US Federal Reserve Expected to Cut Interest Rates in 2025

Several financial institutions and market analysts are now predicting that the US Federal Reserve, the central bank of the country, will cut interest rates from the current target interest rate of 4.25% – 4.5% at least twice in 2025. This forecast follows a weak job report in August, in which only 22,000 jobs were added compared to the expected 75,000. The weak job market has led analysts to believe that the Federal Reserve will cut interest rates to stimulate economic growth.

Analysts from Bank of America, a banking and financial service company, have revised their previous stance and now project two 25-basis point cuts (BPS), one in September and another in December, according to Bloomberg. Similarly, economists from Goldman Sachs, an investment banking company, project three 25 BPS cuts in 2025, from September, October, and November. Citigroup, another banking giant, forecasts a total of 75 basis points, distributed in 25 BPS steps in September, October, and December, as reported by Reuters.

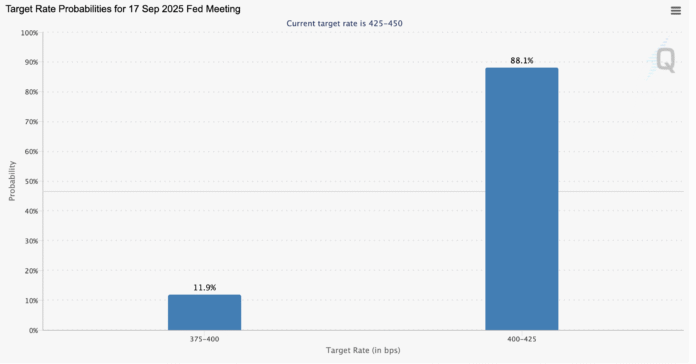

Interest rate cuts are expected to have a significant impact on the cryptocurrency market, as lower interest rates lead to increased liquidity in the market, which can drive up crypto prices and lead to persistent bull runs. On the other hand, higher interest rates can have the opposite effect on asset prices. According to the Chicago Mercantile Exchange (CME), over 88% of dealers expect a 25 BPS interest rate cut in September, while about 12% expect a 50-BPS reduction.

Job Market Revisions and Interest Rate Expectations

The chairman of the Federal Reserve, Jerome Powell, signaled a potential rate cut in September during the Jackson Hole Economic Symposium in Wyoming on August 22nd. The weak US job market, which is part of the Federal Reserve’s dual mandate to achieve maximum employment and keep prices stable, has led to expectations of interest rate cuts. The US job market has shown signs of weakening, with more unemployed than employed, according to the Koobeissi letter.

The US Bureau of Labor Statistics (BLS) has revised the jobs report for June, resulting in a total of -160,000 jobs, and has warned that 2024 job numbers may be reduced by around 818,000, and 2025 figures may be reduced by up to 950,000 jobs, according to the Koobeissi letter. These revisions have significant implications for the US economy and the Federal Reserve’s monetary policy decisions.

For more information on the expected interest rate cuts and their potential impact on the economy, visit https://cointelegraph.com/news/banking-giants-forecast-two-interest-rate-cuts-2025?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound