Introduction to HumidiFi and its Rise to Prominence

The dark pool HumidiFi has made a significant impact on the Solana blockchain, surpassing major competitors such as Meteora, Raydium, and Pump to become the largest decentralized exchange (DEX) protocol. With a recorded $1.1 billion in 24-hour trading volume, HumidiFi’s rise underscores a broader shift in the decentralized finance (DeFi) sector towards dark pool or proprietary automated market maker (AMM) models. These models prioritize execution efficiency and privacy over transparency and open liquidity.

Key Statistics and Market Position

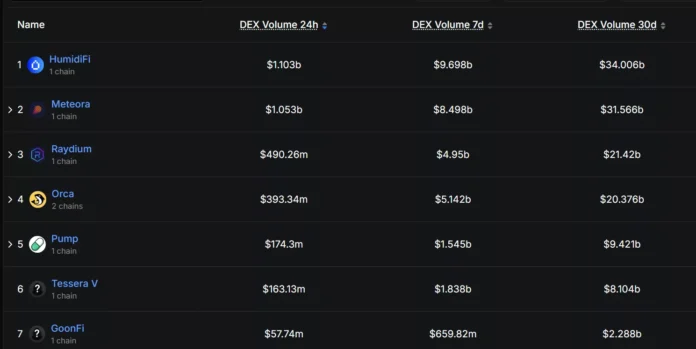

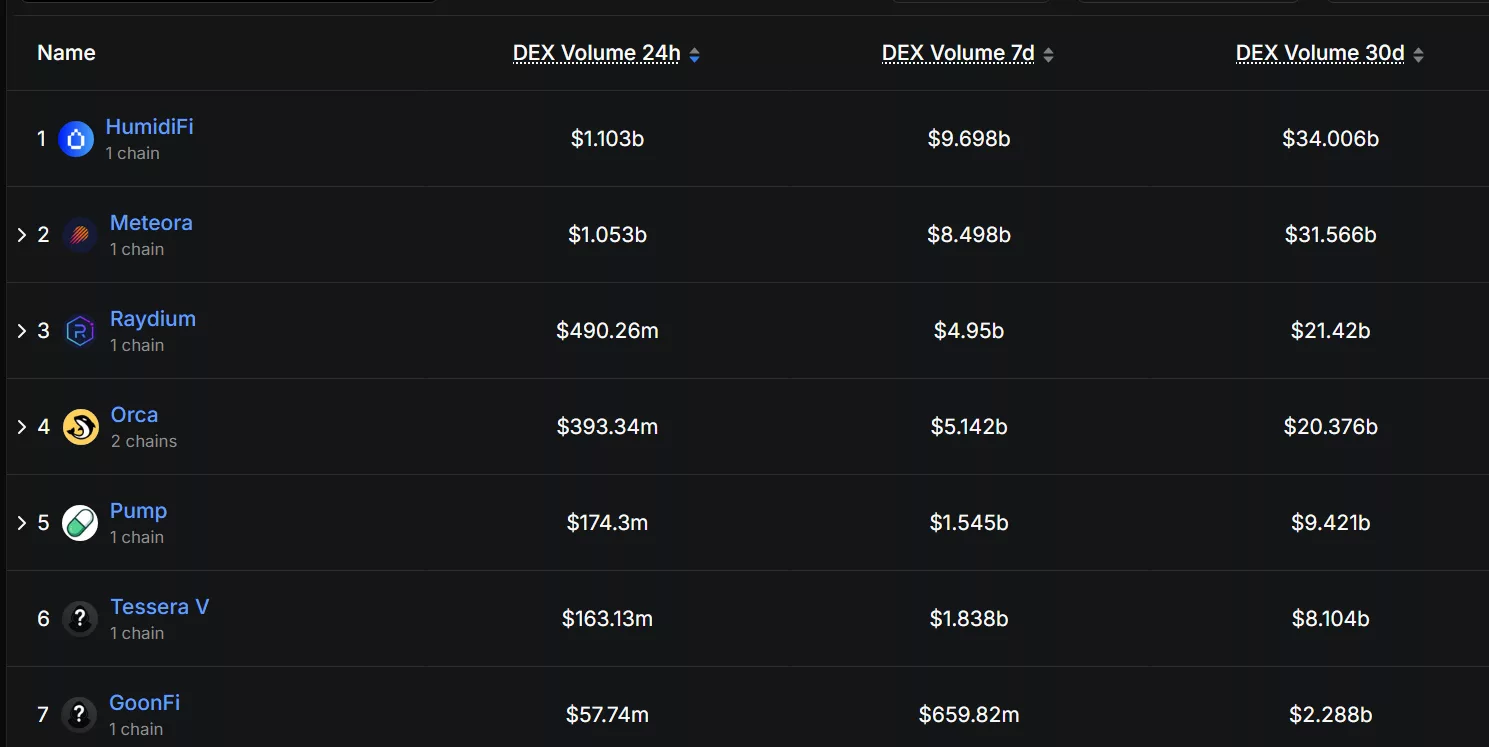

According to DeFi Llama, HumidiFi contributes up to $1.1 billion of the total 24-hour DEX trading volume on Solana, with the total daily DEX volume on Solana (SOL) exceeding $3.68 billion. In comparison, Meteora, the second-largest DEX on Solana, trails behind HumidiFi by $100 million. Over the last seven days, HumidiFi has maintained its lead with a trading volume of almost $10 billion, while Meteora’s seven-day trading volume is around $1.2 billion lower.

Raydium (RAY) daily DEX volume is close to $500 million, with its seven-day trading volume still under $5 billion, placing it behind the two largest DEX platforms on Solana. Meanwhile, Solana’s meme coin launchpad Pump.fun (PUMP) has seen a significant decline, with its DEX trading volume standing at $174.3 million, despite reaching $1.5 billion in DEX trading volume and $9.4 billion in 30-day volume.

HumidiFi climbs to the top of Solana DEX protocols on October 20th | Source: DeFi Llama

HumidiFi climbs to the top of Solana DEX protocols on October 20th | Source: DeFi Llama

Understanding HumidiFi’s Proprietary AMM Model

HumidiFi operates with a proprietary automated market maker (Prop-AMM) model, distinct from the traditional open liquidity pool AMM model. This means that the protocol does not rely on external liquidity providers contributing to open pools, as is the case with many standard AMMs. Instead, HumidiFi’s model is often referred to as a “dark pool” due to its ability to execute private trades, making it particularly useful for high-value trades and large liquidations.

Implications of HumidiFi’s Rise

The sudden surge in trading activity on HumidiFi could signal deeper changes in the DeFi sector, suggesting a shift towards models where liquidity is managed centrally and trades are routed to highly efficient trading venues via aggregators. This may indicate that the market is moving away from public pools and towards dark pools, with traders valuing execution efficiency and institutional-level trading mechanisms over traditional metrics such as total visible value or open pool liquidity.

However, this transition to closed liquidity models raises concerns about transparency, decentralization, and on-chain fairness. The long-term sustainability of this model is also a topic of discussion, as the increase in activity may be temporarily motivated by specific market conditions or pairs currently executing on the platform.

Conclusion and Future Outlook

In conclusion, HumidiFi’s rise to become the largest DEX protocol on the Solana blockchain marks a significant shift in the DeFi sector. As the market continues to evolve, it is essential to monitor the implications of this shift and the potential impact on the broader DeFi ecosystem. For more information on HumidiFi and its position in the Solana DEX market, visit https://crypto.news/humidifi-becomes-solanas-largest-dex-with-1-1b-volume/