Bitcoin Price Faces Pressure as Yield Gap Widens to 2021 Highs

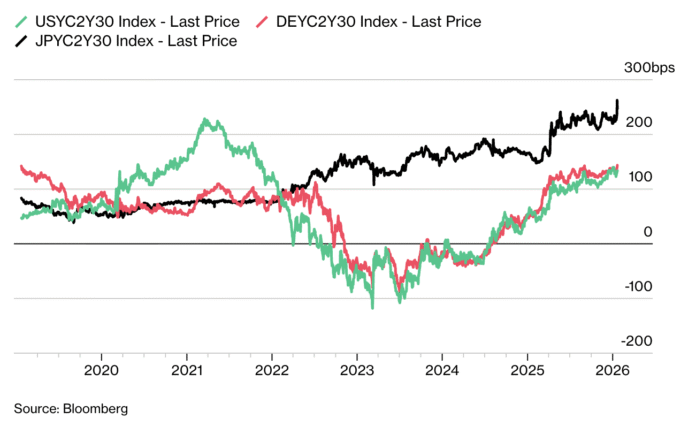

The Bitcoin (BTC) price is facing significant pressure as the gap between U.S. longer- and shorter-dated bonds has widened to its highest level since 2021, signaling potential trouble for the cryptocurrency in 2026. This development is largely driven by the sell-off in Japanese long-dated bonds, which is pushing up U.S. yields. As a result, the market outlook for Bitcoin appears increasingly pessimistic, with experts warning of a sustained rise in yields that could hurt stocks and high-beta assets like Bitcoin.

The gap between two-year and 30-year US bond yields (green). Source: Bloomberg

The gap between two-year and 30-year US bond yields (green). Source: Bloomberg

Rising Yield Gap and Its Implications

According to David Roberts, head of fixed income at Nedgroup Investments, a sustained rise in yields would put pressure on stocks, particularly those with longer-term returns. This is because higher yields increase the opportunity cost of holding non-yielding assets like stocks, making them less attractive to investors. The same logic applies to Bitcoin, which is often considered a high-beta risk asset. As yields rise, the likelihood of Bitcoin falling also increases.

Weekly chart of Japanese 30-year bond yields. Source: TradingView

Weekly chart of Japanese 30-year bond yields. Source: TradingView

Japanese Bond Yields and Their Impact on U.S. Yields

The 30-year Japanese bond yield has risen to a record 3.92%, widening its gap to two-year bond yields by 220 to 325 basis points. This trend is expected to continue, with some experts predicting that the yield could rise by another 75 to 100 basis points. The 30-year U.S. Treasury yield is largely tracking its Japanese counterpart, suggesting that it will also rise in tandem in the coming weeks or months.

Comparing 30-year returns between Japan and the US. Source: TradingView

Comparing 30-year returns between Japan and the US. Source: TradingView

Implications for Bitcoin and Other Assets

The rising yield gap and increasing yields have significant implications for Bitcoin and other assets. Higher yields reduce the opportunity cost of holding non-yielding assets like stocks, increasing the likelihood that Bitcoin will fall. Additionally, the outperformance of gold creates further headwinds for Bitcoin, as investors favor traditional inflation hedges over high-beta, risky assets.

Source: X

Source: X

According to Bloomberg Intelligence strategist Mike McGlone, gold’s “historic alpha grab” is drawing capital toward traditional inflation hedges, making it more challenging for Bitcoin to reclaim key psychological levels at or above $100,000.

Source: X

Source: X

For more information, visit https://cointelegraph.com/news/us-yield-spread-2021-highs-warning-for-bitcoin-price?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound