Kanye West, the renowned rapper, has made a significant splash in the cryptocurrency world with the launch of his Yy token on the Solana blockchain. In a remarkable turn of events, the token’s market capitalization soared to $3 billion just 40 minutes after its introduction. However, concerns regarding insider sales have led to a substantial decline in profits, sparking debate within the crypto community.

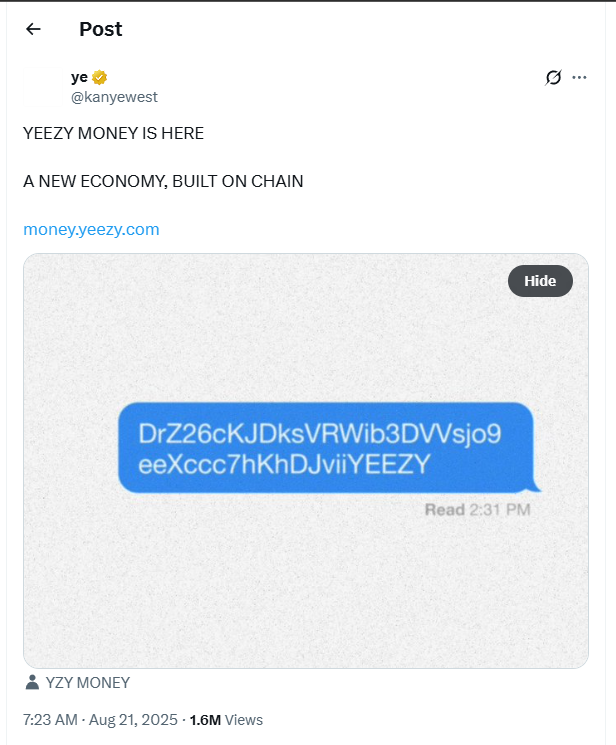

On Thursday, West, who now goes by the name YE, shared the contract address and website for Yeezy Money, which he refers to as a “new economy on the chain.” The website describes Yy as a currency, enabling transactions in “Yy Money,” a financial system built on crypto rails. West later announced, “The official Yy token has just dropped.”

Source: Kanye West

Within a mere 40 minutes, the YY token achieved a market capitalization of $3 billion, but its value has since decreased to over $1.05 billion at the time of writing. The website’s warning section cautions users about the risks associated with digital assets, including the potential for complete loss.

A user shared a screenshot of West warning users in February about being approached to promote a fake currency for $2 million, which led to him falsifying his account after applying for the token. At the time of writing, West’s net worth is estimated to be around $400 million.

Insider Trading Concerns

The Yeezy Money website claims to have used 25 contract addresses for the YY token, with a chance to be chosen as the official token to discourage token snipers. However, the YY token launch has raised suspicions of insider trading, similar to other celebrity-endorsed tokens.

Source: Yeezy money

Lookonchain, an on-chain analytics platform, noticed that only YY tokens were added to the liquidity pool, allowing developers to sell the tokens at any time if they change the pool’s liquidity. Conor Grogan, director of Coinbase, pointed out that at least 94% of the token supply was held by insiders, with a single multi-pocket wallet holding 87% of the supply before it was distributed to several other wallets.

Crypto Investors and Retailers

Despite concerns, several well-known crypto retailers have purchased the token. Lever dealer James Wynn explained that whales will likely be attracted to the token due to its liquidity and volume. Wynn stated that it’s a short-term game and that he has doubled or quadrupled the amount he invested in the tokens, citing President Donald Trump’s memo as a reason for his investment.

Bitmex co-founder Arthur Hayes also appears to have bought the token.

Source: Arthur Hayes

Celebrity Tokens and Market Trends

Celebrity tokens have received significant attention this year, with Argentina’s President Javier Milei considering support for the Scale token being one of the most controversial. In February, the Argentine President shared the Scale token on X, prompting the token to reach a market capitalization of $4 billion. However, he deleted the post hours later, voting against the community, which led to the token’s price falling.

The incident sparked outrage, with many demanding stricter regulations on memecoins funded by politicians. At the beginning of this year, US President Donald Trump launched the Trump Memecoin before his presidential inauguration.

For more information on the Kanye West memecoin and its market trends, visit Cointelegraph.