Japan’s Crypto Tax Reforms: A New Era for Investors

Japan is on the cusp of a significant change in its cryptocurrency tax policy, with plans to introduce a flat 20% tax rate on crypto profits in the 2026 financial year. This move aims to reconcile digital assets with traditional investments, making them more competitive and well-regulated. The current system, which imposes progressive tax rates of up to 55%, has discouraged participation and driven many traders away from Japan. In contrast, shares are taxed at a lower rate of 20%, giving them a significant advantage.

The proposed tax reforms, which are part of a broader economic strategy, will introduce stock-like insider trade regulations for cryptocurrencies. This will prevent unfair profits from private information, such as token listings or protocol changes, and strengthen market integrity. The reforms will also allow investors to offset losses over a three-year period, enabling them to better manage portfolio risk in a volatile market.

Key Takeaways

The key takeaways from Japan’s proposed crypto tax reforms are:

- Japan plans to replace progressive crypto tax rates of up to 55% with a flat 20% rate in the 2026 financial year.

- New rules will reconcile digital assets with shares and add protection against insider trade and unfair practices.

- Investors will receive three-year losses to facilitate volatility and improve portfolio risk management.

- Japan shifts from strict regulations to a web3-friendly framework, bringing innovation into harmony.

Proposed Crypto Tax Reforms and Regulatory Changes

The proposed tax regime is likely to come into effect in the 2026 financial year, subject to parliamentary approval. This change will introduce a significant deviation from the existing control system. The reforms will also introduce stock-like insider trade regulations for cryptocurrencies, which will prevent unfair profits from private information, such as token listings or protocol changes, and thus strengthen market integrity.

The tax reform is not an independent measure but part of a broader economic strategy to organize cryptocurrencies with traditional investments, making them competitive and well-regulated. The tax check from 2025 can also include investor-friendly measures, such as allowing three-year losses to enable the prerequisites for loss, bringing crypto into harmony with stocks, and offering decisive flexibility in a volatile market.

How the Crypto Tax Reforms Can Announce a New Era for Retailers in Japan

Japan is shifting from one of the hardest tax regimes in crypto to a fairer, more investor-friendly system. The government sees this as a way to strengthen its role as a global hub for digital assets. Finance Minister Katsunobu Katō openly supported Crypto’s place in diversified portfolios, however, he noted its volatility, emphasizing that building the right environment could transform it into a legitimate investment option.

The ruling Liberal Democratic Party has made these reforms part of their political platform. The plan includes moving crypto to a flat-rate tax regime and expanding supervision in a stock-style, which signals that digital assets are now part of Japan’s wider economic strategy. The Financial Services Agency (FSA) is preparing the details, including a flat 20% tax rate for crypto profits from the 2026 financial year, three-year loss regulations, and the categorization of crypto as part of the law on financial instruments and exchange.

Japan: From Strict Regulation to Web3 Embrace

After high-profile hacks, particularly the collapse of Mt. Gox in 2014 and the notorious Coincheck hack in 2018, Japan implemented some of the world’s strictest cryptocurrency regulations. The FSA enforced strict standards for crypto exchanges, custody services, anti-money laundering (AML) and know-your-customer (KYC) practices, and cybersecurity, prioritizing investor protection, even at the expense of innovation.

Under the former Prime Minister Fumio Kishida, Japan began moving in a new direction. As part of its broader strategy “New Capitalism” and Web3, the government signaled a hug of blockchain and decentralized finance (DeFi) to maintain domestic technical talents and remain competitive worldwide. Public consultations and legislative planning will follow to re-calibrate Japan’s cryptopolitics and reconcile security with innovation and web3-friendly growth.

Possible Market Effects of Japanese Crypto Reforms

When Japan implements its proposed tax reforms, both corporate and individual acceptance of crypto will likely accelerate. Lower taxes and clearer rules could increase liquidity, attract institutional capital, and promote the development of digital financial infrastructure. The reforms also align with a greater goal: Japan’s position as a global digital financial center, competing with crypto-friendly jurisdictions such as Singapore and the United Arab Emirates.

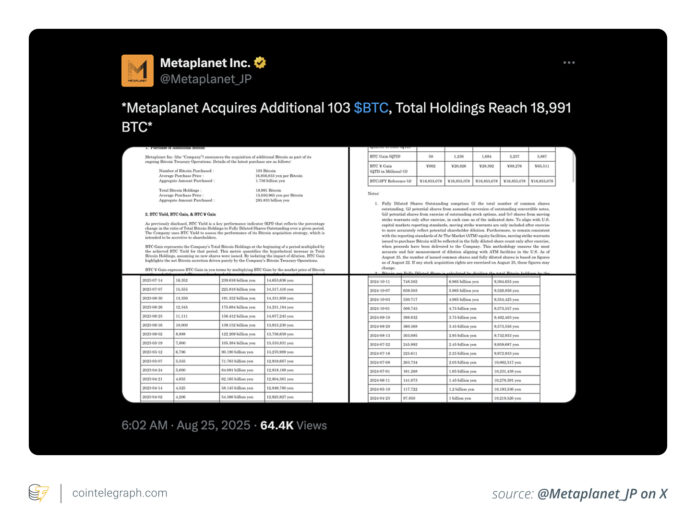

A regulated, investor-friendly environment would help attract global capital, promote domestic markets, and strengthen Japan’s role in the web3 economy. Optimism about these reforms is already visible. MetaPlanet, Japan’s largest Bitcoin owner of companies, was added to the FTSE Japan Index, a sign of growing mainstream acceptance. On August 25, 2025, the company bought another 103 BTC, increasing its total holdings to 18,991 BTC.

Challenges and Future Prospects

The proposed cryptocurrency tax reforms in Japan face several challenges, including the inherent volatility of digital assets, which raises concerns about market stability and investor protection. The enforcement of regulatory authority presents another hurdle, as compliance with new insider trade rules requires robust supervision. Additionally, parliamentary approval for the 20% flat-rate tax rate may be delayed due to political debates or competing priorities.

Despite these challenges, Japan’s planned reforms signal a significant change in direction towards investor-friendly policies and a stronger global positioning of the country. It is expected that these changes will pave the way for rapid growth in the Japanese crypto industry and promote the development of stable coins such as JPYC. With crypto reforms, Japan lays the basis for a leading regulated cryptocurrency center in Asia, appealing to both retail and institutional investors with improved clarity, tax parity, and infrastructure.

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision. For more information, visit https://cointelegraph.com/news/how-japan-plans-to-fix-its-crypto-tax-rules?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound