Kaito Kickstarter Projects Suffer Massive Post-TGE Crash – Is the Alpha Gone?

Several projects that raised capital through Kaito’s community-driven launchpad are facing significant losses following their token generation events, again raising questions about post-TGE performance, valuation discipline, and whether the early “alpha” surrounding the platform has faded.

According to data shared by market participants, a number of Kaito-backed projects experienced significant declines after launch. Play AI, which launched for $50 million, now has an FDV of just $2.1 million; Hana Network was founded at a valuation of $40 million and now has an FDV of $10.5 million; Novastro launched at a valuation of $50 million and now has an FDV of $1.05 million.

Play AI, which debuted at a completely diluted valuation of about $50 million, is now worth nearly $2.1 million. Hana Network fell from a starting value of $40 million to around $10.5 million, while Novastro fell from $50 million to just over $1 million. Bitdealer fell from $35 million to about $2.8 million.

Kaito Launchpad Faces Questions as Multiple Tokens Decline After TGE

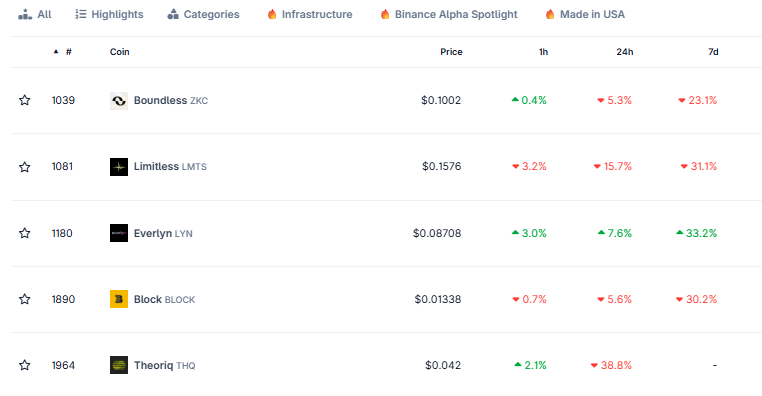

The weakness was not limited to newly launched projects. Several tokens that previously ran campaigns within the Kaito ecosystem also saw sustained declines. Boundless’s ZKC token is trading at around $0.0995, down nearly 90% since its launch in September.

Source: CoinGecko

Limitless’s LMTS is down more than 46% since October, Everlyn’s LYN is down over 71%, and Block’s BLOCK token is down almost 70% from its starting level.

Concerns Over Post-TGE Performance and Valuation Discipline

Notably, the tokens launched under Kaito Capital Launchpad, which aggregates these offerings, currently have a combined market cap of approximately $77.1 million, down nearly 15% in the last 24 hours, with a daily trading volume of approximately $38.3 million.

Source: CoinGecko

Kaito operates an AI-powered information platform focused on “InfoFi,” transforming user-generated content, engagement, and on-chain activity into structured data.

As Campaigns Falter, Pressure Builds Across the Kaito Ecosystem

Its Launchpad, sometimes referred to as Yapper or Capital Launchpad, allows Web3 projects to raise funds and attention before and after their TGEs. Projects set their own terms, including ratings and vesting schedules, while the community helps promote campaigns through stakes, voting, and reputation points earned through content creation.

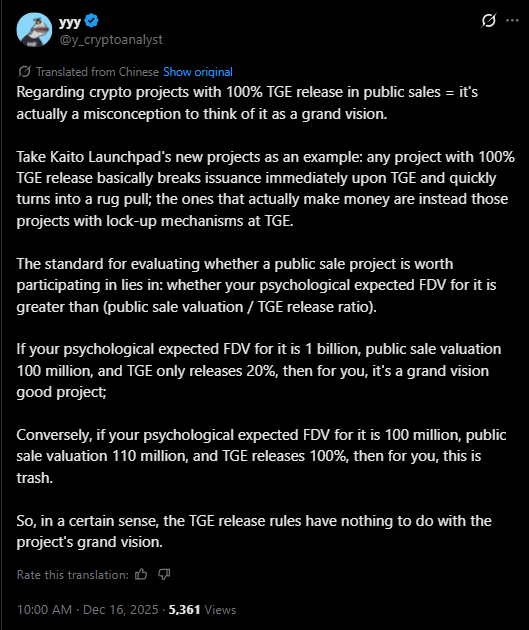

Criticism of the outcome of some of these campaigns has grown. Analysts have pointed out that the full token unlocking at TGE is a major cause of the sharp sell-offs.

Source: YYY/X

One crypto analyst pointed out that projects that release 100% of supply at launch essentially put all of their issues into circulation at once, leaving little buffer against immediate selling pressure.

Others highlighted that valuations of public sales often offered little upside once token trading began.

Creator relationships have also become a flashpoint. Community members tracking campaign results said dozens of projects either changed reward terms or delayed distribution after campaigns concluded, while others launched without clear timelines or structures.

Only a minority said they delivered the rewards as originally communicated. These disputes have created additional tension between developers and project teams who relied on Kaito’s engagement engine for visibility.

Kaito’s Response to Criticism and Future Plans

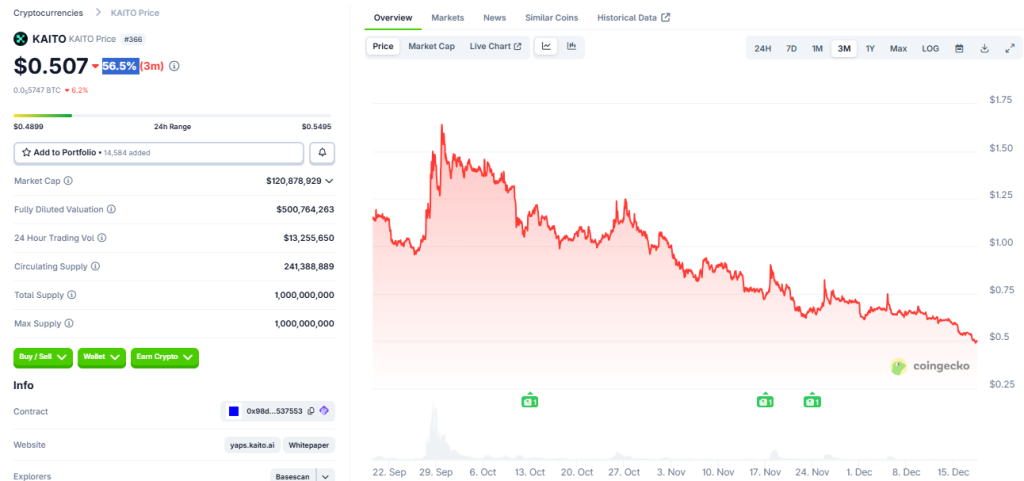

The general shift in sentiment has weighed on Kaito’s own token. KAITO is trading at around $0.50, down more than 56% in the last three months.

Source: Coingecko

The token is now about 83% below its all-time high of $2.88, but remains slightly above its all-time low.

Kaito recently outlined changes focused on on-chain identity checks, stricter reputation thresholds, and new verification methods aimed at reducing manipulation and bot-driven engagement.

The company said its system is evolving in response to feedback and further adjustments are expected.

For more information,