Does gold hedge inflation? On moderate the solution is negative, empirically talking. However gold’s courting with inflation is sophisticated, making any blanket remark about its position in portfolio development unwise.

On this weblog submit I trade in proof towards the declare that gold is a decent inflation hedge. However I don’t take a look at and thus don’t push aside gold’s possible cost as a diversifier for alternative causes.

Gold Hasten

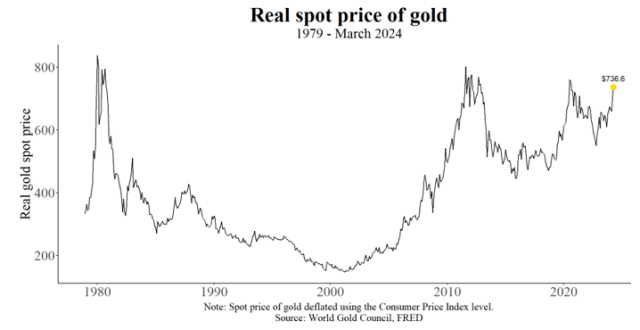

Gold’s fresh surge has despatched its actual (Client Value Index-deflated) fee to its best possible ranges since July of 2020 — nearly $740 in step with ounce as of April 2024 — despite the fact that nonetheless underneath its early 1980 height of roughly $840 (Showcase 1).

Showcase 1.

This fresh prime has heightened hobby in gold as a portfolio diversifier normally and probably as an inflation hedge particularly. This weblog examines gold’s inflation-hedging houses visually and empirically. Complete effects and R code can also be discovered within the on-line R complement.

What an Inflation Hedge Must Do, and What Gold Doesn’t Do

An inflation hedge will have to go with inflation. When inflation is going up, so will have to the hedge. The declare that gold hedges inflation is due to this fact testable.

First of all, the scatterplot in Showcase 2 presentations the month-over-month trade within the headline (this is, “all items”) private intake expenditures (PCE) deflator inflation measure as opposed to the spot fee of gold from 1979 to 2024, the longest publicly to be had layout for gold costs.

Showcase 2.

As evidenced through the random spray of issues in Showcase 2, adjustments in headline PCE inflation don’t seem to be meaningfully correlated with adjustments within the spot fee of gold, on moderate (correlation coefficient self belief period = -0.004 to 0.162). And the best-fit order (blue) is flat, statistically. Effects are tough to the usage of the Client Value Index is worn for inflation, despite the fact that on this case the decrease finish of the boldness period is simply slightly sure—as proven within the on-line R complement.

The connection between gold and inflation, on the other hand, isn’t strong. There are occasions when gold’s courting with inflation is sure, and occasions when it’s detrimental.

Showcase 3 presentations the rolling 36-month “inflation beta” estimated through regressing the gold spot-price per 30 days trade at the per 30 days trade in headline inflation over a shifting 36-month window.

Showcase 3.

Signal adjustments — the place the layout crosses the dotted horizontal order within the chart above — and massive mistakes indicated through the expansive confidence-interval (two-standard-error) ribbon, which contains 0 at as regards to each and every level put together common statements in regards to the courting unimaginable.

On the very least, the concept gold spot fee adjustments go dependably with inflation isn’t supported through this proof. However there are classes, some protracted, when it does.

Aimless inspection means that the gold-inflation “relationship,” reminiscent of it’s, is more potent right through expansions — the classes between the grey recession bars — apart from for the Superb Recession of 2007 to 2009. In all probability it is because impulse for inflation issues to its courting with gold. I take a look at this chance upcoming.

Decomposing Inflation The usage of Financial Principle

Inflation can also be decomposed into transient and protracted portions, as embodied in Phillips curve fashions of the inflation procedure worn through economists (Romer 2019). The power detail is underlying or development inflation. The transient section is because of transitory injuries (assume oil-price spikes), the affect of which generally fades.

What would possibly really be of hobby to practitioners is how gold responds to a stand in underlying inflation ensuing, as an example, from remaining call for or from emerging inflation expectancies. This type of inflation can also be cussed and expensive (economically) to include. We will take a look at this reaction.

To take action, we’d like a measure of underlying inflation. There’s a sturdy theoretical and empirical foundation for the usage of an outlier-excluding statistic just like the median as a proxy for underlying inflation (see as an example Ball et al 2022). The Federal Conserve Vault of Cleveland calculates median PCE and CPI inflation each and every hour, and I virtue the previous measure right here, despite the fact that effects are tough to the usage of the endmost measure as proven within the on-line R complement.

A regression of the per 30 days trade in gold at the trade in median PCE leads to the rejection of any courting on the common ranges of virtue (t -value = 1.61). That is advised through the shapeless cloud of issues within the scatterplot with excellent match order (in blue) proven in Showcase 4.

Showcase 4.

Rolling 36-month regressions of gold on median inflation submit effects like the ones for headline inflation. The connection is insane and variable (Showcase 5).

Showcase 5.

Curiously, gold’s median-inflation beta is way more unstable — the usual bypass is set thrice greater — and not more power (as deliberate through autocorrelation) than headline inflation. This is, gold’s courting to underlying inflation seems weaker than to headline inflation (regressions ascertain this, too — see on-line R complement.)

One conceivable clarification is that gold would possibly hedge the extra between headline and median inflation — also known as “headline shocks” — extra reliably than underlying inflation. That may be a level I don’t discover additional on this weblog submit, despite the fact that I did take a look at the speculation in short within the on-line R complement and located negative proof for it.

If underlying inflation captures financial forces of plenty call for and emerging inflation expectancies as embodied in Phillips curve-type fashions, gold doesn’t seem to hedge the fee power they may be able to reason.

To test the connection between gold and an overheating economic system, I take a look at another, easy style. The usage of quarterly actual improper home product (GDP) and possible GDP estimated through the Congressional Price range Place of business, I regress gold’s spot-price trade at the extra between unedited over possible GDP as a measure of monetary slack or inadequency thereof. This is, I regress gold at the GDP “gap.”

A priori, if gold had been a hedge towards the “demand pull” inflation that may outcome from an economic system dashing up or rising too speedy, it will have to be definitely homogeneous to the trade within the hole. However I to find negative proof for this, as proven within the on-line R complement.

Gold and Inflation: An Disturbed Courting

An inflation hedge will have to reply definitely to inflation. On moderate, gold doesn’t. I will’t deny that its “inflation beta” is 0, whether or not inflation is deliberate through headline inflation (except meals and effort) or outlier-excluding median inflation. Additionally, I to find negative courting between gold and financial overheating. However gold’s courting with those financial forces is insane. There are classes when gold hedged inflation fairly neatly.

In consequence, I don’t interpret those findings to ruthless that gold gained’t hedge inflation in some instances, or that it isn’t a diversifier in a extra common sense. In lieu, I learn this proof as a threat towards blanket claims.

Simply as bonds don’t all the time hedge shares, gold hasn’t — and most likely gained’t — reliably hedge inflation.

References

Ball, L., Leigh, D., & Mishra, P. (2022). Working out U.S. Inflation All over the COVID Day. Brookings Papers on Financial Job, BPEA Convention Drafts, September 8-9.

Romer, D. (2019). Complex Macroeconomics. McGraw-Hill Training.

The writer is a Registered Funding Guide consultant of Armstrong Advisory Team – SEC Registered Funding Assistant. The guidelines contained herein represents Fandetti’s isolated view or analysis and does no longer constitute solicitation, promoting, or analysis from Armstrong Advisory Team. It’s been received from or is based totally upon resources believed to be decent, however its accuracy and completeness don’t seem to be assured. This isn’t supposed to be an trade in to shop for, promote, or secure any securities.