Stay informed with free updates

Simply sign up to the US banks myFT Digest — delivered directly to your inbox.

Investors reaped the rewards of looser bank supervision as Wall Street’s biggest banks announced a flood of shareholder payouts on Tuesday, after passing regulatory stress tests that imposed easier conditions than in years past.

JPMorgan, Goldman Sachs, Bank of America, Morgan Stanley and other banks said they would raise quarterly dividend payments to shareholders. JPMorgan and Morgan Stanley also said they would buy back billions of dollars’ worth of their shares.

Goldman said it would raise its dividend 33 per cent. JPMorgan said it would increase its quarterly common stock dividend by 7 per cent in the next quarter.

Bank of America said it would raise its quarterly common stock dividend 8 per cent starting in the same quarter. Citi and BNY also said they would increase their dividends by 7 and 13 per cent, respectively.

JPMorgan said it would authorise the purchase of up to $50bn worth of its own shares while Morgan Stanley announced a buyback programme worth up to $20bn.

The higher payouts reflect what analysts and investors view as a less onerous regulatory environment for banks after more than a decade of tight restrictions in the aftermath of the 2008 financial crisis.

Bank share prices were little changed after the announcements on Tuesday, but have booked gains in recent days as investors absorbed news of the lighter stress test requirements.

The Federal Reserve last week confirmed that 22 banks — ranging from the largest ones such as JPMorgan and Goldman Sachs to smaller players including PNC and BNY — successfully passed annual tests assessing their resilience to potential economic and market crises.

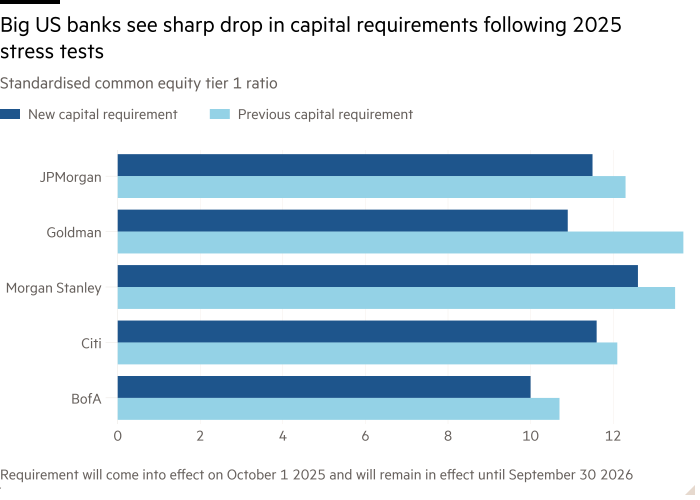

Banks use the results to calculate the minimum level of capital that they need relative to their risk-adjusted assets — which in turn can influence the amount of excess capital they return to shareholders. Capital is used by banks to absorb losses.

This year’s stress tests were the first since the Fed loosened its scenario with a less severe theoretical recession than it used the previous year. While the new test was designed before US President Donald Trump retook office, it is in line with the looser banking regulation that his administration has championed.

Analysts at Morgan Stanley had said the Fed’s results were “even better than expected” as they flagged methodology changes that led to lower hypothetical losses including changes to the way the regulator measures private equity exposure.

“A New Era for Bank Regulation is here,” Morgan Stanley analysts wrote in a note to earlier this week.

The Fed said this year’s tests would push banks’ aggregate tier one capital ratio, their main cushion against losses, down by 1.8 percentage points — well below the 2.8-percentage-point fall in last year’s exercise.

The central bank is expected to provide clarity in coming weeks on whether it will begin to use an average of the past two years’ stress tests results to calculate banks’ capital requirements, a move that vice-chair for supervision Michelle Bowman said would help mitigate volatility in the results.

As part of a broader push to ease banking regulation, the Fed and two other watchdogs last week announced plans to slash the enhanced supplementary leverage ratio, which sets how much capital the biggest institutions need to have against their total assets.