Introduction to Zcash’s Recent Surge

Zcash, a privacy-focused cryptocurrency, has experienced a remarkable surge in recent weeks, with its value rising over 10-fold and briefly returning to large-cap territory with a valuation of over $10 billion. This sudden increase in value has led to Zcash becoming the most searched asset on Coinbase, surpassing both Bitcoin and XRP. But what factors have contributed to this sudden rise, and is this a sign of a longer-term trend or just a fleeting moment of speculation?

Understanding Zcash’s Technology and History

Zcash was launched in 2016 as a Bitcoin-style proof-of-work (PoW) chain with a hard cap of 21 million coins. It is based on state-of-the-art zero-knowledge proofs, which allow users to send either transparent transactions, similar to Bitcoin, or fully shielded transactions, where amounts and addresses are hidden but still mathematically verifiable. Initially, Zcash was viewed as a promising project, supported by leading cryptographers and privacy advocates. However, over time, it slipped in the market capitalization rankings, and its daily volumes declined, making it seem like a legacy token from an earlier era.

The Recent Changes and Upgrades

Despite its decline, Zcash has been quietly reshaping its underlying story. The latest halving on November 23, 2024, reduced the block reward from 3.125 ZEC to 1.5625 ZEC, reducing daily new issuance from around 3,600 coins to around 1,800. Additionally, the amount of ZEC held in protected addresses has increased from about 1.7 million coins to about 4.5 million over the past year, with more than 1 million coins moving into protected pools within a three-week window. The new financing and governance structure, introduced with the NU6.1 upgrade, provides 8% of block rewards to community grants and 12% to a coin holder-controlled fund, giving ZEC holders a formal say in how millions of dollars in development capital will be deployed until the next halving in 2028.

The Catalyst for the Surge

The catalyst for Zcash’s recent surge was a mix of narrative and timing. A high-profile exploit in Monero, a rival privacy coin, shook confidence in the sector, and commentators looked for an alternative with active governance and a clear upgrade path. At the same time, regulators continued to tighten supervision over opaque money flows, making “total darkness” more difficult to defend, while Zcash’s model of optional privacy and verifiable view keys appeared more compatible with compliance-oriented institutions. This combination of factors positioned Zcash as a candidate to fill the vacuum left by Monero and capitalize on the renewed interest in “responsible” privacy coins.

Search Volume and Retail Interest

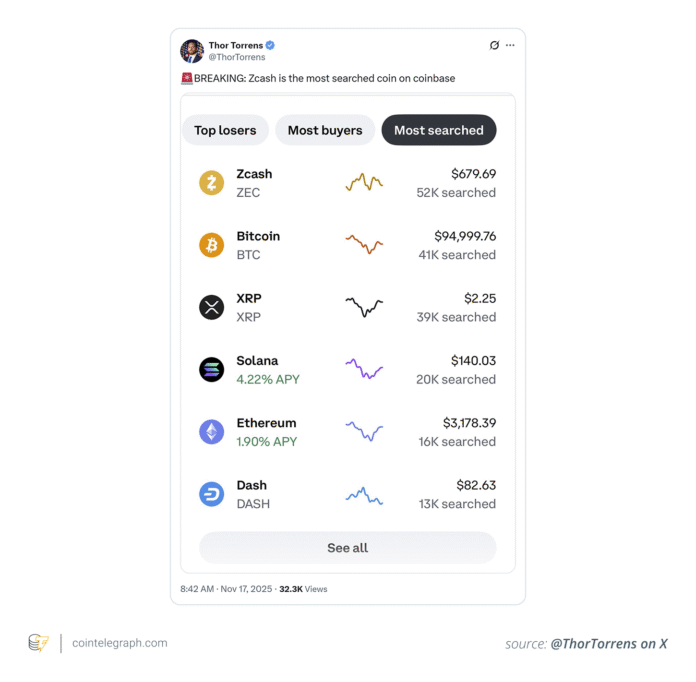

According to Zcash consultant Thor Torrens, ZEC saw around 52,000 unique searches on Coinbase in mid-November, compared to around 41,000 for XRP and 39,000 for Bitcoin. This sudden increase in search volume is a clear snapshot of retail curiosity, with tens of thousands of users typing “Zcash” into the search bar on one of the world’s largest fiat driveways. Social data from X and Reddit showed a similar increase in mentions, indicating that November was the month that Zcash came back into the retail consciousness.

Evaluating the Surge

While it’s easy to call this a blow-off top, given the rapid increase in value, there is also a case that November was more of a reassessment than a pure mania peak. Supply growth has already been halved by the halving in 2024, shielded usage now accounts for more than a quarter of circulating supply, and NU6.1 has introduced a clearer and more transparent funding model by the next halving cycle. If these fundamentals hold, some analysts argue that any sharp correction could mean a rebalancing to a higher range, although the results remain uncertain.

Conclusion and Future Outlook

Zcash’s November moment says as much about the broader crypto market as it does about an older token. Markets have a habit of rediscovering assets that are quietly improving their economy, strengthening governance, and waiting for the right macroeconomic story to catch up. In this case, the story was about privacy, and Zcash’s model of optional privacy and verifiable view keys appeared more compatible with compliance-oriented institutions. As the crypto market continues to evolve, it will be interesting to see whether Zcash can maintain its momentum and establish itself as a leading player in the privacy coin sector. For more information, visit https://cointelegraph.com/news/how-zcash-went-from-low-profile-token-to-the-most-searched-asset-in-november-2025?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound