The buying and selling international could be a maze of doubt, the place each resolution carries a degree of threat.

In this type of park, having robust allies is an important…

…and that is the place the Ichimoku Cloud boldly rolls in!

On this article, you’ll embark on a progress – finding out to harness the uncooked features of Ichimoku Cloud.

Even supposing it’ll appear complicated in the beginning, it offer a really multifaceted technique to buying and selling.

It will possibly grant an important insights, predictions, and alerts to toughen your decision-making considerably.

From figuring out tendencies to pinpointing backup and resistance ranges, Ichimoku Cloud is a flexible software with skillful attainable to your buying and selling methods.

So on this article, you’ll uncover:

- What precisely the Ichimoku Cloud is.

- The place to seek out this robust software.

- The 5 necessary elements that assemble up the Ichimoku Cloud.

- Actual-world examples illustrating methods to significance it successfully.

- Truthful insights into its barriers.

- The compelling advantages it brings on your buying and selling progress.

In a position to switch your buying and selling perpetually?

Splendid, let’s do it!

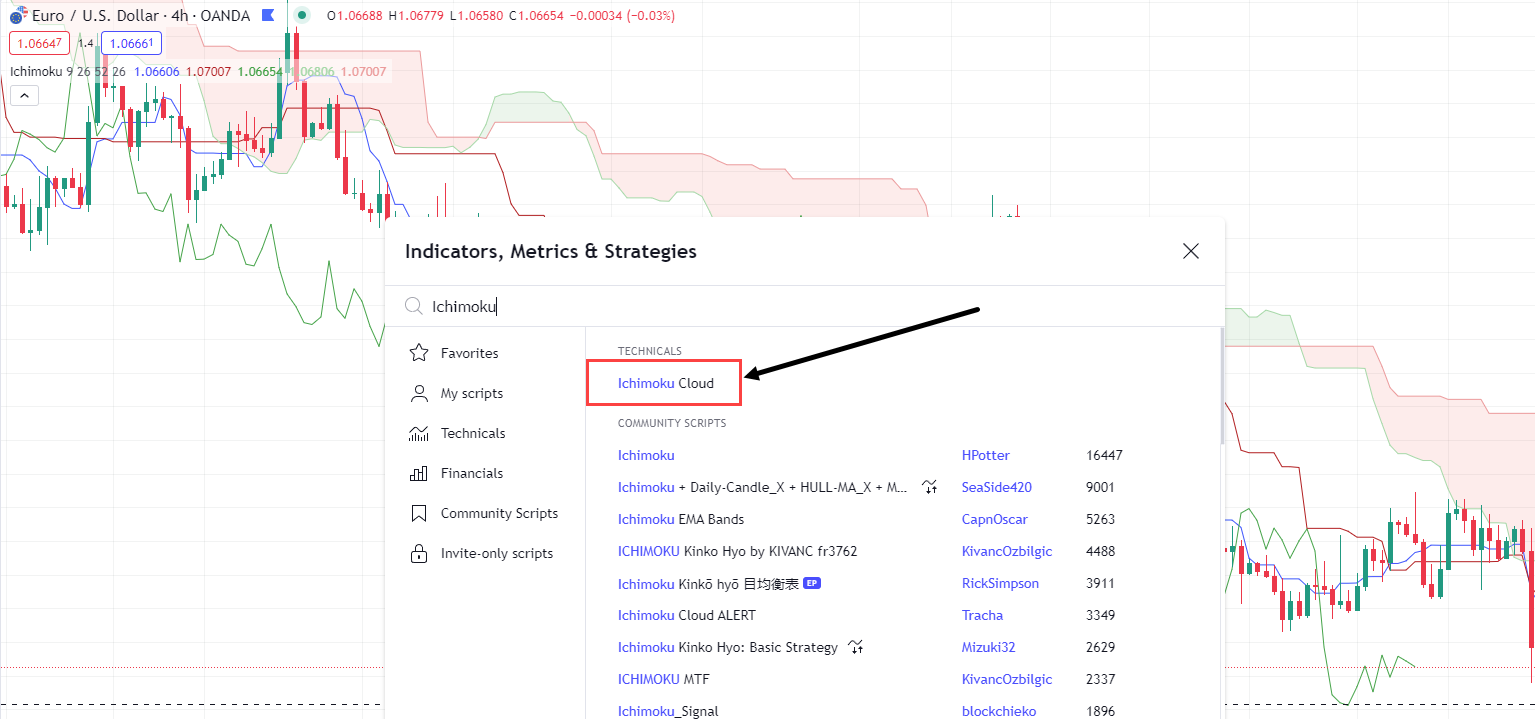

The place to seek out the Ichimoku Cloud

Let’s get started with the place you’ll in finding the Ichimoku Cloud.

You’ll be able to in finding the Ichimoku Cloud by way of navigating to the Signs button on the manage of your Tradingview panel as proven beneath…

Upcoming, seek for Ichimoku Cloud the usage of the hunt bar, and make a choice it underneath the Technicals heading…

When you’ve positioned “Ichimoku Cloud”, make a choice it – and also you’re in a position to start out your research!

Let’s dive in!

What’s Ichimoku Cloud?

The Ichimoku Cloud is without doubt one of the maximum regularly old technical research gear amongst investors.

In contrast to maximum signs that grant ancient and provide information, the Ichimoku Cloud sticks out by way of projecting hour ranges throughout the cloud.

Its recognition stems from a capability to spot conceivable backup and resistance ranges, in addition to visually representing development route and momentum thru ideas reminiscent of its ‘cloud’.

Ichimoku Cloud is an impressive software with a cloudless objective: to grant complete chart data at a unmarried look.

It offer intensity with out useless complexity, making it available to investors of all ranges.

Now I do know what you may well be pondering:

“Ichimoku Cloud sounds complex!”

And in the beginning look, it’ll appear obscure.

On the other hand, as you delve into the elements that assemble up Ichimoku Cloud, you’ll start to clutch its ideas and attainable as a trademark.

With follow, it is possible for you to to look at an Ichimoku Cloud chart and feature a miles clearer indication of what may happen!

So, let’s crack indisposed the elements of an Ichimoku Cloud chart .

The 5 Key Parts of the Ichimoku Cloud

The Ichimoku Cloud consists of 5 an important elements, every providing decent insights which might be attached to are expecting hour value movements and tendencies.

Now, let’s delve into those elements by way of discussing them for my part and analyzing how they seem on a chart.

Conversion Layout

First, you’ve got the Tenkan-Sen sometimes called the Conversion Layout…

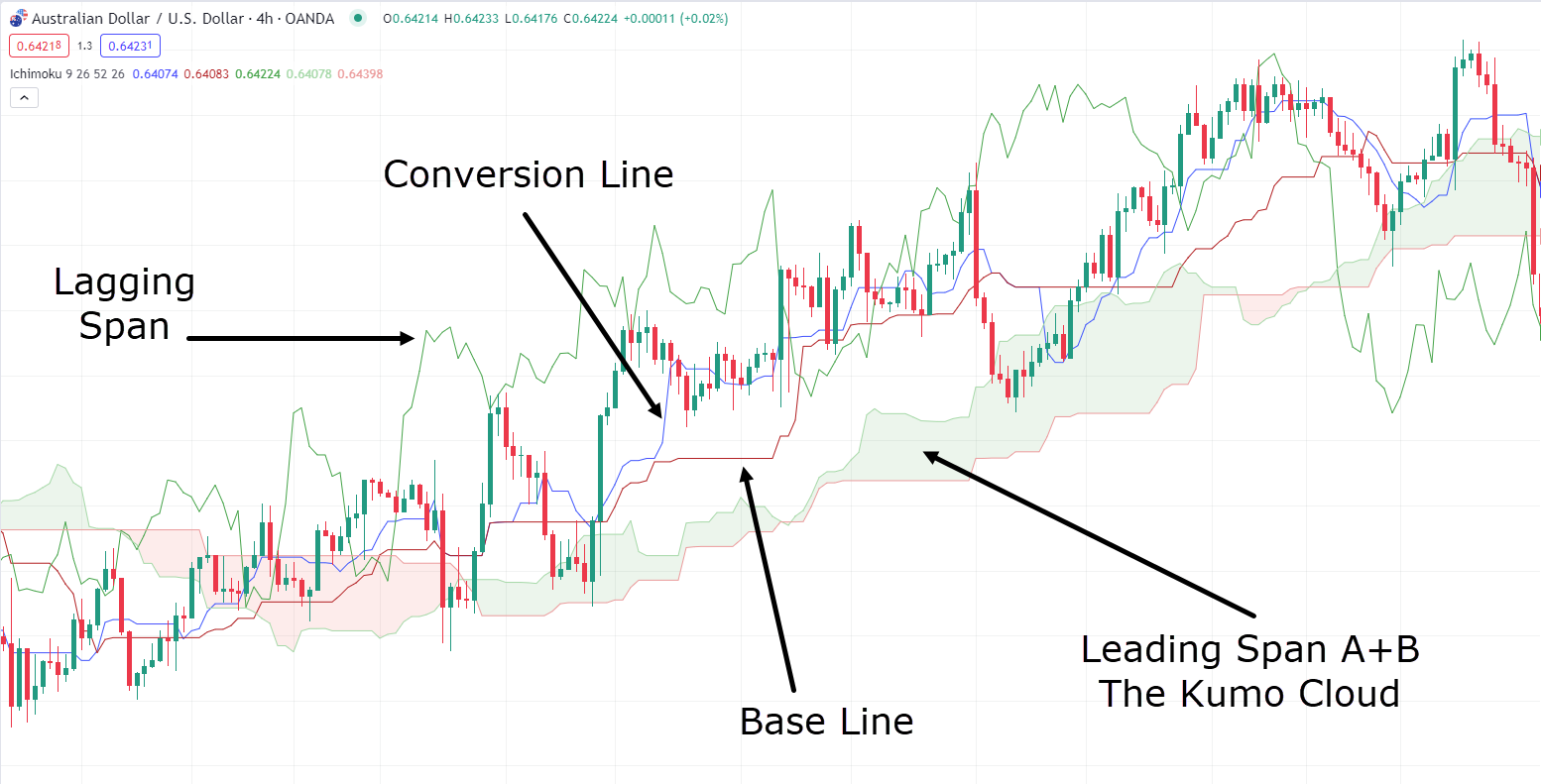

Ichimoku Cloud Conversion Layout Chart:

The Conversion form, a detail of the Ichimoku Cloud, serves as a non permanent transferring moderate.

