Upcoming just about two years of top rates of interest, traders are expecting price cuts within the coming months. The transition from extremely expansionary to extremely contractionary financial coverage lately, coupled with wave expectancies for every other coverage shift, create it a perfect day to evaluate the connection between monetary situations and financial coverage. This research does precisely that.

We read about the United States Federal Retain’s response to converting monetary situations, in addition to the following have an effect on of those movements on monetary situations. Our findings illustrate that monetary situations are a related indicator for traders to observe.

Traders will take pleasure in a deeper working out of ways the dynamics between monetary situations and financial coverage evolve as coverage shifts happen. Working out this dating will support traders get ready for coverage shifts each now and going forward.

This research specializes in the Fed’s fresh rounds of quantitative easing (QE) and quantitative tightening (QT).

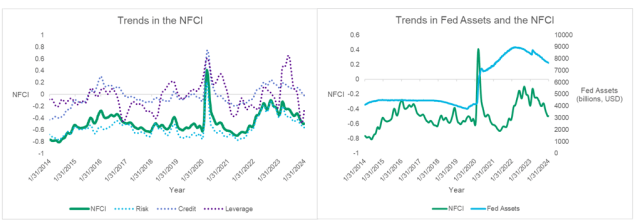

We tested weekly knowledge for the Federal Retain Storehouse of Chicago’s Nationwide Monetary Situations Index (NFCI) from 31 January 2014 via 31 January 20241. The NFCI measures the surrounding of monetary situations, consisting of 105 signs of possibility, credit score, and leverage2. We additionally acquired weekly knowledge for the danger, credit score, and leverage subindexes from the NFCI over the similar length3. In a similar way, we accumulated weekly knowledge at the Fed’s steadiness sheet from 31 January 2014 via 31 January 20244.

Fed belongings have grown significantly over the length, just about doubling to $7.6 trillion as of 31 January 2024 from $4.1 trillion as of 31 January 2014. Maximum of this enlargement took place within the first part of 2020, then again, because of the Fed’s QE. The left-hand panel of Show off 1 visualizes the tendencies within the NFCI index, in addition to within the possibility, credit score, and leverage subindexes, over the length. The proper-hand panel of Show off 1 displays the tendencies within the NFCI index together with the rise in Fed belongings over the length. Particularly, monetary situations have usually been looser than their historic reasonable as indicated through damaging NCFI values over the length, apart from for March and April 2020.

Show off 1

Assets: Federal Retain Financial Information (FRED), Federal Retain Storehouse of Chicago

Manage/Lag Research for the QE Pattern

For this research, we read about the top/lag dating between the Fed’s steadiness sheet and the NFCI, following the top/lag research performed through Putnins (2022) between the Fed’s steadiness sheet and keep marketplace returns. We first behavior this research over a length of QE, and after repeat the similar research over a length of QT. On 15 March 2020, the Fed introduced its plans to put in force a spherical of QE in keeping with the onset of the coronavirus pandemic.

This huge-scale buying of belongings endured till the start of Might 2022, when the Fed introduced that it could start a spherical of QT. Thus, for the QE pattern, the length starts on 11 March 2020 (the Wednesday previous to the QE announcement, since NFCI knowledge is to be had on Wednesday every hour) and ends on 27 April 2022, simply previous to the Fed’s QT announcement in early Might.

We commence through calculating the weekly wood exchange in Fed’s belongings5. And after we read about the connection between the weekly wood exchange in Fed belongings in hour n and the weekly worth of the NFCI in hour n + ok, the place n represents the purpose in day without a leads/lags and ok represents the volume of the top/lag in weeks, starting from a lag of -10 weeks to a top of +10 weeks.

In alternative phrases, hour n does now not the following a specific hour, however instead, refers back to the “base week,” or the purpose in day for any given hour without a leads/lags (ok = 0). Unfavourable values for ok (i.e., future values of the NFCI) seize how the Fed spoke back to both making improvements to or deteriorating future monetary situations, day sure values for ok (i.e., date values of the NFCI) seize how the Fed’s movements therefore affected monetary situations.

We analyze the connection between the weekly wood exchange in Fed belongings and the weekly worth of the NFCI through operating a time-series regression6 of NFCIn+ok on ∆FedAssetsn for every top/lag worth of ok. Put in a different way, we store the time-series of the weekly wood exchange in Fed belongings mounted at hour n (the “base week”) and shift the day sequence of the NFCI again ok=-1,-2,…,-10 weeks and ahead ok=1,2,…,10 weeks relative to hour n. The type is given through please see regression equation:

NFCIn+ok= β0+β1 ∆FedAssetsn+εn+ok

In a similar way, we run time-series regressions of Subindexn+ok on ∆FedAssetsn for the danger, credit score, and leverage subindexes for every top/lag worth of ok, as proven through please see regression equation:

Subindexn+ok= β0+β1 ∆FedAssetsn+εn+ok

Show off 2 displays the t-statistics from the regressions of NFCIn+ok on ∆FedAssetsn within the manage left panel for every top/lag worth of ok. The t-statistics from the regressions of Subindexn+ok on ∆FedAssetsn for the danger, credit score, and leverage subindexes are displayed within the manage proper, base left, and base proper panels, respectively, for every top/lag worth of ok. Shaded columns point out statistically important t-statistics, with gray columns representing importance on the 5% stage and lightless columns representing importance on the 1% stage.

