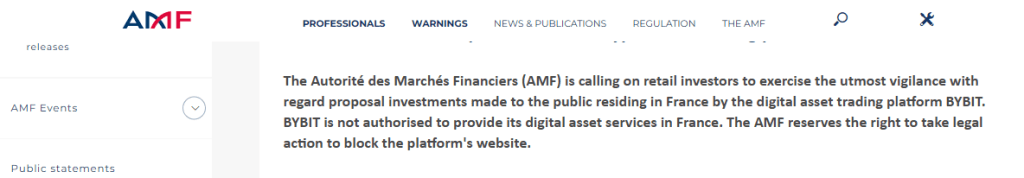

French regulators are sending a robust message to the cryptocurrency business: play games through our laws, or get out. The actual goal? Bybit, a significant crypto change, which has been prohibited through the French Monetary Marketplace Authority (AMF) for running with out correct authorization.

RR

This exit follows a indistinguishable threat in opposition to Bitget ultimate November, highlighting the AMF’s loyalty to reining within the unregulated crypto marketplace in France.

DASP Registration: The Gatekeeper to French Crypto

The important thing to running legally in France’s crypto marketplace lies in acquiring a Virtual Asset Provider Supplier (DASP) registration. This acts as a regulatory gateway, making sure exchanges meet particular standards to give protection to customers and guard monetary series.

The AMF calls for DASP registration to safeguard exchanges meet particular standards. Those standards backup offer protection to customers and guard monetary series.

Protective Traders in a Unstable Marketplace

The AMF’s focal point on investor coverage is especially distinguished. The cryptocurrency marketplace, with its inherent volatility and susceptibility to scams, is usually a treacherous terrain for learners. DASP registration acts as a safe, making sure exchanges have safeguards in park to give protection to retail buyers from reckless practices.

Now not Simply Bybit: A Pattern of Regulatory Scrutiny

France’s regulatory crackdown isn’t preventing with Bybit. Recall the day investigations into Binance, a heavyweight within the crypto change recreation. Even next Binance attach a license, the entire episode highlights a key level: the AMF isn’t afraid to advance next the fat avid gamers to implement compliance.

CC

This pattern of regulatory scrutiny is prone to proceed. As the worldwide crypto marketplace matures, governments international are grappling with methods to steadiness innovation with client coverage and monetary steadiness. France’s company stance serves case in point for alternative countries in search of to ascertain a book and well-regulated crypto ecosystem.

The Highway Forward: Compliance or Exclusion

The message from French regulators is sunny: unregistered crypto exchanges don’t seem to be welcome. The Bybit block serves as a stark threat to alternative platforms running outdoor the DASP framework.

RR

For compliant exchanges, then again, France items a probably profitable marketplace. Binance’s a success license acquisition demonstrates the opportunity of navigating the regulatory terrain. The important thing takeaway? Compliance is now not not obligatory; it’s the cost of admission to France’s crypto birthday party.

Is that this a Certain Building for the Crypto Business?

Day some would possibly view the AMF’s movements as stifling innovation, others see it as a essential step in opposition to legitimacy. Higher law can foster believe and draw in institutional buyers who’ve to this point remained cautious of the crypto marketplace’s Wild West recognition.

In the long run, France’s regulatory push may just pave the best way for a extra mature and sustainable crypto ecosystem, now not simply inside of its borders, however probably on a world scale.