It’s calculated by way of averaging the perfect prime and lowest low over a specified duration, in most cases i’m ready at 9 sessions.

The main serve as of this form is as an instance the non permanent value momentum.

It’s use noting that the Conversion form differs from familiar transferring averages, which regularly depend at the last costs of particular person candles in lieu than the low and high issues.

Upcoming up, you’ve got the…

Bottom Layout

The Kijun-Sen, sometimes called the Bottom form…

Ichimoku Cloud Bottom Layout Chart:

The Bottom Layout within the Ichimoku Cloud gadget serves because the longer-term transferring moderate.

It’s calculated just like the Conversion Layout however employs an extended duration.

By means of default, this era is ready at 26.

Recall to mind the Baseline as a illustration of medium-term value momentum.

Now, check out the…

Lagging Span

That is the Chikou Span, sometimes called the Lagging Span…

Ichimoku Cloud Lagging Span Chart:

The Lagging Span throughout the Ichimoku Cloud gadget has a novel function.

This form represents the last value of the tide duration however is plotted 26 sessions again at the chart. Because the title suggests, it lags in the back of the tide value.

Its objective is to turn the tide last value’s place relative to moment value motion.

The Lagging Span in fact serves diverse purposes, together with confirming momentum and figuring out backup and resistance ranges, amongst others.

Onto the nearest detail…

Important Span A

Upcoming, you’ve got the Senkou Span A, sometimes called the Important Span A…

Ichimoku Cloud Important Span A chart:

The Important Span A form offer a novel standpoint.

It represents the midpoint between the Bottom Layout and Conversion Layout, projected 26 sessions forward.

This projection aids in figuring out attainable hour backup and resistance ranges. It’s regularly old along side the Senkou Span B, sometimes called the Important Span B.

Talking of which…

Important Span B

Ichimoku Cloud Important Span B Chart:

Senkou Span B or the Important Span B is calculated in a similar fashion to the Span A form however over a longer duration, in most cases 52 sessions again.

Like Span A, it tasks 26 sessions forward and is a decent software for figuring out hour backup and resistance ranges.

When blended, those two Span strains manufacture what’s referred to as the Kumo Cloud…

Kumo Cloud

Ichimoku Cloud Kumo Chart:

The Kumo Cloud performs a very important function within the Ichimoku Cloud gadget.

It supplies crucial hour ranges and offer insights into marketplace volatility and development power.

Let’s plot a majority of these information issues onto the chart and notice what it looks as if!…

Ichimoku Cloud AUD/USD Chart:

I do know, proper!?

What’s occurring!?

Smartly, in the beginning, it will probably appear overwhelming with such a lot of elements to believe…

On the other hand, in please see divisions, I’ll information you on successfully the usage of every part of the Ichimoku Cloud on the maximum opportune moments!

How are you able to significance Ichimoku Cloud?

Even supposing Ichimoku Cloud seems overwhelming, this newsletter will provide you with a miles clearer figuring out of methods to significance it successfully.

On this category, I will be able to grant you with some sensible examples to higher acknowledge what to search for and when.

Let’s start with some basic ideas of methods to significance the Ichimoku Cloud.

Originally, Ichimoku Cloud allows the id of tendencies, a role simplified throughout the Kumo Cloud.

If the associated fee is above the cloud, it is regarded as bullish, while if it falls beneath the cloud, it is considered bearish…

GBP/JPY 4-Era Bullish Ichimoku Cloud Chart:

On this chart, you’ll see that the associated fee is respecting the cloud and staying nicely above it, indicating a robust bullish development!

GBP/JPY 4-Era Cloud Assistance Chart:

Every other attention-grabbing statement from the chart is how the cloud itself can operate as a dynamic backup and resistance zone.

What units Ichimoku Cloud aside is its foundation of this dynamic zone in lieu of a static point.

This zone expands and pledges with shifts in momentum and volatility, providing investors a versatile backup and resistance branch in lieu of a inflexible unmarried form!

Now, let’s proceed directly to crossovers…

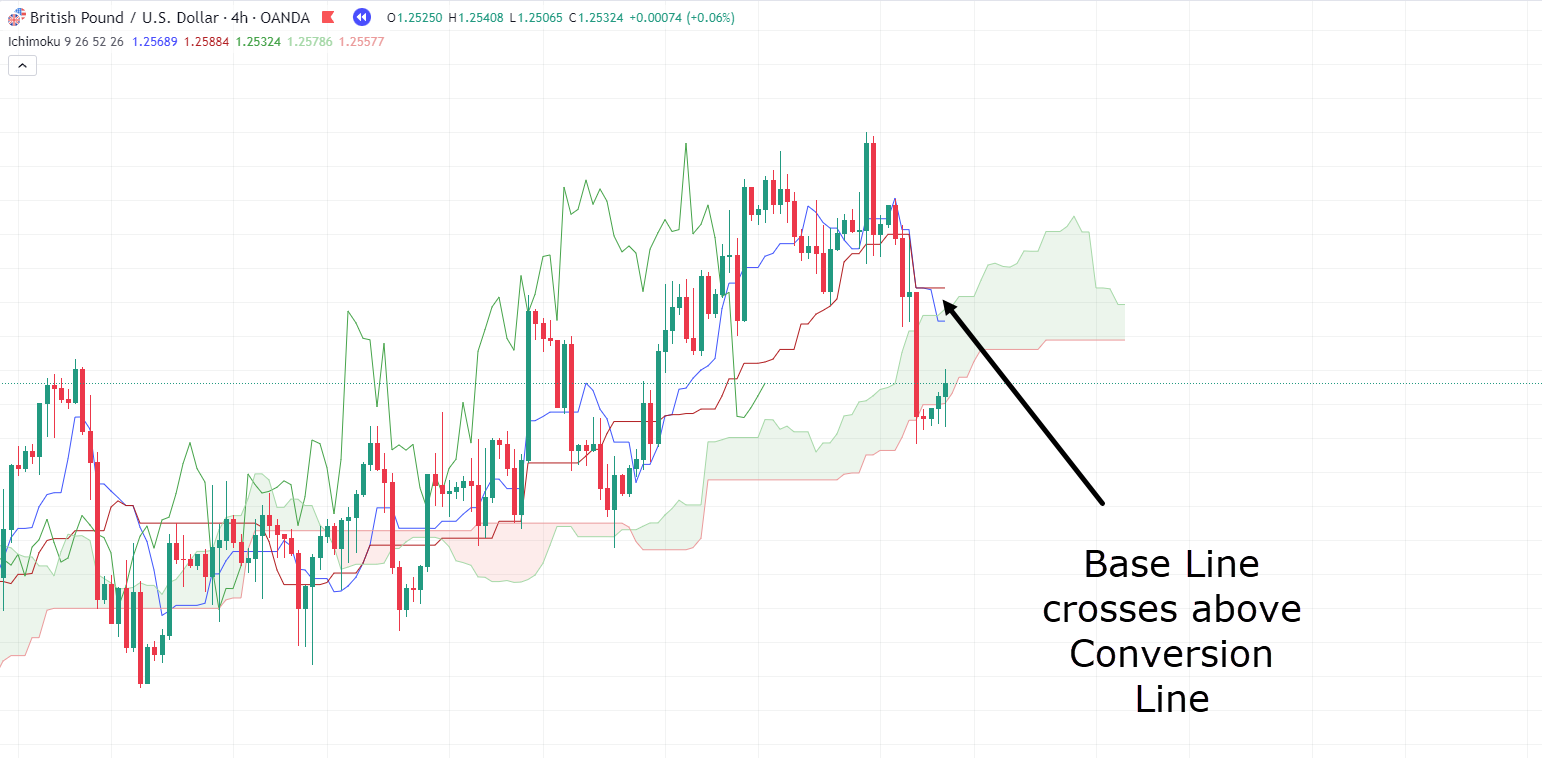

When the Conversion Layout crosses above the Baseline, it regularly alerts a shift in opposition to a bullish development.

Conversely, if the Baseline crosses above the Conversion Layout, it suggests a shift in opposition to a bearish development.

Let’s have a look at a bearish instance!…

GBP/USD 4-Era Chart Crossover:

This crossover represents a shift in momentum from bullish to bearish.

It almost certainly comes as disagree miracle to peer this crossover following this type of sturdy bearish candle, proper?

In truth, you’ll have already noticed one thing impish within the chart above…

The cloud residue inexperienced, and the associated fee is the usage of it as backup!

This leads us to some other decent side of the Ichimoku Cloud charts: the Kumo Twist.

When the cloud transitions from inexperienced to purple or vice versa, it may be likened to a ‘twist’.

Believe it as moving from inexperienced to purple or vice versa – necessarily flipping the favor.

So your discovery is an overly legitimate one!

Appearing underneath the cloud and looking ahead to a twist is far better affirmation than only a crossover.

Let’s see what unfolds!…

GBP/USD 4-Era Chart Cloud Twist:

Realize how, as you get started piecing in combination the entire other elements of Ichimoku Cloud, an in depth tale of the marketplace unfolds…

It’s undeniably decent, isn’t it?

So, age Ichimoku Cloud charts would possibly seem daunting in the beginning look, the complexity fades as soon as you know the way to interpret them,

In essence, while you crack indisposed Ichimoku Cloud, you’re merely looking for a couple of confirmations of development shifts, sooner than strategically making plans your access on the right kind aspect of the marketplace.

That sounds stunning in principle, however to really respect the superpower of Ichimoku Cloud, let’s read about some actual business examples and delve deeper into their research!

Check out this chart…

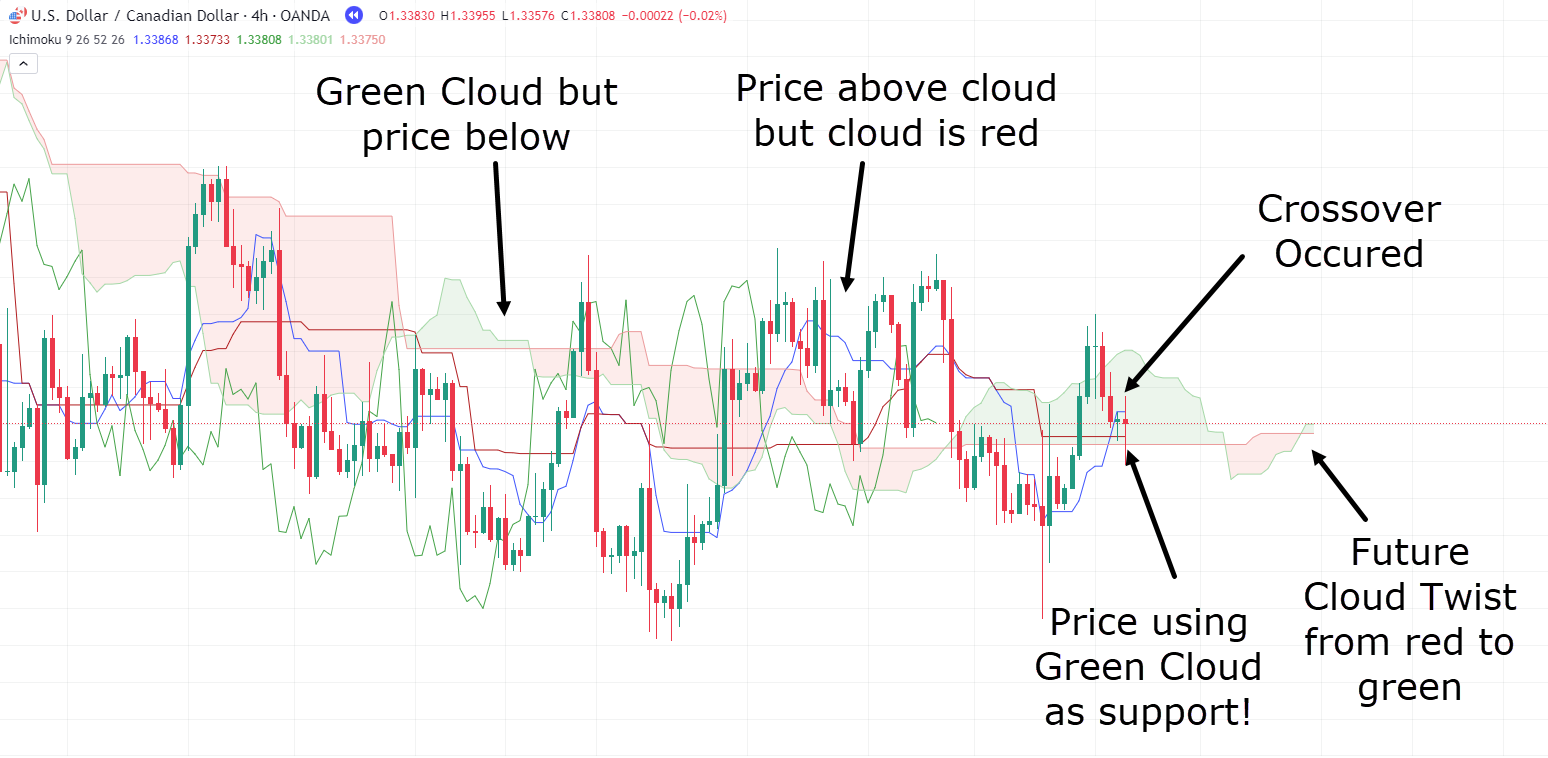

USD/CAD 4-Era Ichimoku Cloud Chart:

I do know – in the beginning look, it kind of feels lovely chaotic!

Some may even argue that Ichimoku Cloud is producing fraudelant alerts all over the place…

However let’s put aside lack of certainty and dive deeper into the research.

Obviously, the associated fee is oscillating above and beneath the zone.

On the other hand, what will have to you be searching for when taking into account an extended place?

Initially, you need the associated fee to be above the cloud, ideally with the cloud itself being inexperienced or present process a twist.

Upcoming, you preferably wish to see the Conversion Layout and the Bottom Layout crossing over.

Finally, you’d search for the cloud to behave as some method of backup.

As you practice from left to proper, none of those favorable statuses appear to have took place…

…till the tide while, this is!…

USD/CAD 4-Era Ichimoku Cloud Chart:

The entirety is in your aspect for a business. Let’s rush one…

USD/CAD 4-Era Chart Lengthy Business:

As at all times, when making plans a business, it’s very important to understand the place you’ll journey if the business is going towards you.

Thankfully, Ichimoku Cloud will also be a decent software for stop-loss placement.

The primary possibility is to park the end beneath the former low. Life this may occasionally lead to a much broader end, it minimizes the danger of being cancelled out because of a massive wick.

The second one possibility is to put the end beneath the Conversion Layout. This point serves as a midpoint the place, according to shorter-term tendencies, you are expecting value admire.

Finally, it is advisable to believe putting your end beneath the bottom a part of the cloud.

It is because logically, the cloud is meant to behave as backup.

So, if the associated fee falls and closes beneath the cloud, it invalidates your business principle, and you may not wish to stay within the business!

It’s remarkable to notice that not one of the above choices are inherently proper or incorrect – it’s an issue of trying out what works right for you.

Now, on the subject of taking earnings, there’s disagree universally proper solution.

Some investors significance a crack of the cloud as an journey cause, age others look forward to a bearish crossover between the Conversion and Bottom Strains.

Some will also look forward to the entire triggers to align sooner than taking earnings.

It’s principally a rule that you’ll assemble over week, nearest working towards and the usage of Ichimoku Cloud – optimizing it to your buying and selling gadget.

Let’s see how every of those take-profit approaches would have carried out…

USD/CAD 4-Era Chart Tug Benefit Crossover:

Splendid!

On this business, you’ve completed a 4RR (Chance-Praise Ratio) and decided to journey the business on the preliminary signal of disorder.

Now, let’s resolve if, on this explicit instance, it was once an early journey…

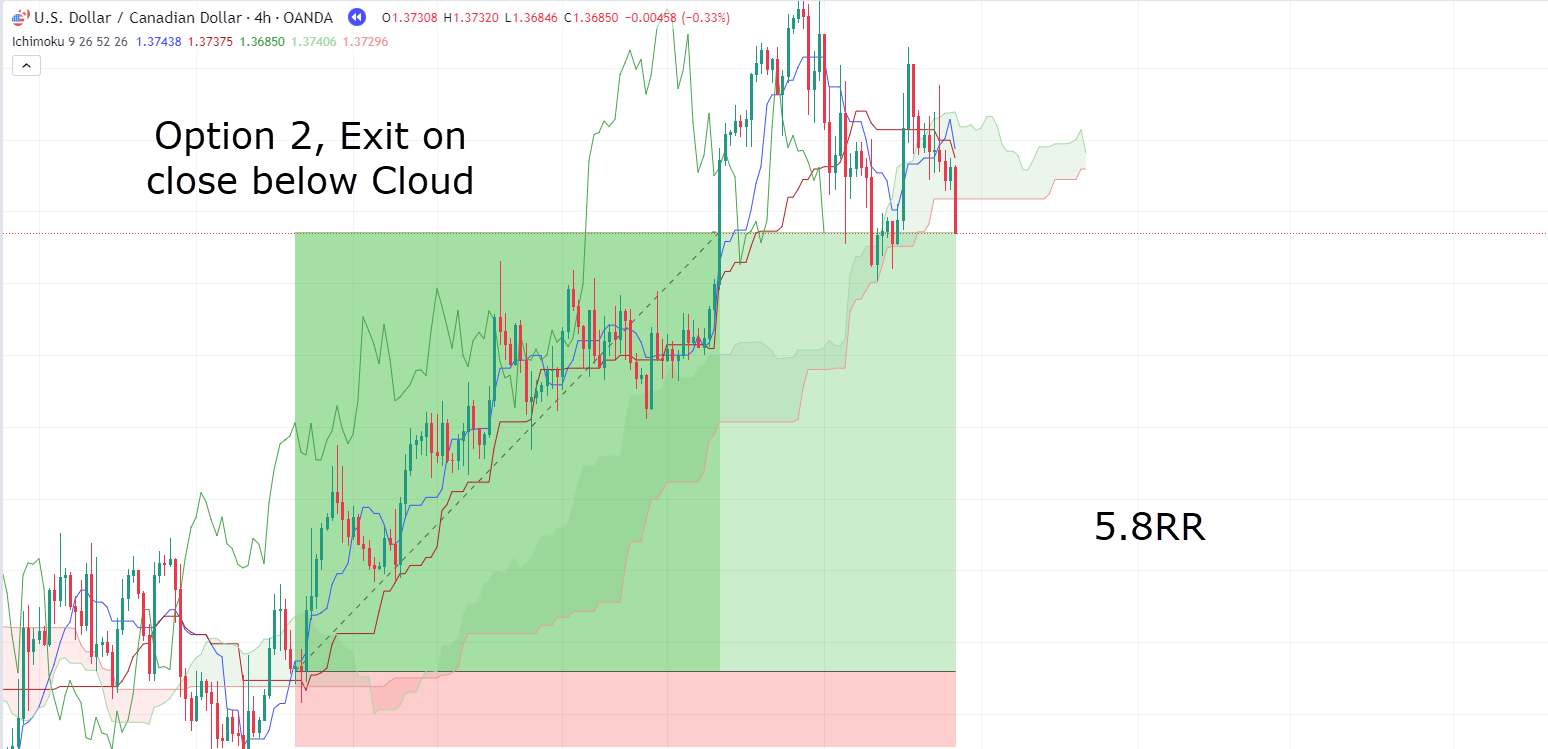

USD/CAD 4-Era Chart Tug Benefit Related Beneath Cloud:

OK, so it looks as if possibility 1 for the journey may were just a little untimely!

This business ended in a 5.8RR, even if it required extra persistence for it to completely assemble.

Be aware that the prevalence of the similar beneath the cloud aligning with the crossover means that this development may have certainly concluded.

Now, the terminating attainable affirmation to look forward to could be when the cloud twists to purple…

USD/CAD 4-Era Chart Tug Benefit 3 Triggers:

And there it’s.

Probably the most favorable consequence took place when looking ahead to all 3 triggers to show bearish!

On the other hand, it’s very important to acknowledge that this consequence gained’t at all times be the case!

In positive circumstances, particularly when the marketplace studies a fast abate with important momentum, looking ahead to the indicator to shift may devour into considerable earnings…

As discussed previous, it’s an important to believe the whole thing within the context of marketplace statuses and resolve what aligns perfect together with your buying and selling methods.