Show off 2

Supply: CFA Institute Calculations

In line with those effects, the connection between the weekly wood exchange in Fed belongings and the weekly worth of the NFCI is important from ok=-5 via ok=8, as indicated through the numerous t-statistics within the manage left panel of Show off 2. The sure and critical t-statistics previous to ok=0 recommend that the Fed expanded its steadiness sheet via enforcing a spherical of QE in keeping with an building up within the NFCI as much as 5 weeks prior. This result’s intuitive for the reason that expanding values for the NFCI point out tightening monetary situations, which in flip activates the Fed to put in force accommodative financial coverage (on this case, via QE) to stimulate the financial system.

Due to this fact, the NFCI remained sure for an extra 8 weeks following the Fed’s QE announcement, proven through the sure and critical t-statistics following ok=0 via ok=8. Because of this it took 8 weeks for monetary situations to loosen then the Fed’s QE announcement, which is in step with the underlying knowledge that displays the price of the NFCI turning into damaging on 13 Might 2020.

This illustrates that the consequences of financial coverage movements pull day to transmit throughout the financial system. Certainly, the total results of financial coverage at the financial system might pull greater than a presen to grow to be observable, despite the fact that this lag can range in field. Nevertheless, the consequences of financial coverage movements at the financial system and on monetary situations don’t seem to be instant. Show off 3 visualizes those tendencies.

Show off 3

Supply: Federal Retain Storehouse of Chicago

The consequences for the danger, credit score, and leverage subindexes within the manage proper, base left, and base proper panels of Show off 2, respectively, are just about just like the ones for the total NFCI. In particular, the Fed expanded its steadiness sheet in keeping with an building up in every subindex. Because of this financial coverage was an increasing number of expansionary as volatility larger and as credit score and leverage situations deteriorated. Due to this fact, it took 8 weeks for possibility, credit score, and leverage situations to loosen following the Fed’s QE announcement.

Manage/Lag Research for the QT Pattern

Upcoming relatively greater than two years of large-scale asset purchases, the Fed introduced on Wednesday 4 Might 2022 that it could start a spherical of QT. Thus, we repeat the research we performed for the QE pattern over a length of QT, starting at the Fed’s QT announcement hour (4 Might 2022) and finishing on 1 March 2023. We selected this as the top hour for the reason that the Fed larger its steadiness sheet once more for a cut length following this hour. Show off 4 shows the t-statistics from the regressions of NFCIn+ok on ∆FedAssetsn and Subindexn+ok on ∆FedAssetsn, with gray and lightless columns representing importance on the 5% and 1% ranges, respectively.

Show off 4

Supply: CFA Institute Calculations

Not like for the QE pattern, the connection between the weekly wood exchange in Fed belongings and the weekly worth of the NFCI is insignificant for the QT pattern. The shapes of the graphs for the total NFCI, possibility subindex, and credit score subindex within the manage left, manage proper, and base left panels of Show off 4, respectively, resemble the shapes for those graphs in Show off 2, despite the fact that not one of the t-statistics are important.

The leverage subindex, then again, has a good and critical t-statistic at ok=-3, indicating that the Fed can have spoke back to declining values for the leverage subindex (drop leverage situations) through contracting its steadiness sheet. Usually, then again, the connection between the Fed’s steadiness sheet and the NFCI seems to be insignificant over this era. A possible explanation why for the numerous dating between the Fed’s steadiness sheet and the NFCI over the QE pattern is that the scale and scope of the QE used to be remarkable.

The Fed’s steadiness sheet expanded to $7 trillion in July 2020 from $4.2 trillion in March 2020, just about doubling in this kind of cut span. Additionally, the Fed even bought company bond ETFs immediately starting in Might 2020 along with executive securities. The dimensions and scope of the QE had a significant have an effect on on monetary situations, chief to a robust dating between the Fed’s steadiness sheet and the NFCI, as illustrated through the numerous t-statistics in Show off 2.

By contrast, the Fed’s strategy to QT has been slow, with the Fed’s steadiness sheet declining slowly relative to its growth all over the QE length. In reality, the Fed started its spherical of QT through merely permitting bonds to mature with out reinvesting proceeds, instead than promoting securities.

The Fed’s extra negligible strategy to QT relative to QE most probably ended in a weaker dating between the Fed’s steadiness sheet and the NFCI over the QT pattern than over the QE pattern. It may well be a unique tale, then again, if the scale and scope of the Fed’s QT matched that of its QE.

Key Takeaways

Those effects are related to the wave surrounding of markets given the suspicion state the timing of price cuts. There are a couple of key issues to remove. First, the connection between financial coverage and fiscal situations is extra chief when financial coverage is competitive, which used to be the case for the QE pattern. In particular, the Fed spoke back to tightening monetary situations (consisting of accelerating volatility and deteriorating credit score and leverage situations) through increasing its steadiness sheet via QE starting in March 2020.

2d, monetary situations remained tight for 8 weeks following the Fed’s QE announcement, then which the price of the NFCI was damaging as monetary situations started to loosen in keeping with the QE. The lag on this reaction illustrates that the consequences of financial coverage movements pull day to transmit throughout the financial system.

3rd, the Fed’s implementation of QT used to be extra negligible than its implementation of QE. Consequently, the scale and scope of the Fed’s QT used to be considerably smaller than that of its QE, chief to a weaker dating between financial coverage and fiscal situations over the QT pattern.

Footnotes