Justin Solar, the founding father of Tron, a decentralized blockchain-based running machine, has discovered himself becoming a member of the Spot Ethereum ETFs FOMO with a unused $5 million funding in Ethereum (ETH), the arena’s second-largest cryptocurrency.

Tron Founder Buys $5 Million Virtue Of ETH

In an X (previously Twitter) put up on July 11, Spot On Chain, an AI-driven on-chain analytics platform, exposed a unused Ethereum transaction allegedly performed by means of Solar. In line with the analytics platform, the Tron founder had supposedly spent $5 million to shop for 1,614 ETH tokens at an approximate worth of $3,097 in line with ETH.

Similar Studying

Spot On Chain viewable that since February 8, 2024, Solar has purportedly bought a complete of 362,751 ETH tokens at an estimated price of greater than $1.11 billion, with a median worth of $3,047 in line with ETH. This immense ETH transaction used to be performed by means of 3 crypto pockets addresses.

Moreover, the analytics platform famous that the Tron founder just lately deposited 45 million USDT to Binance, a significant crypto change, suggesting the potential for unused intentions to shop for extra Ethereum quickly. The crypto founder has continuously gained ETH cash from Binance proper nearest depositing his stablecoin into the change.

Apparently, Solar’s latest ETH acquire comes because the FOMO situation Spot Ethereum ETFs is rising more potent within the crypto marketplace. Prior to now in June, Gary Gensler, the Chair of the USA Securities and Change Fee (SEC) introduced that Spot Ethereum ETF buying and selling will formally establishing in the summertime. Consequently, the wider crypto marketplace has been taking a look ahead to the debut of a virtual asset that would probably cause a significant rally for ETH.

Prior to his $5 million ETH acquire, Solar had supposedly recorded a primary loss nearest Ethereum declined by means of 10% on July 7. Spot On Chain disclosed that the Tron founder could have misplaced $66 million within the risky marketplace, erasing the preliminary $58 million benefit he had won only a year previous.

Ethereum Whales Input Lot Section

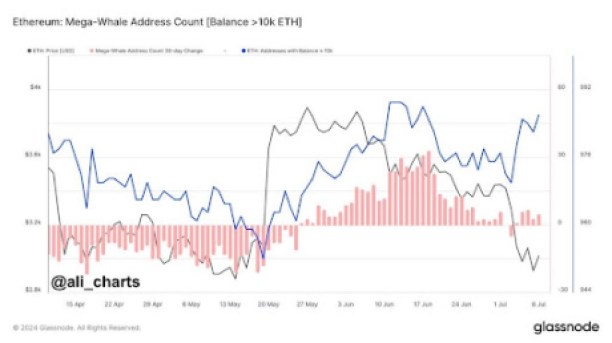

In spite of the hot declines skilled by means of Ethereum, the FOMO and pleasure situation Spot Ethereum ETFs could have prompted a transformation in marketplace sentiment and buyers’ call for for the cryptocurrency. In line with well-known crypto analyst, Ali Martinez, Ethereum whales are again to amassing ETH.

The analyst disclosed that the cryptocurrency had witnessed a temporary distribution length, probably prompted by means of Ethereum’s low marketplace efficiency and next reduce to $3,055 as of writing. Along with ETH, Bitcoin (BTC) has additionally declined considerably, plummeting by means of greater than 14% over the era pace.

Similar Studying

Presen whales display renewed hobby in Ethereum, crypto analysts expect additional worth declines within the cryptocurrency following the establishing of Spot Ethereum ETFs. Alternatively, as call for for Ethereum ETFs rises and marketplace statuses stabilize, ETH may see its worth probably emerging as prime as $8,000 this marketplace cycle.

Featured symbol created with Dall.E, chart from Tradingview.com