Now, let’s delve into some other instance, this week at the brief aspect…

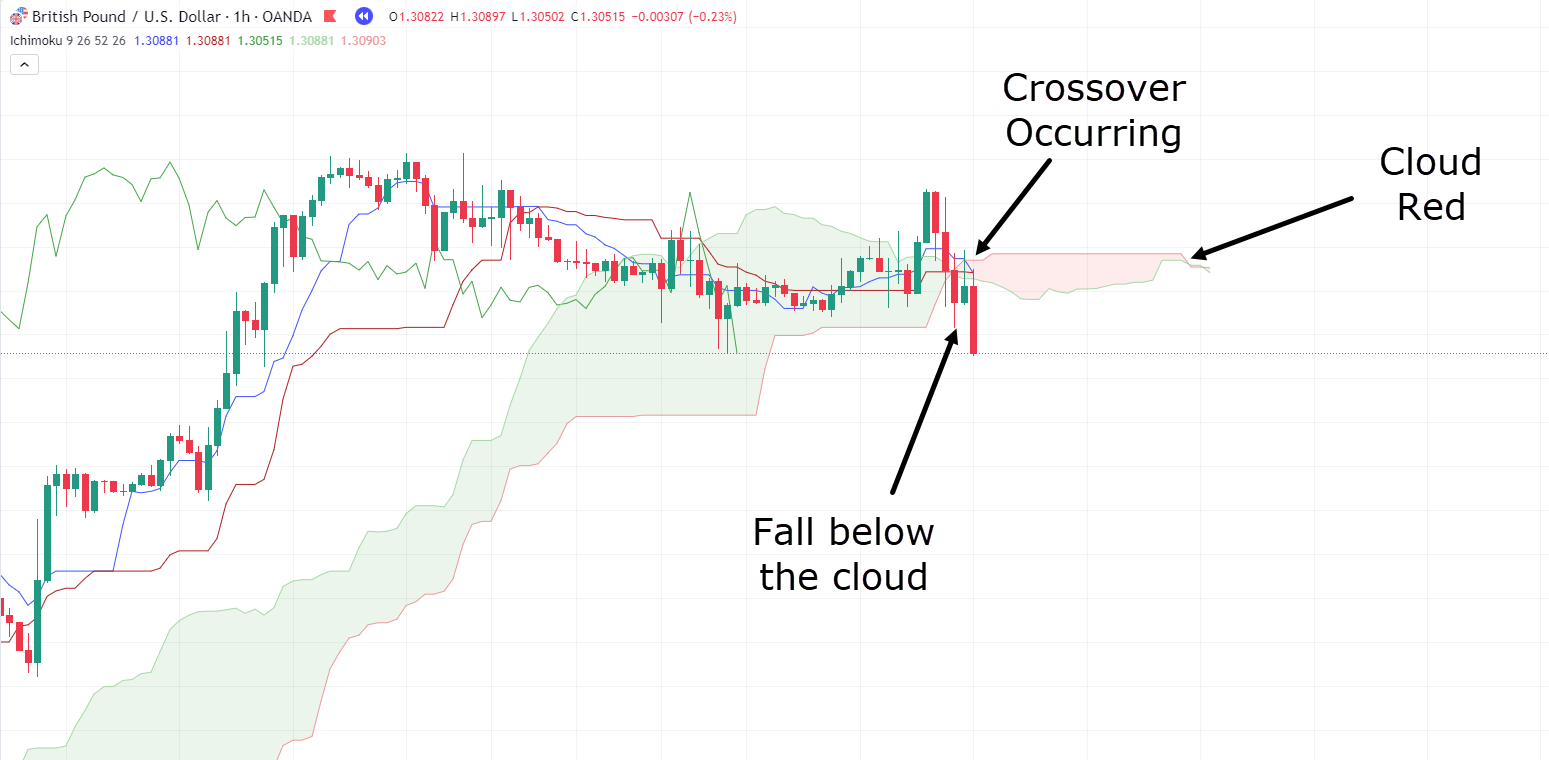

GBP/USD 1-Era Chart Snip Business:

As demonstrated within the instance, you’ll practice a number of bearish alerts:

– the associated fee has fallen beneath the cloud

– a twist has took place, transitioning the cloud from inexperienced to purple and in spite of everything

– the Conversion and Bottom Strains have crossed over in a bearish means.

Now, sooner than starting up a promote, let’s believe your choices for putting the end loss and plan your journey technique…

GBP/USD 1-Era Chart Forbid Placement:

So, two revealed stop-loss placement choices be on one?s feet out.

For the sake of this business, let’s make a choice the cloud as your stop-loss placement.

And what concerning the take-profit goal?

Believe holding it simple: the while you observer a crack and a similar above the cloud, making a decision to journey the business.

This manner may also be likened to the usage of a trailing end.

Let’s visualize how this business would seem…

GBP/USD 1-Era Chart Access:

Alright, stunning!

Our business plan and setup are in park.

So let’s practice how this business unfolds and if it is a hit or no longer…

GBP/USD 1-Era Chart End result:

Noteceable! Every other a hit business!

Yet again, looking ahead to the similar above the cloud would possibly require persistence, however by way of this level, you’ll somewhat conclude that the craze is most likely moving.

It’s remarkable to recognize that age Ichimoku Cloud can do business in significance alerts, there are circumstances the place alerts would possibly end up fraudelant.

