Blockchain Technology Revolutionizes Institutional Payments

Leading financial institutions, such as JPMorgan and DBS, are exploring the potential of blockchain technology to enable faster and cheaper institutional payments. This move signals a growing interest in tokenization solutions, which aim to bring financial and physical assets onto the blockchain, improving investor access. The collaboration between JPMorgan and DBS to develop a blockchain-based tokenization framework is a significant milestone in this direction.

The tokenization framework will enable the two financial institutions to facilitate 24/7 instant payments across public and permissioned blockchain networks, providing their institutional customers with broader access to cross-bank on-chain transactions. According to DBS, this framework will allow institutional customers to exchange or redeem tokenized deposits and make real-time cross-border payments on both public and permissioned blockchain networks, operating 24 hours a day, seven days a week.

Growing Institutional Interest in Tokenized Financial Solutions

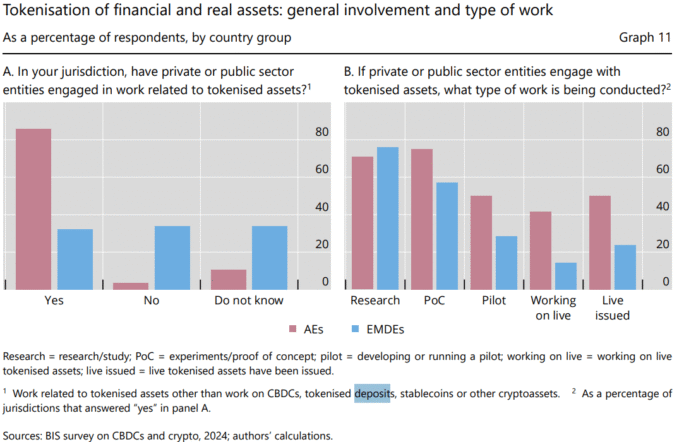

A 2024 survey by the Bank for International Settlements (BIS) revealed that at least a third of commercial banks surveyed have launched, tested, or researched tokenized deposits. This growing interest in tokenized financial solutions is part of the broader tokenized real-world assets (RWA) sector, which aims to improve investor access. The development of interoperable frameworks, such as the one between JPMorgan and DBS, is critical to reducing fragmentation in tokenized, cross-border money transfers.

Financial institutions, such as UBS, PostFinance, and Sygnum Bank, are also exploring blockchain-based interbank payments. On September 16, these institutions made the first blockchain-based, legally binding payment, proving the technology’s effectiveness for bank deposits and institutional payments. Rachel Chew, group chief operating officer and head of digital currencies and global transaction services at DBS Bank, emphasized the importance of creating an interoperable framework to reduce fragmentation in tokenized, cross-border money transfers.

Standard Chartered’s Venture Arm and Tokenized RWAs

Standard Chartered’s venture arm aims to raise $250 million for crypto funds, according to reports. The bank also expects $2 trillion in tokenized RWAs by 2028, equivalent to stablecoins. JPMorgan is preparing to launch its tokenization platform in 2026 and plans to tokenize additional assets, including personal loans and real estate. The investment bank launched its first transaction on its upcoming tokenization platform Kinexys Fund Flow, as reported on October 30.

JPMorgan and DBS were among the main backers of Patrior, a blockchain-based settlement network and payments platform that raised $60 million in July 2024. The development of tokenization frameworks and interoperable solutions is expected to continue, with more financial institutions exploring the potential of blockchain technology to revolutionize institutional payments. For more information, visit https://cointelegraph.com/news/jpmorgan-dbs-to-develop-tokenization-framework-for-interbank-deposits?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound