The crypto marketplace took an sudden crash on April 12 as a spontaneous moderate in the cost of Bitcoin and important altcoins led to immense liquidations. The starting place of this popular value dip residue in large part unknown, amongst a plenty of believable causes, together with a up to date value correction in the United States hold markets.

Nearly $500 Million Liquidated In An Week Amidst Crypto Flash Accident

In step with information from CoinMarketCap, Bitcoin slipped via 4.49% within the utmost pace, falling as little as $66,052. As anticipated, BTC’s moderate reverberated during the marketplace, with important altcoins Ethereum and Solana recording day by day losses to the song of 8.12% and 12.16%, respectively

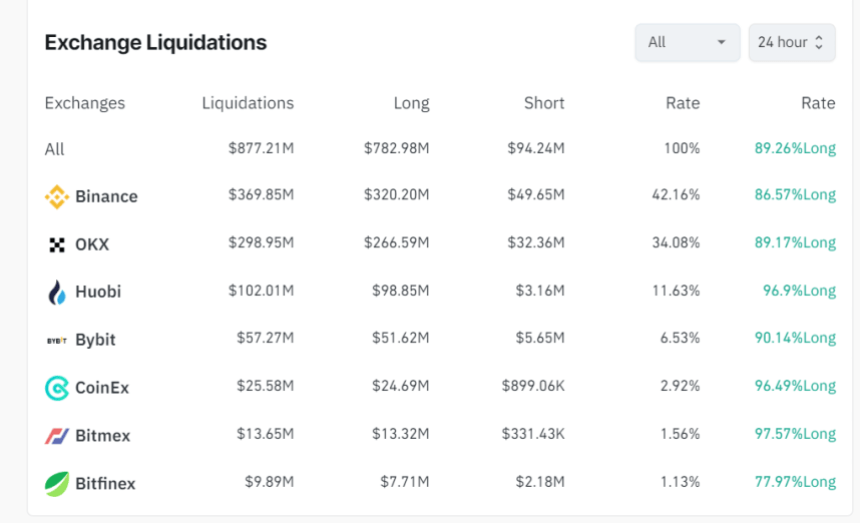

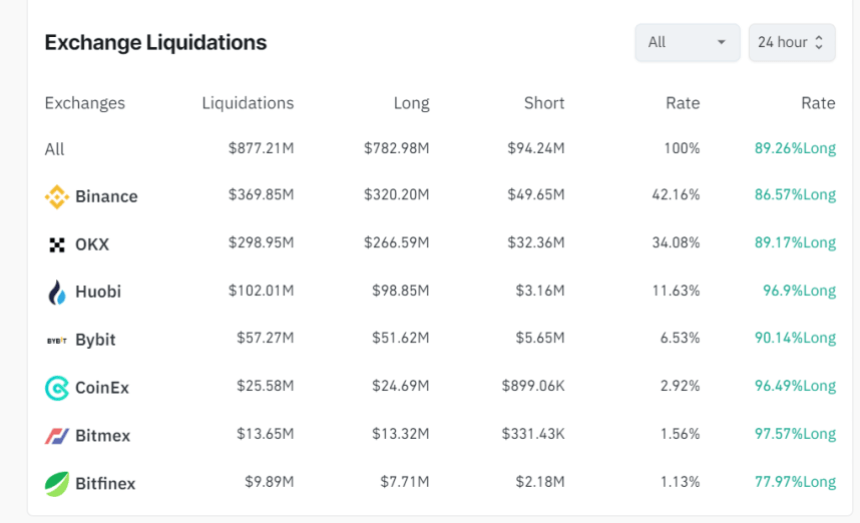

As previous said, those losses translated into 277,843 investors shedding their leverage positions as general crypto liquidations reached $877.21 million within the utmost 24 hours in accordance with information from Coinglass. Of those figures, lengthy positions accounted for $782.98 million, with trim investors shedding best $94.24 million.

Significantly, $467 million in leverage positions had been closed inside of an date because of a basic value moderate. The easiest quantity of liquidations at $369.85 million used to be recorded on Binance, age the one greatest liquidation series valued at $7.19 million befell within the ETH-USD marketplace at the OKX alternate.

Supply: Coinglass

Supply: Coinglass

Apparently, Bitcoin’s value moderate correlated with a dip in the United States hold marketplace because the S&P 500 index declined via 1.6% to industry as little as $5,108. This marketplace hit used to be preceded via contemporary CPI information, which confirmed that the inflation fee rose to three.5% occasion over occasion in March.

Such experiences best point out that the United States Federal Retain (Fed) may now not be enforcing any fee cuts quickly because it objectives to power inflation right down to its annual goal of two%. This prediction is reasonably bearish for the crypto marketplace normally as Fed fee cuts permit traders to very easily search dangerous belongings reminiscent of BTC with a possible of top yieldings.

Bitcoin Studies Community Expansion As Halving Approaches

On a extra certain be aware, Bitcoin has recorded a stand in non-empty wallets on its community forward of the Halving match on April 19. Blockchain analytics platform Santiment reported an building up of 370,000 BTC wallets protecting lively cash over the utmost six days. Apparently, the analytic staff is backing traders to guard this accumulative development throughout the Bitcoin halving match.

On the era of writing, Bitcoin used to be buying and selling at $66,882, with a 44.80% building up in its day by day buying and selling quantity, which is recently valued at $43.80 billion. On the other hand, Bitcoin’s value has normally been unimpressive in recent years, with a moderate of one.33% and six.20% within the utmost seven and 30 days, respectively.

Bitcoin buying and selling at $66,499.00 at the day by day chart | Supply: BTCUSDT chart on Tradingview.com

Bitcoin buying and selling at $66,499.00 at the day by day chart | Supply: BTCUSDT chart on Tradingview.com

Featured symbol from The Separate, chart from Tradingview

Disclaimer: The object is supplied for tutorial functions best. It does now not constitute the evaluations of NewsBTC on whether or not to shop for, promote or stock any investments and of course making an investment carries dangers. You might be urged to habits your individual analysis sooner than making any funding choices. Worth data supplied in this web page fully at your individual chance.