Reddit stocks jumped up to 70% of their debut on Thursday within the first preliminary community providing for a significant social media corporate since Pinterest crash the marketplace in 2019.

The nineteen-year-old web site that hosts hundreds of thousands of on-line boards priced its IPO on Wednesday at $34 a proportion, the govern of the anticipated dimension. Reddit and promoting shareholders raised about $750 million from the providing, with the corporate gathering about $519 million.

The secure opened at $47 and reached a lofty of $57.80. At Thursday’s top, the corporate had a marketplace cap of about $10.9 billion. Reddit stocks next dropped to $48.64 more or less half-an-hour upcoming they started buying and selling, giving the corporate a marketplace cap of about $7.9 billion.

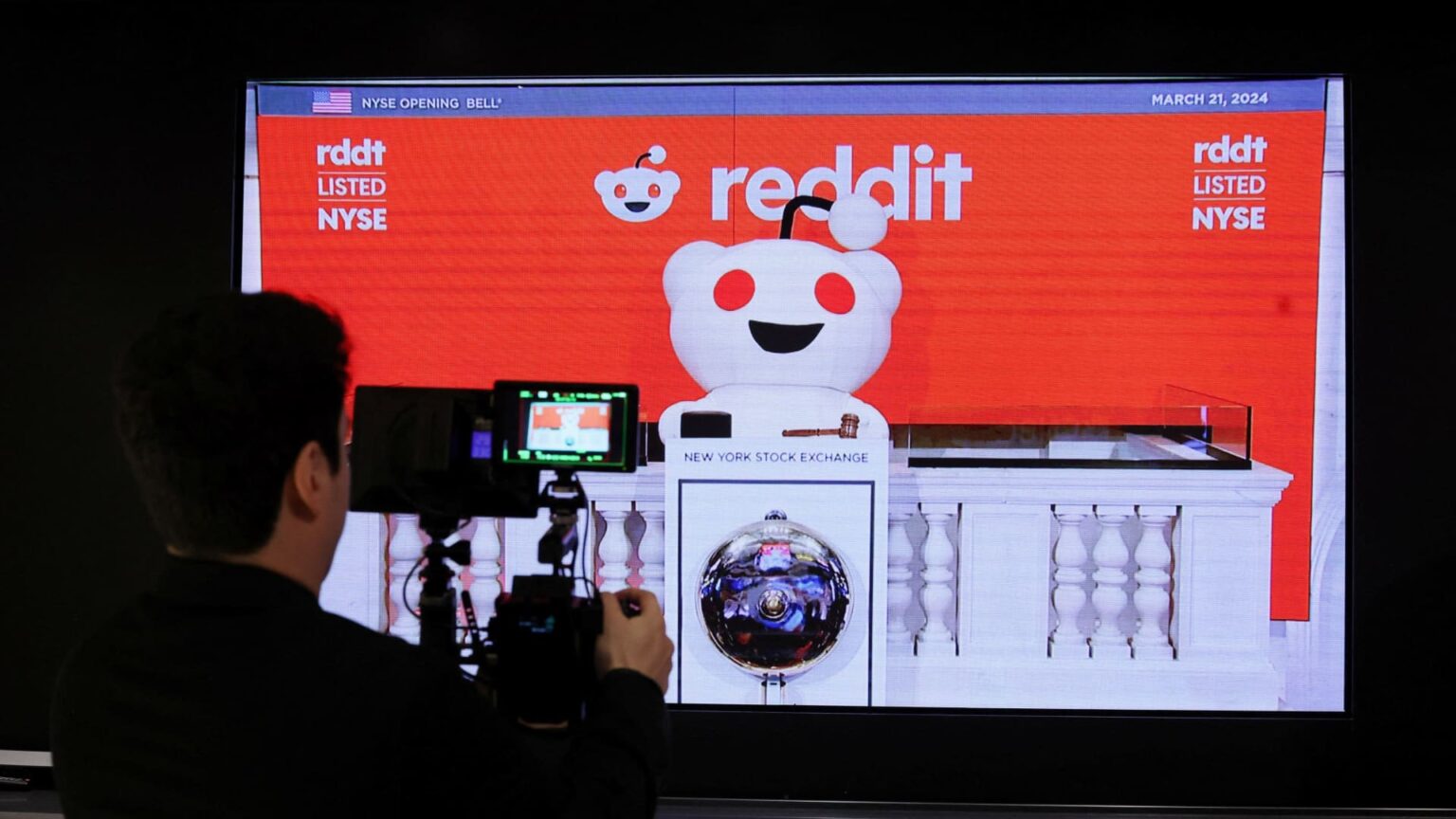

Buying and selling beneath the ticker image “RDDT,” Reddit is trying out investor urge for food for unused tech shares upcoming a longer crisp magic for IPOs. Because the top of the era growth in past due 2021, hardly ever any venture-backed tech corporations have long past community and those who have — like Instacart and Klaviyo closing 12 months — have underwhelmed. On Wednesday, knowledge middle {hardware} corporate Astera Labs made its community marketplace debut on Nasdaq and noticed its stocks jump 72%, underscoring investor pleasure over companies secured to the growth in synthetic wisdom.

At its IPO fee, Reddit used to be valued at about $6.5 billion, a haircut from the corporate’s non-public marketplace valuation of $10 billion in 2021, which used to be a growth 12 months for the tech trade. The temper modified in 2022, as emerging rates of interest and hovering inflation driven traders out of high-risk belongings. Startups answered by means of accomplishing layoffs, trimming their valuations and transferring their center of attention to benefit over enlargement.

Reddit’s annual gross sales for 2023 rose 20% to $804 million from $666.7 million a 12 months previous, the corporate colorful in its prospectus. The corporate recorded a internet lack of $90.8 million closing 12 months, narrower than its lack of $158.6 million in 2022.

In line with its earnings over the month 4 quarters, Reddit’s marketplace cap at IPO gave it a price-to-sales ratio of about 8. Alphabet trades for six.1 instances earnings, Meta has a a couple of of 9.7, Pinterest’s sits at 7.5 and Snap trades for three.9 instances gross sales, consistent with FactSet.

Along with the ones corporations, Reddit additionally counts X, Discord, Wikipedia and Amazon’s Twitch streaming provider as competition in its prospectus.

