Mantra Launches $25 Million Buyback Program to Restore Investor Trust

Mantra, a blockchain-based platform, has announced a new allocation of $25 million to restore the trust of investors and the value of its OM token, according to a recent statement. This move is part of the company’s efforts to revitalize its market capitalization, which suffered a significant loss of over $5 billion in April.

The Mantra buyback program, dubbed OM-Reverse, aims to purchase approximately 110 million OM tokens, representing around 10% of the circulating supply, from the open market. The program is set to be carried out transparently on major exchanges, with independent trading companies executing recurring purchase orders at or near market prices.

Background and Context

In April, Mantra’s CEO, Mullin, promised a token buyback program after the price of OM plummeted from $6 to less than $0.50, resulting in a significant loss of market capitalization. The recent announcement of the $25 million allocation is a fulfillment of this promise, demonstrating the company’s commitment to its investors and stakeholders.

The new allocation is in addition to the $20 million investment from Inveniam, announced earlier this month, which aims to drive the development of Mantra’s RWA blockchain in the United Arab Emirates and the USA. The $25 million allocation is specifically intended for the purchase of OM tokens from the open market, with the goal of strengthening the company’s belief in the long-term value of the tokens.

Market Impact and Analysis

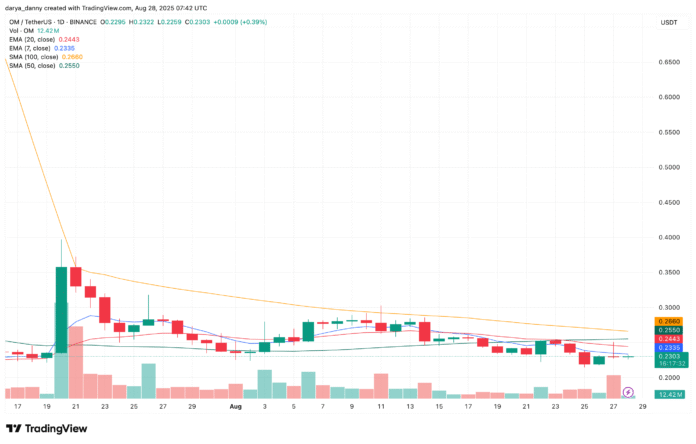

The announcement of the Mantra buyback program has already had a positive impact on the market, with the trading volume of OM increasing by over 200% in the past 24 hours. The current price of OM is $0.2305, with an immediate resistance at $0.25, which corresponds to the 50-day simple moving average (SMA). However, the medium and long-term outlook remains bearish, with OM continuing to trade between the 50-day and 100-day SMAs.

A closer look at the price chart reveals that OM was strongly rejected at the 50-day SMA yesterday, indicating a potential resistance level. The short-term dynamics also favor the downside, with the 7-day exponential moving average (EMA) below the 20-day EMA. A crossover of the 7-day EMA and 20-day EMA could signal a potential attempt to reverse the trend, but a decisive break above the 50-day EMA would be necessary to confirm a wider reversal of the trend.

Source: Tradingview

Source: Tradingview

For more information on the Mantra buyback program and its potential impact on the market, please visit https://crypto.news/mantra-buyback-25m/