The Bitcoin price has experienced a notable surge, rising 1.5% to over $115,000 in the last 24 hours. This upward trend is supported by various technical and on-chain indicators, which suggest that the BTC market is gaining momentum on higher levels, according to Glassnode. To secure a recovery, BTC must maintain its price above $115,000, with a resistance level of $116,000 to $121,000.

Key Factors Influencing Bitcoin’s Price

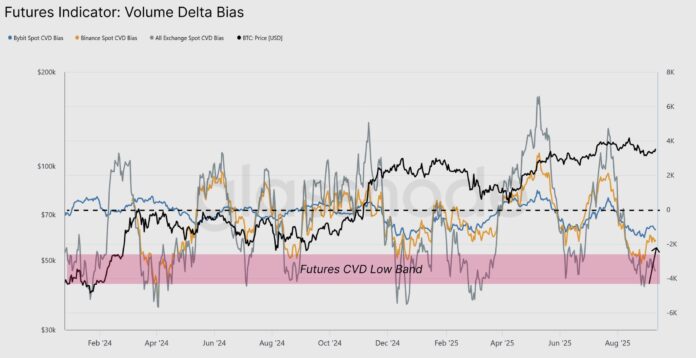

Bitcoin’s ability to stage a persistent recovery has been restricted by weak demand and softening ETF inflows. However, derivative markets are now playing a crucial role in indicating the sound when the spot market becomes weaker. The volume-Delta imbalance between buy and sell pressure has recovered during the bounce back from $108,000, signaling the exhaustion of sellers across exchanges such as Binance and Bybit.

Bitcoin-Futures indicator: Volumendelta -prehistority. Source: Glasnode

Bitcoin Derivatives and Open Interest

The open interest (OI) in Bitcoin futures has reached an all-time high of $54.6 billion, representing a 26% increase compared to $43 billion on September 1. This surge in OI reflects growing investor interest in the derivative market, which can have a positive impact on the BTC price. Additionally, options OI has reached a record high, accompanied by Bitcoin’s rise to new all-time highs over $124,500.

Bitcoin options open interest. Source: Glasnode

The futures basis and option positioning reflect a more balanced structure than in previous overheated phases, indicating that the market is occurring on more solid foundations. As CoinTelegraph reported, Bitcoin’s $4.3 billion in open interest favors optimistic bets, which could open the door for a BTC rally to $120,000 as long as the price remains above $113,000.

Key Bitcoin Price Levels to Watch

Data from CoinTelegraph Markets Pro and TradingView show that the Bitcoin price is trading at $115,400 after encountering resistance around $116,000. The BTC/USD pair must hold above $115,000 to continue its upward trend towards all-time highs. There is a large supply zone that extends from $116,000 to $121,000, which Bitcoin must overcome to continue its upward trend.

BTC/USD Daily Chart. Source: CoinTelegraph/Tradingview

Conversely, bears will attempt to defend the $116,000 level and push the price back. An important area of interest is between $114,500, where the 50-day moving average (SMA) and $112,200, currently being supported by the 100-day SMA. Another area of importance extends from the local low of $107,200 (reached on September 1) to the psychological level of $110,000.

BTC/USD chart. Source: Killaxbt

The BTC/USDT liquidation heatmap shows a liquidity cluster between $116,400 and $117,000, according to data from Coinglass. If this level is broken, it could trigger a liquidation squeeze, forcing empty sellers to close positions and drive prices to $120,000.

BTC/USDT 24-hour liquidation heatmap. Source: Coinglass

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision. For more information, visit https://cointelegraph.com/news/bitcoin-reclaims-115k-watch-these-btc-price-levels-next?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound