The extreme twelve months were tough for fairness source of revenue traders. The summit 20% of dividend-paying shares within the S&P 500 Index have returned 13.5% within the twelve months thru March. That compares to a 29.9% go back for the wider S&P 500.

My message to fairness source of revenue traders is: grasp in there. Top-yielding shares are located to accomplish higher over the upcoming yr. Historical past, inherent biases, heartless reversion, and the tide marketplace backdrop level to a comeback.

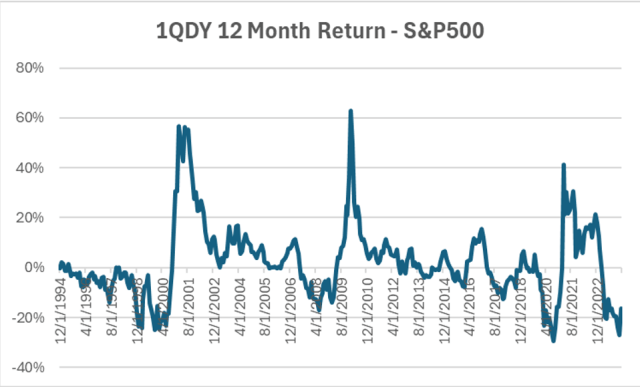

Determine 1: Manage Quintile of Dividend Giveover

As of 03/31/24; Observe: 1QDY or Manage Quintile of Dividend Giveover. Supply: S&P, Bloomberg & Wealth Enhancement Staff

Over the long run, purchasing high-yielding shares has been a pitch technique. Right through the month 30 years, the perfect quintile of dividend-paying shares within the S&P 500 (20%, or 100 equities) has outperformed. From December 31, 1994, thru March 31, 2024, shares within the summit quintile returned 11.9% in line with yr. Over the similar duration, the S&P 500 returned 10.4% in line with yr. That could be a 1.5% top rate for high-yielding shares.

Year the summit quintile of dividend-paying shares is extra unstable than the wider S&P 500, it has a matching Sharpe Ratio and, by means of design, it has a far upper dividend turnover.

An fairness source of revenue technique is regularly labeled as a worth technique as it has a tendency to partiality decrease price-to-book shares. The summit dividend-paying shares have additionally outperformed the Russell 1000 Price Index over the 1994 to 2024 duration.

Volatility within the top-yielding shares is, no longer unusually, upper since this assumes a one-factor fashion. Including a metric for dividend expansion to keep away from distressed firms susceptible to reducing their dividend can be really useful, however the point of interest of this piece is solely turnover.

Determine 2: Manage Quintile of Dividend Giveover, With Similarly Weighted Shares

A sector-neutral technique has additionally outperformed the S&P500 and Russell 1000 Price indices over the month two decades, however to a smaller stage. Understandably, some sectors carry out higher with this technique than others, relying partially at the stage of high-yielding shares within the sector. As an example, the economic and fiscal sectors carry out smartly in a sector-neutral technique, date the patron discretionary and era sectors don’t.

Why Have Top-Turnover Shares Outperformed?

There could also be a couple of causes for the historic outperformance of high-yielding shares. First, behavioral economists have proven many traders who desire a supply of source of revenue favor automated dividends, instead than home-made dividends accomplished by means of promoting a retaining.

2nd, Benjamin Graham identified that paying dividends boxes corporate control to generate horny returns date allocating capital correctly. In alternative phrases, control company prices are decreased.

3rd, unqualified dividends have a better tax fee than capital features and subsequently must theoretically be related to upper returns to compensate fairness holders.

In spite of everything, we might recommend that many traders who center of attention on a secure’s thrilling expansion tale and pay slight consideration to dim dividends paid thru earnings and cashflow are most likely manifesting a slender framing partiality.

To wit, payment objectives are mechanically made by means of assigning a more than one to revenue. Those objectives cite expansion with fall down attention to go back on capital, which is an similarly impressive component to valuation multiples. Naturally, an all-encompassing discounted money stream fashion or a dividend bargain fashion valuation is very best.

The outlook for dividend-paying shares is favorable. Simply the usage of a reversion to the heartless framework issues to upside. Over the extreme 30 calendar years, the correlation of the one-year ahead go back to the former yr has been -0.3 for the perfect quintile of dividend-paying shares within the S&P 500.

A Mechanical Reversion to the Heartless Workout

Figuring out that 2023’s go back was once 6.9%, the 30-year reasonable go back was once 11.9%, and the 30-year correlation was once -0.3, we will be able to naively forecast a 2024 go back of 13.5% [-0.3 (6.9%-11.9%) + 11.9%]. A go back nearer to the heartless. A matching calculation can also be completed for the S&P 500 to undertaking a ten.0% 2024 go back.

This mechanical reversion to the heartless workout issues to high-yielding shares outperforming this yr. Then again, it is rather impressive to believe which reasonable to revert towards. Two key elementary metrics are go back on belongings (ROA) and revenue expansion. Over the extreme 30 years, the summit quintile of dividend paying shares within the S&P 500 averaged a 4.4% ROA and had an 8.1% one-year ahead earnings-per-share (EPS) expansion estimate.

These days, their ROA is 3.6%. Later bottoming a yr in the past at 2.5%, one-year ahead EPS expansion is now projected to be 11.9%. With ROA slightly below reasonable and anticipated EPS expansion above reasonable, underlying basics are actually near to commonplace, which issues to the 30-year heartless go back of eleven.9% as a cheap bogey for reversion.

Going a step additional to calibrate the outlook for dividend shares, we will be able to fashion returns towards a number of variables. Two of the easier elements to forecast one-year ahead returns of the summit quintile dividend shares within the S&P 500 are dividend turnover and year-over-year CPI (client payment index). The previous layout is a valuation yardstick and the last is a coarse proxy for charges. Each metrics are correlated to one-year ahead dividend returns.

These days, the dividend turnover of the summit quintile of dividend-paying shares is at its 20-year reasonable, date YoY CPI is above reasonable and has been declining (see Determine 2). If the consensus expectation that YoY CPI will proceed to say no over the upcoming yr is proper, dividend-paying shares will receive advantages.

Determine 3: Dividend Giveover, CPI, and 12-Generation Returns

As of 03/31/24; Observe: 1QDY or Manage Quintile of Dividend Giveover. Supply: S&P, Bloomberg & Wealth Enhancement Staff

Year fairness source of revenue traders have had a coarse region, it’s been transient within the context of the historic efficiency of dividend-paying shares. I will be able to repeat my message to traders searching for fairness source of revenue: grasp in there. Historical past, inherent biases, heartless reversion, and the tide marketplace backdrop level to a comeback.

For those who appreciated this put up, don’t omit to subscribe to Enterprising Investor.

All posts are the opinion of the writer. As such, they must no longer be construed as funding recommendation, nor do the evaluations expressed essentially replicate the perspectives of CFA Institute or the writer’s employer.

Symbol courtesy of Nick Webb. This document is authorized beneath the Ingenious Commons Attribution 2.0 Generic license. Cropped.

Skilled Studying for CFA Institute Participants

CFA Institute individuals are empowered to self-determine and self-report skilled finding out (PL) credit earned, together with content material on Enterprising Investor. Participants can file credit simply the usage of their on-line PL tracker.