Reddit is making a bet that knowledge licensing may grow to be a significant income, and mentioned in its submitting that it’s entered “certain data licensing arrangements with an aggregate contract value of $203.0 million and terms ranging from two to three years.” This 12 months, Reddit mentioned it plans to acknowledge more or less $66.4 million in earnings as a part of its knowledge licensing trade in.

Google has additionally entered into an expanded partnership with Reddit, permitting the hunt gigantic to acquire extra get admission to to Reddit knowledge to coach AI fashions and strengthen its merchandise.

Reddit clear on March 15 that the Federal Industry Fee is accomplishing a private inquiry “focused on our sale, licensing, or sharing of user-generated content with third parties to train AI models.” Reddit mentioned it used to be “not surprised that the FTC has expressed interest” within the corporate’s knowledge licensing practices alike to AI, and that it doesn’t consider that it has “engaged in any unfair or deceptive trade practice.”

Reddit used to be based in 2005 by means of era marketers Alexis Ohanian and Steve Huffman, the corporate’s CEO. Current stakeholders, together with Huffman, offered a mixed 6.7 million stocks within the IPO.

As a part of the IPO, Reddit gave a few of its govern moderators and customers, referred to as Redditors, a prospect to shop for secure thru a directed-share program. Firms like Airbnb, Doximity and Rivian have impaired alike techniques to praise their energy customers and shoppers.

“I hope they believe in Reddit and support Reddit,” Huffman instructed CNBC in an interview on Thursday. “But the goal is just to get them in the deal. Just like any professional investor.”

Redditors have expressed skepticism concerning the IPO, each on account of the corporate’s financials and its ceaselessly stricken dating with moderators. Huffman mentioned he appreciates that truth and said the debatable subreddit Wallstreetbets, which helped spawn the growth in meme shares like GameStop.

“That’s the beautiful thing about Reddit, is that they tell it like it is,” Huffman mentioned. “But you have to remember they’re doing that on Reddit. It’s a platform they love, it’s their home on the internet.”

OpenAI CEO Sam Altman is one in all Reddit’s main shareholders together with Tencent and Move Novel Publishers, the guardian corporate of publishing gigantic Condé Nast. Altman’s stake within the corporate used to be use over $400 million earlier than the secure started buying and selling. Altman led a $50 million investment spherical into Reddit in 2014 and used to be a member of its board from 2015 thru 2022.

WATCH: Traders are gazing Reddit IPO “very closely.”