The Crypto Treasury Conundrum: A Cautionary Tale of Overexuberance

The current crypto market cycle has been marked by a significant trend: the rise of crypto treasury companies. However, according to Ray Youssef, founder of a peer-to-peer lending platform, this phenomenon bears an uncanny resemblance to the dotcom era of the late 1990s and early 2000s, which ultimately resulted in an 80% decline in value. Youssef warns that the same overzealous investor psychology that led to the dotcom crash is still present in the crypto market, despite the involvement of financial institutions.

Youssef notes that the dotcom era was characterized by innovative companies with solid ideas and long-term strategies, but also by a plethora of companies with unsustainable business models. Similarly, the current crypto market is driven by the idea of cryptocurrency, decentralized finance, and the web3 revolution, but not all companies will survive the test of time. He predicts that the majority of crypto finance ministries will be forced to liquidate their assets, creating the conditions for the next crypto bear market, while a select few will thrive and accumulate crypto at a significant discount.

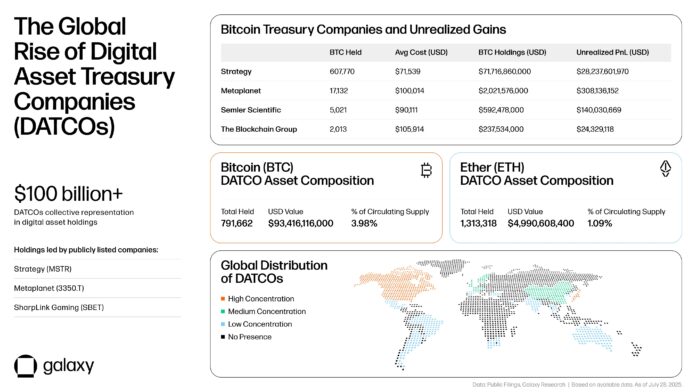

Crypto treasury companies have dominated the headlines in recent times, with institutional investments being touted as a sign of crypto’s maturation into a global wealth class. However, Youssef’s warnings suggest that not all is as rosy as it seems. In fact, the crypto market’s similarities to the dotcom era are striking, with many companies investing heavily in crypto without a clear understanding of the risks involved.

Surviving the Crypto Bear Market: A Tale of Responsible Management

While Youssef’s predictions may seem dire, not all crypto treasury companies are doomed to fail. With responsible management and risk assessment, companies can navigate the challenges of the crypto market and even thrive. Reducing debt burdens and investing in new equity capital can significantly improve a company’s chances of survival, as equity holders do not have the same legal rights as creditors.

Companies that invest in cryptocurrencies with a proven track record, such as Bitcoin (BTC), can also structure their debts to avoid repayment issues during market downturns. For example, if a company knows that Bitcoin tends to follow four-year cycles, it can structure its debts to mature in five years, avoiding the risk of loan repayment during periods of depressed crypto prices.

Furthermore, companies with an operating business and revenue streams are better positioned to weather the crypto market’s ups and downs than pure treasury games that rely solely on crypto investments. By investing in digital blue chip assets and maintaining a diversified portfolio, companies can reduce their risk exposure and increase their chances of success.

In conclusion, while the crypto treasury narrative may seem compelling, it is essential to approach the market with caution and a critical eye. By learning from the lessons of the dotcom era and adopting responsible management practices, companies can navigate the challenges of the crypto market and thrive in the long term. For more information, visit https://cointelegraph.com/news/crypto-treasury-similar-risk-2000-dotcom-bust?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound