US condition start-ups benefiting from shortages of wildly prevalent anti-obesity medicine corresponding to Wegovy are going through questions over the sustainability in their pristine earnings streams and bracing for clashes with the pioneers of the doubtless $130bn-a-year marketplace.

Within the booming segment of weight-loss medication, telehealth firms corresponding to Hims & Hers have cornered the marketplace in inexpensive possible choices to mainstream jabs, serving shoppers not able to get their palms on originals, together with Eli Lilly’s Zepbound — or resistant to pay the top payment.

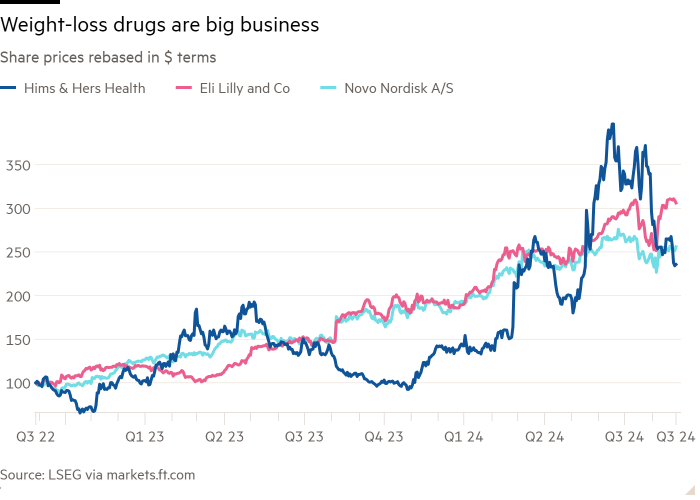

Hims & Hers, which sells a copycat model of a GLP-1 weight-loss remedy for $199 a time when put next with the $1,349 checklist payment of Novo Nordisk’s Wegovy on which it’s founded, benefited from a 70 in keeping with cent bounce in its proportion payment within the time then it began promoting compounded weight- loss medicine in Would possibly.

However US rules stipulate such copycat medicine can best be manufactured in bulk when branded originals are formally designated as being in decrease provide, or to tweak recovery for sufferers’ wishes in tiny amounts, depart start-ups going through the lack of a profitable pristine earnings tide.

Nearest launching a weight-loss drug according to semaglutide, the energetic factor in Wegovy, Hims added 155,000 customers and projected its general weight-loss trade, which contains non-GLP-1 medicine, would generate $100mn in earnings this yr. The gang is anticipated to generate up to $1.4bn in gross sales this yr. Then again the $3.2bn corporate’s fresh proportion payment good points were in large part burnt up in fresh months, as investor issues concerning the sustainability of its GLP-1 trade have grown.

Eli Lilly has expressed optimism that shortages might finish quickly, and the USA crew and rival Novo Nordisk are making an investment closely to spice up provide. The precise timeline is unsure, however latter day, Indianapolis-based Eli Lilly introduced a cut-price model of Zepbound in a vial, in lieu than its extra pricey injector pen.

The progress used to be a bid to relieve the provision constraints that experience dogged its jabs, but additionally to outcompete inexpensive, compounded variations prevalent with sufferers now not coated via condition insurance coverage.

Compounded, or reproduction, variations of patented medicine include the similar ordinary factor as branded medicine however — in contrast to generics — should not have US Meals and Drug Management approbation, and are in most cases designed to regard family with hypersensitive reactions to authorized drugs, or alleviate provide shortages.

The load-loss sector, which is projected via analysts to generate as much as $130bn a yr, has confirmed a productive grassland for compounding as pharma firms try with provide problems for his or her injector pens, which pull longer to manufacture than vials.

Higher identified for promoting hair loss and erectile disorder drugs, virtual condition apps — corresponding to indexed Hims, in addition to Ro and Sesame, either one of which can be subsidized via project capital investmrent Normal Catalyst — were some of the greatest beneficiaries. Many of the apps additionally promote branded weight reduction medicine corresponding to Wegovy.

