The recent flash crash in the cryptocurrency market, which saw Ether (ETH) plummet by 20.7%, has left many investors reeling. However, despite the chaos, there are signs that the ETH derivatives market is stabilizing, and the cryptocurrency may be poised to reclaim the $4,500 mark. In this article, we will examine the key factors that suggest ETH’s recovery may be underway.

ETH Perpetual Contract Distortions Fade

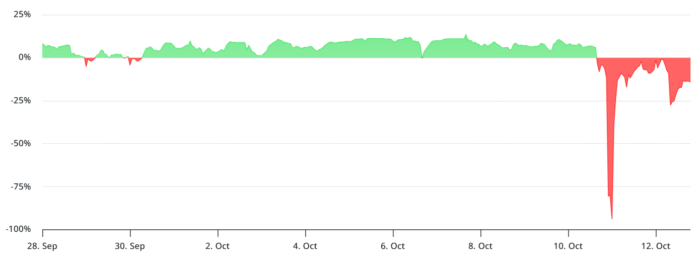

The ETH perpetual futures funding rate has fallen to -14%, indicating that short traders are paying to keep their positions open. This unusual setup likely reflects growing fears that certain market makers or exchanges may face solvency issues. However, this distortion in the derivatives market may continue until market makers regain confidence, which could take weeks or even months. The annual funding rate of ETH Perpetual Futures can be seen in the chart below. The annual funding rate of ETH Perpetual Futures. Source: laevitas.ch

Monthly ETH futures absorbed the shock in less than two hours and quickly regained the 5% minimum premium required for a neutral market. The ETH 60-day futures premium compared to regular spot markets can be seen in the chart below. ETH 60-day futures premium compared to regular spot markets. Source: Laevitas.ch

Options Markets Show Balanced Demand

The Ether options markets on Deribit showed no signs of stress or unusual demand for bearish strategies. Trading volume remained normal over the weekend, and put option activity was slightly lower than call option activity, indicating a balanced and healthy market. The put to call ratio of ETH options at Deribit, USD can be seen in the chart below. Put to call ratio of ETH options at Deribit, USD. Source: laevitas.ch

This data helps allay concerns about a coordinated cryptocurrency market crash. A sharp increase in options volume would likely have occurred if traders had expected a sharp drop in price. Whatever triggered the cascading unravels and instability in the ETH derivatives markets caught traders completely by surprise.

ETH Outperforms Major Altcoins

More importantly, a handful of major altcoins experienced intraday corrections well beyond Ether’s 20.7%, including the extreme cases SUI (SUI) with 84%, Avalanche (AVAX) with 70%, and Cardano (ADA) with a 66% decline. Ether is down 5% in the last 48 hours, while most competitors remain around 10% below their pre-crash levels. The ETH/USD vs. XRP/USD, SOL/USD, ADA/USD (5 min, lows) can be seen in the chart below. ETH/USD vs. XRP/USD, SOL/USD, ADA/USD (5 min, lows). Source: TradingView

Ether’s decoupling from the broader altcoin market underscores the strength of its $23.5 billion in spot exchange-traded funds and $15.5 billion in open interest in options markets. Even as Solana (SOL) and other competitors enter the spot ETF competition, Ether remains the top choice altcoin for institutional capital due to its established network effects and resilience during volatile times.

The outlook for Ether remains good as confidence in derivatives structures is gradually returning, supporting a possible rebound towards the $4,500 resistance level. For more information, visit https://cointelegraph.com/news/eth-readies-to-reclaim-4-5k-as-futures-markets-stabilize-from-crypto-flash-crash?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound