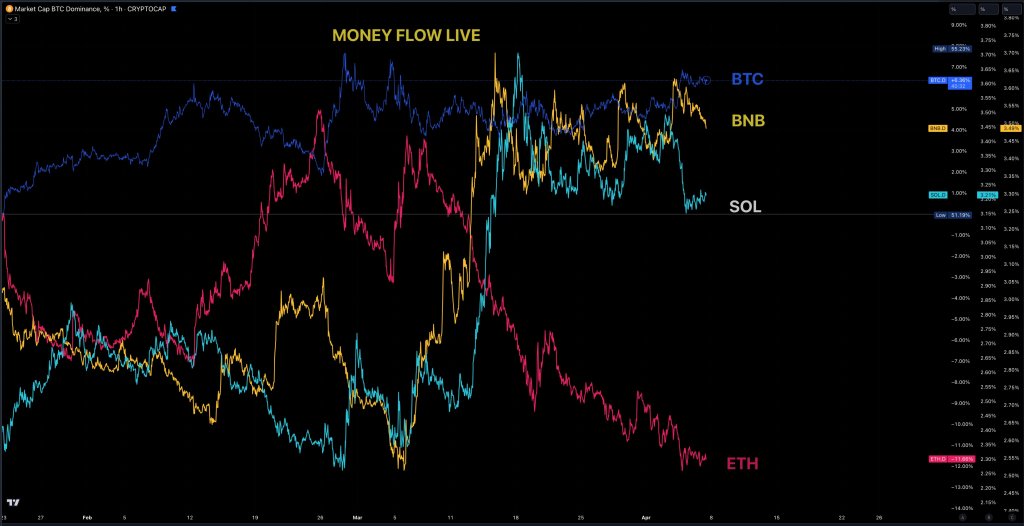

If fresh on-chain knowledge is anything else to proceed via, next there’s a paradigm shift amongst traders. In step with the Actual Era Cash Tide (RTMF) shared via one analyst on X, capital is transferring clear of Ethereum and the BNB Chain.

At the alternative hand, alternative cryptocurrencies, corresponding to Solana, are receiving a large inflow of capital.

Solana Receiving Billions In Capital

Some witnesses are actually involved that Ethereum, the important shrewd words platform, would possibly proceed trending decrease within the coming classes as Solana, considered one of its govern competition, stretches good points, because the RTMF chart presentations.

Merely put, the RTMF chart visualizes cash getting into or retirement an asset. The instrument gauges the purchasing or promoting power in the back of each and every asset. Most significantly, this is a real-time indicator that doesn’t rely on ancient parameters like costs or quantity to print.

If crypto traders are interested by a selected asset, its RTMF will get up. At the alternative hand, whether it is trending decrease, like on the subject of Ethereum and the BNB Chain, it would recommend a shortage of hobby or traders transferring to alternative property.

As issues arise, some analysts are expecting a bleak outlook for Ethereum within the tide marketplace cycle. Impressive, they feature this shift to a possible partiality amongst long-time holders and even “heavy” traders. The money migration against Solana might be because of their worth propositions.

For example, the Solana consumer bottom unexpectedly will increase as protocol builders leverage the community’s scalability and coffee charges. At the alternative hand, Bitcoin has additionally visible a spike in its capital inflow, essentially because of emerging hobby from establishments following the approbation of spot exchange-traded budget (ETFs) in January.

Will Ethereum Hard work For Features This Cycle?

One analyst argues that Ethereum will most likely proceed to “suffer” within the coming months, particularly as festival heats up and customers to find worth in choices.

To assistance this overview, the analyst stated that in spite of Ethereum’s vast bottom and a few customers’ self assurance in its skill to turn out to be a bind of worth, it falls decrease of competing with Bitcoin. Additionally, Ethereum nonetheless struggles with prime fuel charges.

In the meantime, a bullish case is development for Solana. Extreme time, the FTX Chapter Property offered its $1.6 billion preserving of SOL at $64 to crypto project capitals Galaxy Virtual and Pantera Capital.

Those cash gained’t be liquidated. Rather, they’re going to be restaked and locked for 4 years.

Component symbol from Canva, chart from TradingView