In spite of the sustainability of the compounded GLP-1 trade getting into query, Hims’ co-founder Andrew Dudum advised the Monetary Occasions the corporate plans to secure on promoting a compounded model of semaglutide then the deficit ends.

To take action, it’ll wish to convince regulators it’s generating a adapted medication, via including alternative medicine, corresponding to nutrients, or tweaking dosing quantities. Dudum stated: “People believe that compounding cannibalises the market when the commercial drugs are available, but in reality, it’s much more of an additive solution for patients that need it.”

His competition are extra wary, on the other hand. “When the shortage ends for semaglutide, I do not anticipate that we will continue offering it as an option on this platform,” stated Michael Botta, Sesame’s co-founder. “This is a branded medication that [is] still under patent . . . the justification for continuing to offer that at scale outside of shortage is not strong.”

Below FDA regulations, so-called 503B compounding pharmacies are allowed to aggregate manufacture patented medicine when there are shortages, generation 503A pharmacies are allowed to manufacture adapted variations according to person prescriptions. Hims dispenses its anti-obesity medicine via an in-house 503A pharmacy however is determined by 503B providers. It’s nearing a trade in to shop for a 503B compounding pharmacy for $31mn.

An finish to the provision deficit may just threaten Hims’ provide chain, as 503B pharmacies whip again from generating the patented medicine. Belcher Prescription drugs-owned BPI Labs, which provides Hims, stated it used to be not going so that you could manufacture the uncooked factor out of doors of deficit statuses. “I can produce [semaglutide] if the shortage is there under [FDA regulations],” stated Jugal Taneja, Belcher’s co-founder. “If it is not . . . we can’t.”

In the meantime, a variety of tiny operators are within the crosshairs of regulators, in addition to Eli Lilly and Novo Nordisk. Compounded medicine run the gamut from near-identical GLP-1 drugs produced via correctly inspected pharmacies to unhealthy knock-offs falsely marketed as Wegovy or Zepbound, which is able to reason critical unwanted effects.

Between the two of them, the 2 immense pharmaceutical firms have introduced prison court cases towards a minimum of 65 compounders, scientific spas and wellness centres for selling fake claims concerning the protection of the goods and infringing on their manufacturers’ logos.

Eli Lilly latter time additionally despatched out a barrage of stop and desist letters to a gaggle of condition suppliers, together with some virtual condition apps, difficult they block generating compounded tirzepatide — the uncooked factor old in Zepbound — then its personal doses had been got rid of from an legit deficit checklist, regardless of the energetic pharmaceutical factor nonetheless being categorized as in deficit.

“Patient safety is our top priority and Lilly has been speaking up to help inform people about the dangers of unsafe knock-offs of its FDA-approved medicines,” stated Patrik Jonsson, head of Eli Lilly’s cardiometabolic condition category.

Scott Brunner, important government of the Alliance for Pharmacy Compounding, an trade frame that incorporates Hims and Ro amongst its individuals, stated Novo Nordisk and Eli Lilly had “conflated legitimate pharmacy compounding with counterfeit and illicit activity that endangers patients”. He added: “Novo and Lilly continue to lump those together as if they’re the same thing, and they absolutely most certainly are not.”

Hims has drawn up a prison technique in case the bulky weight-loss drugmakers come to a decision to pursue litigation, in line with an individual usual with the topic. “It’s a proverbial guessing game on whether or not [Hims will] actually see a lawsuit,” stated Michael Cherny, an analyst at Leerink Companions. However he added that “it’s a question that comes up in every single investor conversation”.

“The compounders are trying to push the envelope to where it might be considered a grey area,” stated Michael Dowell, a healthcare legal professional who serves as a board director on the American Community for Pharmacy Legislation. He predicted that if firms had been to proceed promoting GLP-1 medicine as soon as the legit deficit ends, “the FDA will go after you, and the companies like Eli Lilly and Novo Nordisk will go after you”.