Japanese Nail Salon Operator Convano Embarks on Ambitious $3 Billion Bitcoin Acquisition Strategy

Convano, a Tokyo-listed nail salon company, has officially launched its Bitcoin acquisition strategy, aiming to raise approximately ¥434 billion ($3 billion) to purchase 21,000 Bitcoin, equivalent to 0.1% of the total supply. According to an August 30 Bloomberg report, the company plans to become one of the world’s largest corporate Bitcoin holders.

Taiyo Azuma, Director of Convano’s BTC Holding Strategy Office, outlined a three-phase Bitcoin acquisition plan, with a target of 2,000 BTC by the end of 2025. The portfolio is expected to reach 10,000 BTC by August 2026, as Azuma stated, “Our goal is clear. By March 2027, we aim to acquire 21,000 BTC and become one of the world’s leading Bitcoin-holding companies.”

Convano’s Bitcoin Acquisition Strategy: A Response to Japan’s Economic Pressures

Convano frames its BTC pivot as a strategic response to macroeconomic challenges. A prolonged decline in the yen, approximately 21% weaker against the dollar over the past decade, has increased costs for wages and raw materials in its consumer services business. “We started to think about Bitcoin because of persistent yen depreciation and geopolitical risks,” Azuma told Bloomberg. “Bitcoin is a long-term store of value.”

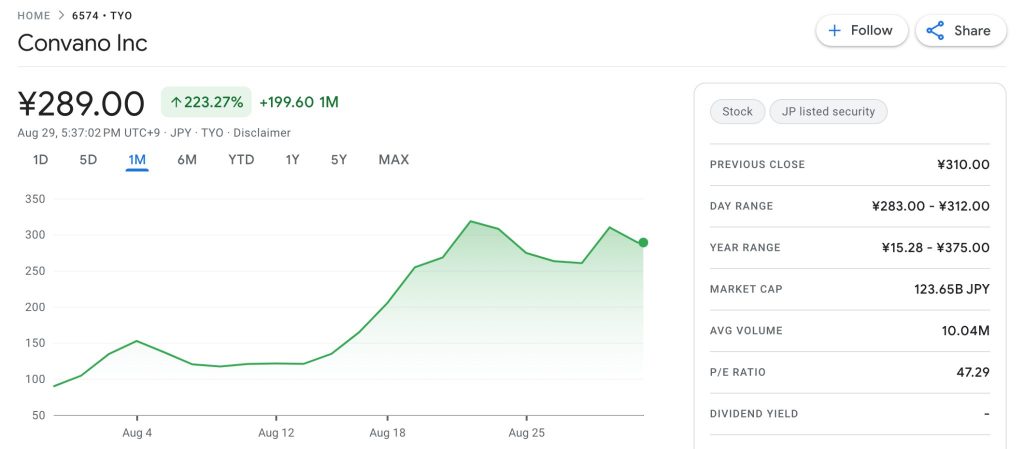

Of the funds Convano has raised to date, ¥4.5 billion came from corporate bonds, and it has acquired 365 Bitcoin with it. The Bitcoin acquisition announcement has driven Convano’s stock higher, with shares climbing 223.27% in the past month and surging 1,414.68% YTD.

Source: Google Finance

Source: Google Finance

Japan’s Growing Role in Bitcoin Accumulation

Japan has become an unexpected hub for Bitcoin accumulation through publicly listed companies. Metaplanet Inc., a former hotel operator, now holds nearly 19,000 Bitcoin, ranking among the top 10 global holders. According to Bitcoin Treasuries, seven Japanese companies now rank among the top 100 public firms holding BTC.

Experts Warn of Risks in Bitcoin Acquisition Strategies

However, experts like VanEck’s head of digital assets research Matthew Sigel argue that Bitcoin treasury strategies adopted by public companies rest on “shaky ground”, with rising risks that could wipe away shareholder value. According to Sigel, when stocks trade significantly above their Bitcoin net asset value (NAV), issuing new equity generates premiums.

Source: YCharts

Source: YCharts

Glassnode lead analyst James Check shared similar concerns about the longevity of corporate Bitcoin treasury strategies. “My instinct is the Bitcoin treasury strategy has a far shorter lifespan than most expect,” Check posted on X in July.

Check argued that while early adopters, such as MicroStrategy, which holds nearly 600,000 BTC, have established their dominance, newer treasury firms face steeper challenges. “Nobody wants the 50th treasury company,” he noted, warning that investors increasingly demand clear differentiation rather than another firm simply adding Bitcoin to its balance sheet.

Read more about Convano’s ambitious Bitcoin acquisition strategy and the growing trend of corporate Bitcoin accumulation in Japan on Cryptonews.