Introduction to the Trump Family’s Crypto Ventures

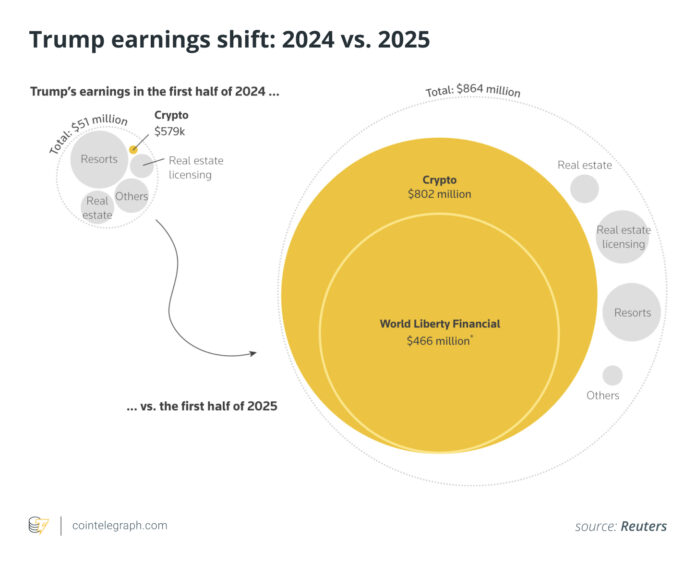

The Trump family has been making headlines with their foray into the cryptocurrency market, with estimates suggesting that Trump-affiliated companies earned a staggering $802 million in cryptocurrencies in the first half of 2025. This revenue primarily came from token sales of World Liberty Financial (WLFI) and the official Trump memecoin (TRUMP), outpacing earnings from their traditional businesses such as golf, licensing, and real estate.

Key Insights into the Trump Family’s Crypto Earnings

A Reuters investigation has shed light on the sources of this significant income, attributing it to a combination of token sales, memecoin trading fees, and stablecoin yields. The WLFI token, launched in late 2024, has been the largest contributor to the family’s crypto earnings, with its governance token offering limited ownership rights. The company’s lawyer argues that the token has “real utility,” with its central monetization model being straightforward: a Trump Organization affiliate is entitled to 75% of the proceeds from token sales after expenses.

Understanding World Liberty Financial (WLFI)

WLFI’s Gold Paper serves as the basis for Reuters’ income model, which estimates that WLFI token sales made up the majority of the family’s crypto money in the first half of 2025. The token’s launch in late 2024 marked the beginning of the Trump family’s significant foray into the cryptocurrency market. With its governance token offering limited ownership rights compared to traditional decentralized finance (DeFi) governance models, WLFI’s central monetization model is based on token sales, with a Trump Organization affiliate entitled to 75% of the proceeds after expenses.

The Alt5 Sigma Deal and Its Impact

In August 2025, WLFI signed a significant deal with Alt5 Sigma, raising hundreds of millions of dollars to purchase WLFI tokens. This move sparked a surge in demand and converted some of the token’s paper value into realized cash for Trump-controlled companies. A separate report outlined a broader $1.5 billion WLFI “treasury” strategy tied to Alt5, aiming to hold a significant portion of the token supply and explaining the scale of inflows into WLFI.

How the TRUMP Memecoin Generated Revenue

The TRUMP coin, launched on January 17, 2025, generated revenue through trading fees from the Meteora exchange, where it was first traded. Within two weeks, on-chain forensics firms estimated fees at $86 million to $100 million, mostly for Meteora. Using a conservative 50% ownership assumption, Reuters projected about $672 million in coin sales, attributing $336 million to Trump-related interests.

The USD1 Stablecoin and Its Interest Streams

WLFI also promotes the USD1 stablecoin, a dollar-pegged stablecoin backed by cash reserves and US Treasuries, with custody provided by BitGo. The reserves supporting the $1 generate an estimated annual interest of $80 million at current yields, with some of this interest benefiting a company 38% owned by the Trump Organization. Although the actual amount realized for 2025 is not specified, this stablecoin is positioned to enable large transactions, as seen in the $2 billion investment in Binance announced by Abu Dhabi-backed MGX in May 2025.

Calculating the $802 Million Estimate

Reuters combined presidential disclosures, property records, court-released financial data, and on-chain trading data to estimate the Trump family’s crypto earnings. Explicit assumptions, such as WLFI’s 75% revenue share for token sales and a 50% share in TRUMP, were made and verified by academics and auditors. The result is an estimated $802 million in crypto revenue for the first half of 2025, compared to $62 million from traditional businesses.

Controversy and Political Background

WLFI disputes parts of Reuters’ analysis, arguing that its revenue model was oversimplified and misinterpreted wallet data. The project’s real-world benefits were also overlooked, according to WLFI. Meanwhile, the change in attitude of US enforcement authorities towards cryptocurrencies since January 2025 has raised concerns about conflict of interest, with ethics experts noting that a sitting president overseeing crypto policy while their family earns significant income from crypto represents a novel conflict, even if it is not unlawful.

Broader Context and Insights

The Trump family’s crypto ventures have created a complex situation, with token-driven sales, high-fee memecoin mechanics, a high-velocity treasury deal, and yield-earning stablecoins all contributing to the estimated $802 million in revenue. While the totals are determined from documented breakdowns and modeled flows, controversy centers on the identity of buyers, transparency, and how US politics changed as the money flowed. This story serves as a live case study of incentives, disclosure, and governance risks in the crypto space.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision.