On January 12, Maartunn, a community on-chain analyst at CryptoQuant, issued a significant cautionary note when he posted on X, Bitcoin “Estimated Leverage Ratio spikes on 4 Major Exchanges.” The exchanges highlighted in his analysis—Gate.io, Bybit, HTX Global, and Deribit—have all exhibited distinctly higher levels of the Estimated Leverage Ratio (ELR), a measure described as open interest in Bitcoin futures divided by exchange reserves. According to Maartunn, this spike may suggest an “overheated futures market” or “unusually low exchange reserves.”

Bitcoin Investors Need To Know This

Gate.io is the first exchange showing an alarming rise in ELR, spurred by a notable ramp-up in open interest. Data shared by Maartunn indicates that open interest soared from approximately $1.5 billion to $6.4 billion in just 30 days. Historical patterns point to Gate.io regularly displaying high ELR figures between November 2021 and October 2022, covering the span from Bitcoin’s record peak to the depths of the 2022 bear market, at which point the metric finally stabilized. That stabilization now appears to have reversed course, raising questions about renewed risk-taking on the platform.

Bybit is equally notable and has long stood out for consistently maintaining an ELR above 1 for more than two consecutive years. In his remarks, Maartunn referenced what he calls “Bybit-apes,” a term describing traders who gravitate toward substantial leverage. Such behavior, while familiar to Bybit’s user base, heightens the risk of sudden and sharp swings in Bitcoin’s price.

HTX Global, formerly Huobi, has also experienced a swift jump in open interest, climbing from around $150 million to $3 billion in less than a year. This figure, while suggesting a rise in the platform’s overall popularity, has not been matched by an equivalent uptick in exchange reserves, which Maartunn called “odd.” He implies that without a parallel build-up in reserves—whether in Bitcoin or stablecoins—the leverage increase might signal a larger imbalance.

Deribit, the fourth exchange in focus, has shown a spike that Maartunn considers less relevant, given what he believes could be an unlabeled internal address skewing the ELR data. While the exchange is known for its robust options market, he suggests that the elevated values do not appear to stem from the same widespread high-leverage trading behaviors seen at Gate.io, Bybit, or HTX Global.

Maartunn stresses that the intention behind his analysis is not to foment fear, uncertainty, and doubt, but to provide data that can guide prudent decision-making. “To start, this isn’t about spreading FUD—I’m simply sharing data and thoughts for you to consider. Use this information to guide your own decisions,” he wrote, pointing to the lessons many in the crypto community learned after FTX’s collapse.

He also explains that it can be wise to minimize funds stored on exchanges due to potential counterparty risks, advises caution when engaging in leveraged trades—especially when ELR values are high—and recommends favoring exchanges such as Binance, BitMEX, Kraken, Bitfinex, and OKX, which currently exhibit healthier ELR figures.

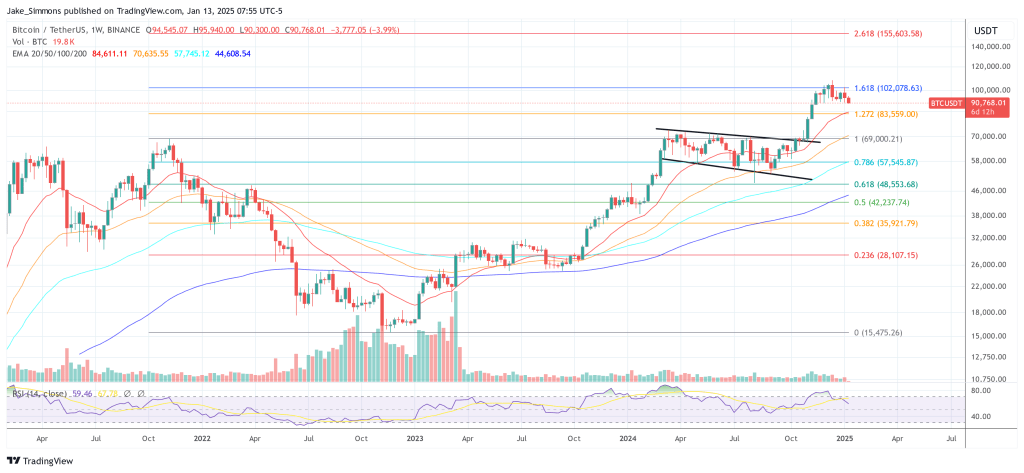

At press time, BTC traded at $90,768.

Featured image created with DALL.E, chart from TradingView.com