Introduction to Stablecoins and the October 2025 Crypto Crash

The crypto market experienced a significant downturn on October 11, 2025, with Bitcoin, Ether, and various altcoins plummeting in value within a few hours. This event resulted in over $19 billion in liquidations, causing substantial losses for traders and highlighting the vulnerability of the crypto market. The crash was triggered by a flaw in Binance’s unified account system, which allowed users to post a wide range of assets, including collateralized derivatives such as wBETH and BNSOL, as collateral. The error lay in the way these assets were valued, with Binance relying on its internal spot market prices rather than external oracles or redemption prices.

The Collateral Trap: Internal Pricing and Systemic Risk

The vulnerability in Binance’s system allowed attackers to manipulate the order books, instantly invalidating the deposited collateral and triggering mass liquidations across the platform. This event highlights the importance of clear, reliable collateral and strong repayment mechanisms in maintaining the stability of digital finance. The consequences of the crash were severe, with the broader crypto market experiencing significant volatility. However, asset-backed stablecoins such as USDC and Tether maintained their pegs and showed resilience, while algorithmic stablecoins struggled to keep up.

The incident brings back memories of the Terra (LUNA) collapse in May 2022, when UST lost its peg and $40 billion vanished from the crypto market in an instant. This incident exposed serious vulnerabilities in the crypto architecture, which still exist today. Both events highlight the crucial reality that the stability of digital finance depends on clear, reliable collateral and strong repayment mechanisms. Without these fundamentals, liquidity is just a fragile illusion waiting to collapse.

Stablecoins under Stress: A Tale of Two Models

Stablecoins are often referred to as digital dollars and promise stability, fast transactions, and global reach. However, when markets become volatile, things get complicated. The recent crash was a stress test that many stablecoins failed, revealing that concrete support is far more important than clever programming when the pressure is high. This is not a new debate, but the scale and speed of the October event are astounding.

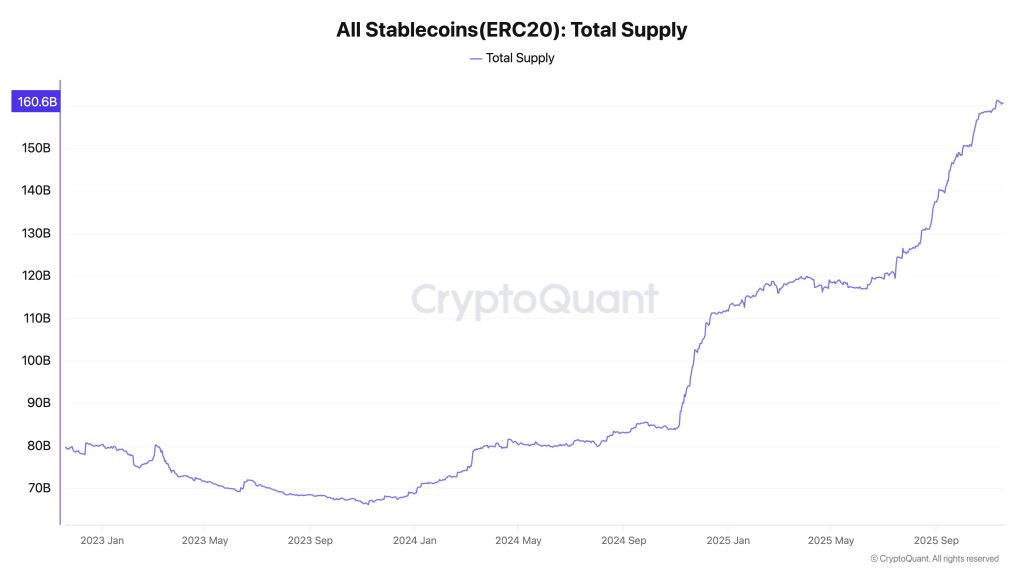

Some analysts believe the global stablecoin supply could reach $1 trillion by the end of 2025, reflecting the size and importance of the entire system. Stablecoins are increasingly being used for cross-border payments, DeFi protocols, and even institutional settlement layers. Their liquidity profile is important not only for traders but also for central banks, regulators, and financial institutions exploring digital dollar systems.

Source: CryptoQuant

Source: CryptoQuant

Why TradFi Standards Still Matter in a Crypto World

The recent crash highlights the importance of adopting traditional finance (TradFi) standards in the crypto world. It is no longer just about creating new tokens or innovative algorithms; it is about structuring liquidity, monitoring, and reducing stress. TradFi has spent decades developing standards for collateral, repayment, and risk management. To avoid contagion and gain institutional trust, stablecoins must begin to adopt principles that reflect traditional finance but learn from them rather than blindly imitating them.

Collateral transparency is no longer optional, and real-time checks, external price oracles, and redemption channels that ensure unconditional functionality even during market stress are essential. It also means rethinking algorithmic models that promise stability without substance. Systemic risks uncovered raise alarm bells, and the crypto industry must take steps to address these vulnerabilities to prevent similar events in the future.

Liquidity Isn’t Just Volume; It’s a Market Structure

Trust in digital dollar systems is not just a matter of robust code; effective governance, operational transparency, and overall system stability are crucial. The recent event has shown that even advanced platforms have their Achilles’ heel. True, unbiased teamwork between regulators and developers is key. The goal shouldn’t just be to mimic the traditional financial playbook; instead, we should focus on creating frameworks to protect DeFi innovation by establishing robust liquidity reserves, clear collateral requirements, and stress testing procedures that go beyond theory.

The crypto market will surely recover, but the lessons of October 2025 should not be forgotten. In the world of crypto, this cadaveric structure begins with how we design, value, and redeem our trust quanta, our digital assets. For more information, visit https://cryptonews.com/exclusives/stablecoins-under-fire-lessons-from-the-october-2025-crypto-crash/