Bitcoin Price Outlook: Can BTC Avoid Falling Below $85,000?

Despite the recent rejection of Bitcoin (BTC) at the $89,000 level, some metrics suggest that the BTC price could avoid falling below $85,000. The BTC futures open interest has fallen to an eight-month low, signaling a leverage flush rather than bearish bets. Additionally, Bitcoin options pricing suggests stabilizing sentiment, which could help support the price.

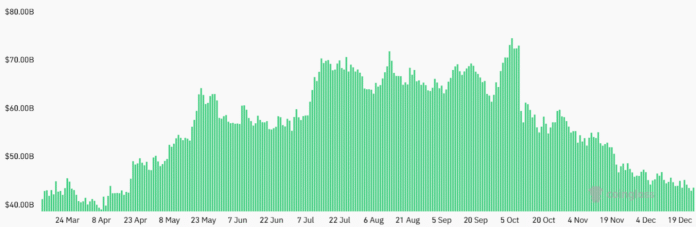

The aggregate BTC futures open interest on major exchanges fell to $42 billion on Friday, down from $47 billion two weeks earlier. This sharp drop in leverage is not inherently bearish, as longs and shorts are always matched. However, investor unease intensified after a five-day outflow from spot Bitcoin ETFs totaling $825 million. While this represents less than 1% of the combined $116 billion in deposits, traders fear the bullish momentum seen in October has faded amid global economic uncertainty.

BTC Futures Open Interest Hits Eight-Month Low

Bitcoin faced another rejection after briefly testing the $89,000 level on Friday, liquidating more than $260 million in leveraged BTC futures positions. The BTC futures open interest fell to $42 billion, an eight-month low, as shown in the image below.

Meanwhile, precious metals such as gold and silver have soared to new all-time highs as investors seek protection from rising United States debt. The demand for government-backed debt increased, pushing yields on the US 10-year Treasury to a three-week low of 4.12%. Part of the skepticism toward US monetary policy stems from inconsistent signals around import tariffs.

Bitcoin’s Basis Rate Recovers

The Bitcoin monthly futures premium helps assess whether whales and market makers have turned bearish. Under neutral conditions, BTC futures typically trade at a 5% to 10% annualized premium, known as the basis rate, to compensate for the longer settlement period. The Bitcoin futures basis rate stood at 5% on Friday, unchanged from the prior week, as shown in the image below.

Meanwhile, the Bitcoin options market can help determine whether whales and market makers expect further downside. The delta skew measures the cost of put (sell) options relative to call (buy) instruments. When sentiment weakens, the metric rises above the neutral 6% threshold, while bullish phases typically push it into negative territory, as shown in the image below.

Although a retest of the $85,000 support level remains possible, the bulls appear to be gradually regaining confidence, even if Bitcoin fails to break above $90,000 in the near term. For more information, visit the original source: https://cointelegraph.com/news/no-90k-bitcoin-futures-open-interest-8-month-low?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound