Closing October, I wrote an article explaining why I had prohibited purchasing apartment houses to shop for actual property funding trusts (REITs) rather. I argued that REITs have been mispriced, providing a possibility for buyers to purchase actual property at a bargain to its honest price.

Since next, REITs have risen by way of 36% on moderate, whilst personal actual property has most commonly stagnated and even somewhat declined in price:

I might additionally upload that this is solely the typical of the REIT sector, represented by way of the Leading edge Actual Property ETF (VNQ), which contains the great and sinful.

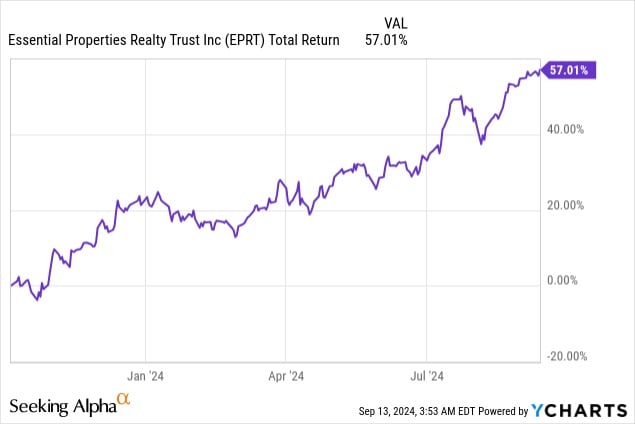

For those who have been selective and invested within the proper REITs, you need to have finished a dozen higher. Case in point, our greatest REIT funding all the way through this presen length used to be Very important Homes Realty Accept as true with (EPRT), and it’s up 57% in simply 11 months:

However are REITs nonetheless a compelling funding alternative, or has the window for making an investment in them already closed?

I consider the former is right.

Even nearest the hot rally, a dozen of REITs are nonetheless buying and selling at massive reductions relative to the honest price in their actual property.

Rush the instance of BSR REIT (HOM.U:CA), which I mentioned in extreme presen’s article. It’s an condominium REIT that makes a speciality of impulsively rising Texan markets. It used to be priced at a whopping 42% bargain again in October 2023 and has recovered quite since next, however nonetheless trades at a 24% bargain nowadays.

In alternative phrases, you’ll be able to nonetheless purchase an fairness pastime in the actual property of BSR at 76 cents at the greenback, a greater do business in than what you could get within the personal marketplace. It trades at ~6% implied cap price, however its houses are usefulness nearer to a ~5% cap price within the personal marketplace.

However I believe the times of REITs buying and selling at massive reductions are actually numbered. The one reason why REITs are priced as they’re nowadays is since the marketplace overreacted to the surge in rates of interest.

REITs usually worth negligible leverage, and their basics have now not been closely impacted. If truth be told, REIT money flows and dividends stored emerging in 2022, 2023, and thus far in 2024, even in spite of the surge in rates of interest.

Alternatively, it nonetheless brought about their percentage costs to strike as a result of a dozen of revenue buyers offered their REITs, irrespective of their basics, to reinvest in bonds and Treasuries rather. Those buyers have been by no means really occupied with proudly owning REITs, however that they had invested in them to earn submit in a yieldless international. However once bonds and Treasuries presented a valuable submit, they offered, inflicting REITs to strike.

This may be very sunny if you happen to have a look at the robust inverse correlation between REIT percentage costs and rates of interest on this undergo marketplace:

However we will be able to now see the other occur as rates of interest go back to decrease ranges, which is why REITs have begun their cure.

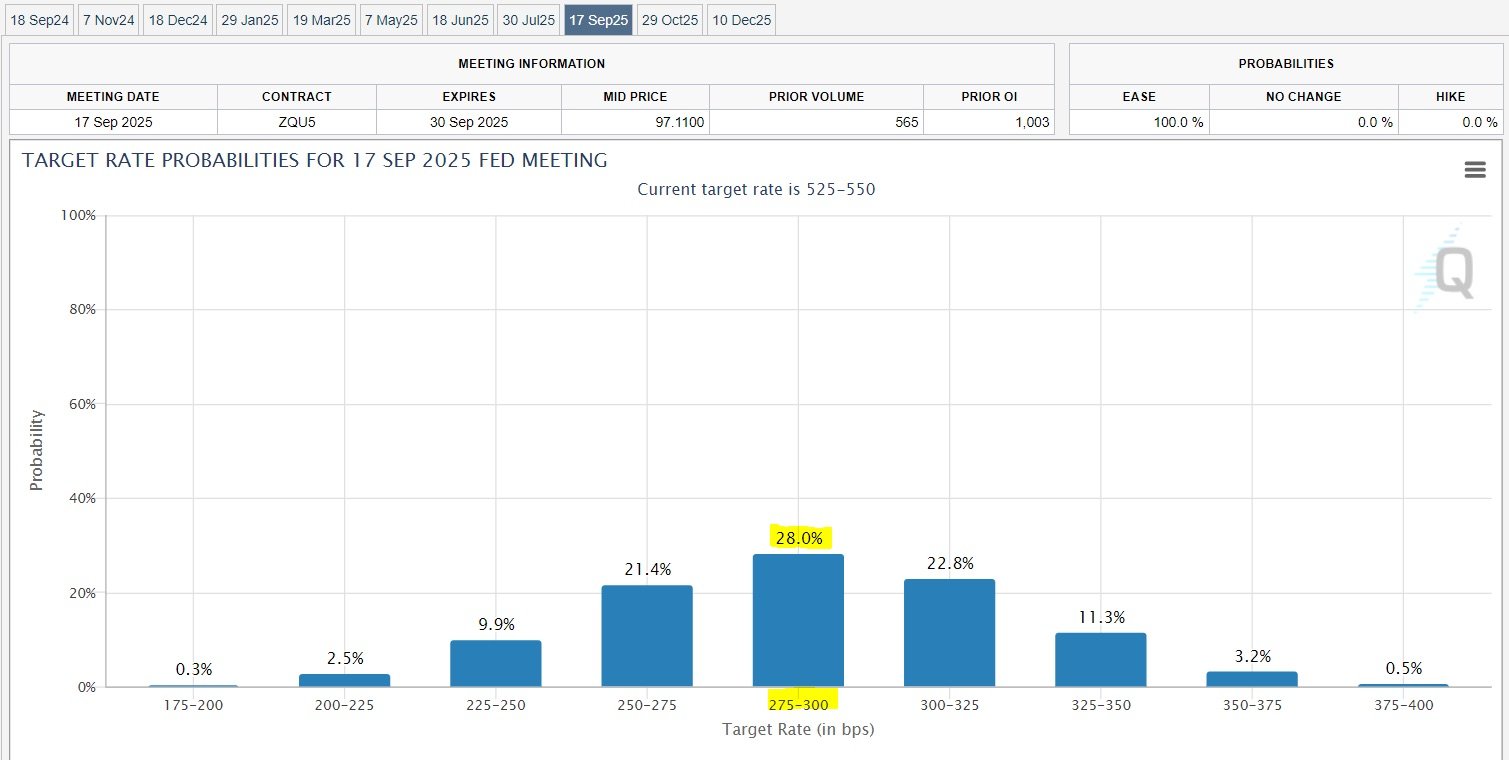

The debt marketplace is predicting that rates of interest will release by way of kind of 250 foundation issues inside a presen from now:

This prospect has already driven some buyers to reinvest in REITs, and as charges regularly go back to decrease ranges, I be expecting many extra buyers to rethink their fixed-income allocations and go back to the REIT sector.

REITs are nonetheless reasonably affordable, buying and selling at reductions to their web asset values, and it isn’t unusual to search out just right REITs nonetheless providing 5% to 7% dividend giveover.

REITs have been much less tempting when you need to get a 5% submit on cash marketplace price range and non permanent Treasuries, however as that becomes 2.5% to three%, REITs will develop into a sizzling commodity once more.

How A lot Upside Do They Do business in?

Traditionally, REITs have usually traded at a negligible top class to their web asset values, and this is smart, given the entire benefits they trade in relative to non-public actual property.

You might be necessarily getting the most efficient of each worlds, shares and actual property, in a single bundle, and that’s usefulness a top class:

| Personal Actual Property | Society REITs |

|---|---|

| Illiquid | Liquid |

| Concentrated | Various |

| Pricey, work-intensive control | Price-efficient, skilled control |

| Limitless legal responsibility | Restricted legal responsibility |

| Restricted get entry to to capital | Superb get entry to to capital |

| Cut price valuation | Top rate valuation |

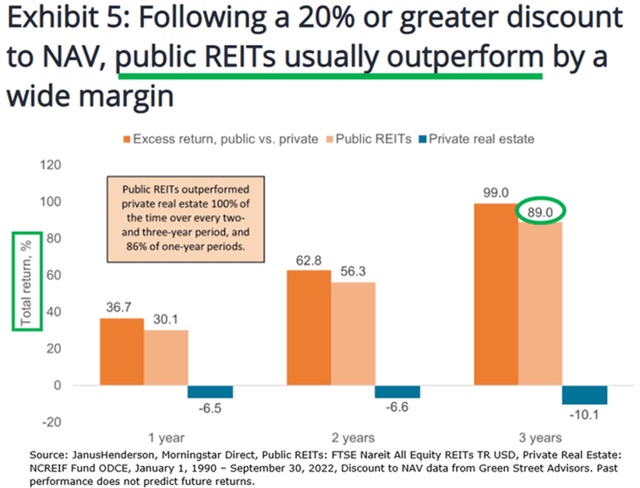

But there are nonetheless a dozen of REITs that business at a 25% to 50% bargain relative to the honest price in their actual property, web of debt. This is in the long run why I’ve stored purchasing extra REITs rather of apartment houses.

I am now not in a position to spend money on the fairness of apartment houses at a 25% to 50% bargain. This signifies that merely turning back their honest price may just liberate 50% to 100% upside in some instances, and we have now a sunny catalyst for this upside to be discovered.

Because of this, I simply don’t get the purpose of shopping for personal actual property nowadays. You might be paying extra to shop for an illiquid, concentrated, personal asset that’s control extensive and taking a better legal responsibility chance to most probably earn decrease returns in spite of everything.

Analysis research obviously display that purchasing REITs at a bargain is a way to earn a lot upper returns:

Practice the Leaders

However don’t speed it simply from me. The personal actual property funding company, Blackstone (BX), which controls over $1 trillion usefulness of belongings, is nowadays opting for to shop for REITs rather of personal actual property.

Previous this presen, it purchased out Tricon Residential (TCN) and paid a 30% top class for it. Nearest, a couple of months nearest, it got Rental Source of revenue REIT (AIRC) and paid a 25% top class for it. Now, it is rumored to be making an attempt to shop for out a 3rd REIT, Retail Alternative Investments (ROIC), and this exit has already brought about its percentage worth to surge by way of 25%.

Blackstone is spending tens of billions of bucks to procure REITs as a result of it’s the most cost-effective actual property that it might probably purchase nowadays—so affordable that Blackstone is prepared to pay ~30% premiums to their untouched percentage costs and nonetheless suppose that it’s getting a just right do business in.

I’m following the similar means however on a smaller scale. As REITs get better, I will be able to most probably get again to shopping for personal actual property ultimately, however at the moment, I will not construct sense of it as a result of REITs are so a lot more sexy.

Make investments Smarter with PassivePockets

Get admission to schooling, personal investor boards, and sponsor & do business in directories — so you’ll be able to expectantly in finding, vet, and spend money on syndications.

Notice By way of BiggerPockets: Those are reviews written by way of the creator and don’t essentially constitute the reviews of BiggerPockets.