation and more uniform global standards for stablecoins, tokenization, and custody.

For more information on the SEC’s revised 2025 plan and its potential impact on the cryptocurrency industry, visit Cointelegraph.