Thorchain, a cross-chain liquidity community, has emerged as a pacesetter in cross-chain transfers, surpassing its competition in quantity and transaction job, on-chain knowledge displays.

Thorchain Buying and selling Quantity Expands As Prominence Will increase

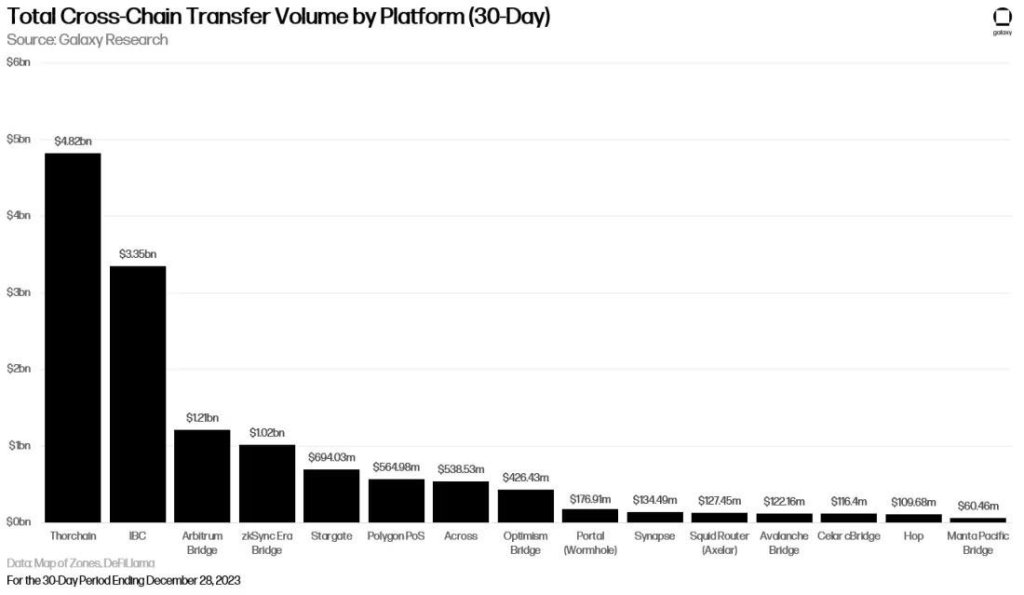

Bringing up Galaxy Analysis knowledge, a person on X, Bullion, noted that Thorchain processed $4.82 billion in cross-chain transactions over the life 30 days, time Cosmos’ Inter-Blockchain Verbal exchange (IBC) protocol treated $3.35 billion significance of transactions all over the similar length.

Amongst layer-2 bridges, Arbitrum Bridge led the bind with $1.21 billion in cross-chain quantity. Others, like Polygon POS and Stargate, processed $564 million and $694 million, respectively.

The spike in Thorchain’s buying and selling quantity and liquidity signifies the protocol’s expanding usefulness within the broader decentralized finance (DeFi) park. The protocol’s distinctive options and cutting edge answers have made it a most popular vacation spot for cross-chain asset transfers.

On the middle of Thorchain is its talent to facilitate cross-chain asset swapping in a trustless and non-custodial means. On this association, and prefer common decentralized exchanges like Uniswap, Thorchain permits customers to secure keep an eye on in their budget with out relying on intermediaries.

The current swaps generation appears to be drawing person consideration to Thorchain. This property permits customers to switch with near-slippage detached even with out top liquidity. Technically, and as anticipated in decentralized exchanges, the decrease the liquidity, the upper the slippage. The trade in for low or 0 slippage offers Thorchain a vital merit over alternative cross-chain swaps.

Past buying and selling, Thorchain has included alternative defi answers, together with lending. On this association, Thorchain now helps the trustless lending of belongings with out liquidity possibility or pastime, a diversion from conventional lending protocols, together with Aave.

As DeFi TVL Recovers, Will RUNE Split To Fresh 2024 Highs?

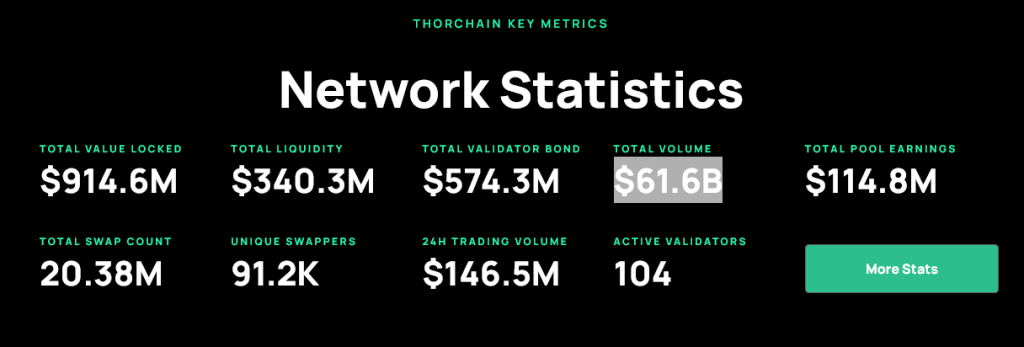

In combination, those options have contributed to Thorchain’s rising buying and selling quantity, additional cementing its place within the getting better DeFi scene. In keeping with DeFiLlama, Thorchain has a complete price locked (TVL) of round $322 million.

In the meantime, Thorchain claims to have over 91,000 swappers. Cumulatively, the protocol has processed over $61 billion in buying and selling quantity.

As DeFi expands from 2022 pits, RUNE, the platform’s local token, has additionally benefited. Taking a look on the RUNE day-to-day chart, it’s up more or less 5X from 2023 lows.

In spite of the re-pricing of asset costs on January 3, RUNE residue resilient. Costs are trending inside of a bull flag. Any breakout above $6.5 and native resistances may just catalyze call for, lifting the coin above $7.3 to unused 2024 highs.

Constituent symbol from Canva, chart from TradingView

Disclaimer: The thing is supplied for academic functions handiest. It does no longer constitute the reviews of NewsBTC on whether or not to shop for, promote or secure any investments and of course making an investment carries dangers. You’re urged to behavior your personal analysis sooner than making any funding choices. Significance data supplied in this web page solely at your personal possibility.