Robert Kiyosaki Stands Firm on Bitcoin and Gold Amid Market Decline

Robert Kiyosaki, the renowned author of Rich Dad Poor Dad, has reassured his 2.8 million followers on X that he will not be selling his Bitcoin or gold holdings despite the recent sharp decline in the market. In a post on Saturday, Kiyosaki stated that the primary reason for the market downturn is a global cash shortage, which he believes is the underlying cause of the “everything bubbles bursting.” He emphasized that the world is in need of cash, leading to the crash of various markets.

Kiyosaki expects a significant event, which he refers to as “The Big Print,” where governments will resort to massive money creation to cover their mounting debt loads, as suggested by Lawrence Lepard’s thesis. He predicts that this will make assets like gold, silver, Bitcoin, and Ethereum more valuable as the value of “fake money” decreases. Kiyosaki advises those in need of cash to consider selling some assets, suggesting that most panic stems from liquidity needs rather than conviction.

Kiyosaki’s Long-Term Stance on Bitcoin

In a follow-up post, Kiyosaki reaffirmed his long-term stance on Bitcoin, stating that he will buy more when the crash is over. He reminded his followers of Bitcoin’s limited supply of 21 million, which is a key factor in its potential for long-term growth. Kiyosaki also encouraged users to form “Cashflow Clubs” based on his board game, emphasizing the importance of learning together to avoid mistakes in investing.

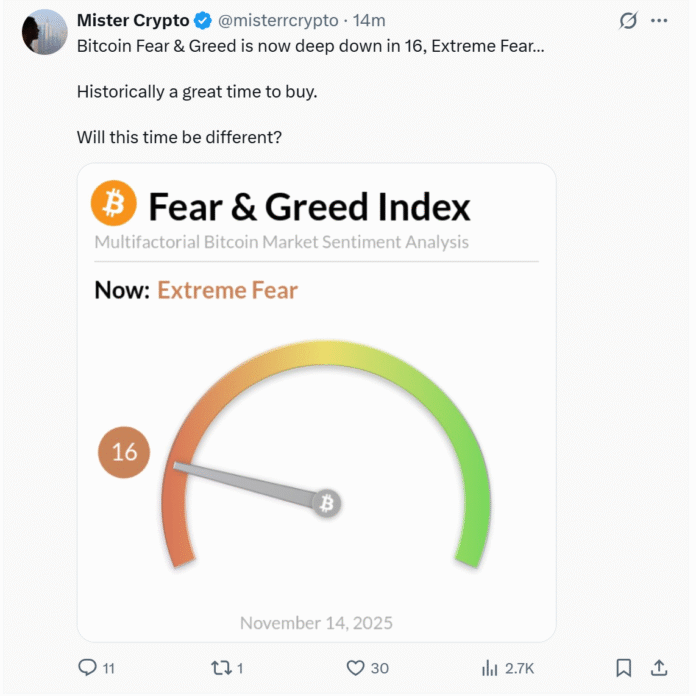

Crypto influencer Mister Crypto noted that the Bitcoin Fear and Greed Index has plummeted to 16, entering “Extreme Fear” territory, which is historically considered a potential buying zone. Mister Crypto noting that Bitcoin Fear and Greed Index has dropped to 16. Source: Mister Crypto

Market Sentiment and Potential Bottom

Meanwhile, analytics firm Santiment has warned traders to be cautious as social media fills with claims that Bitcoin has already bottomed. The firm noted that widespread confidence in a market floor often precedes further declines, citing the brief dip below $95,000 on Friday, which sparked a wave of posts suggesting the worst is over. Historically, Santiment said, bottoms tend to form when most traders expect prices to fall even lower, not when they are calling for a rebound.

For more information on the current market trends and expert analysis, visit the original source.