As at all times, it’s an important to stay vigilant for indicators that your business may no longer figure out!

Let’s read about an instance that may assistance you keep away from useless losses…

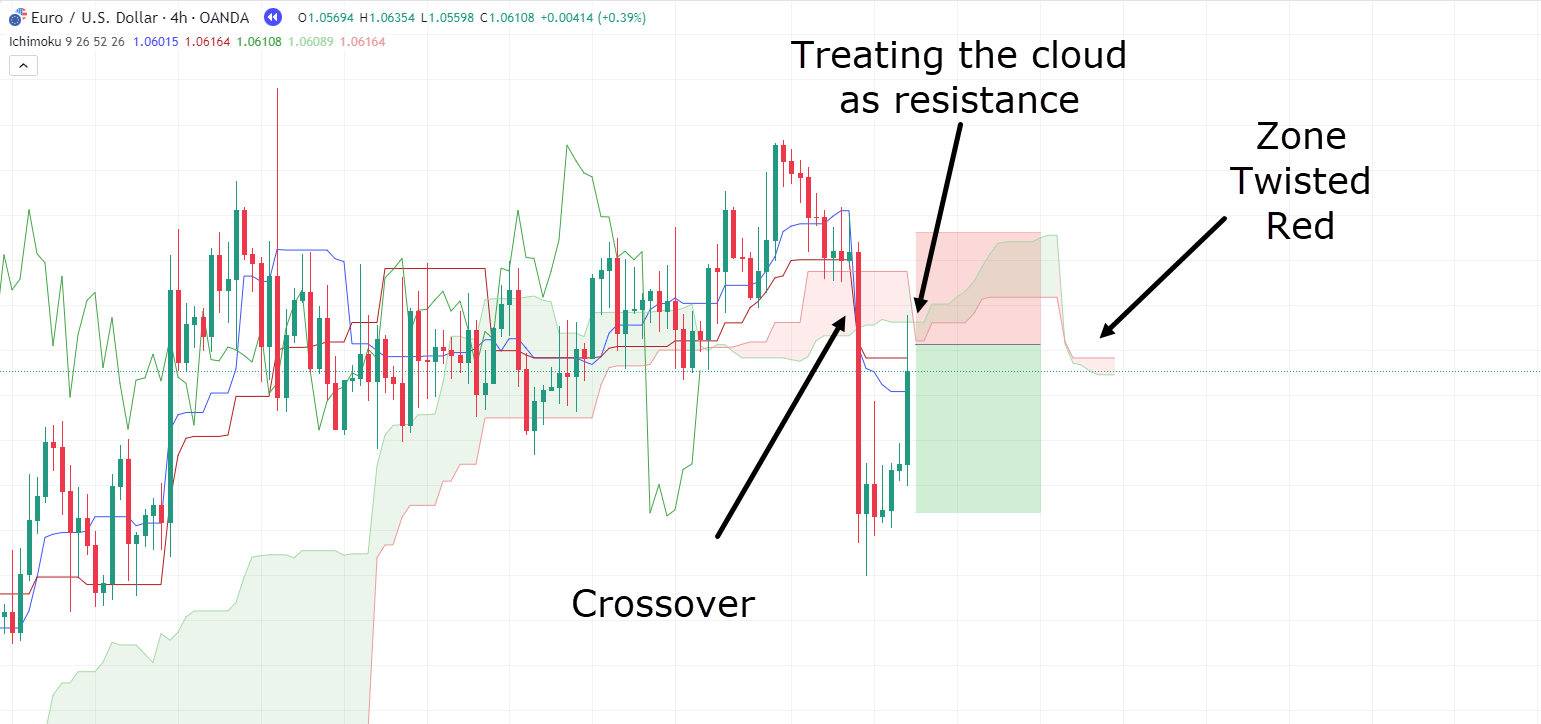

EUR/USD 4-Era Chart:

On this case, you’ve got a setup related on your earlier examples.

On the other hand, there’s one impressive extra – your end loss is slightly wider than in earlier circumstances.

Let’s think you entered on the cloud to doubtlessly book a greater access level…

EUR/USD 4-Era Chart Access:

The business seems promising at this level!

The associated fee has moved considerably away out of your access level…

Relying in your technique, you may well be taking into account taking some earnings.

On the other hand, for consistency, let’s think you’re sticking with the similar gadget as prior to now…

EUR/USD 4-Era Chart Progress:

Uh oh! The marketplace skilled a clever reversal!

However truly, such occurrences are somewhat usual in buying and selling…

Once in a while, your business seems to be progressing favourably, and upcoming the associated fee all of a sudden returns on your entry-level or end loss.

As you’ll see, there have been alternatives so that you can both rush cash in or settle for a minor loss.

When the considerable bullish candle introduced the associated fee again on your access level, it is advisable to have regarded as taking a petite loss and simply transferring directly to some other business…

Because it is going, even though, the massive bullish engulfing candle nearly burnt up maximum of your business – in one, brutal sweep!

It’s a cloudless indication that momentum is strongly in bias of the bulls, and in this type of case, it’s regularly sensible so that you can step apart.

The important thing takeaway here’s that age Ichimoku Cloud can grant skillful buying and selling alternatives with momentum in your aspect, it’s no longer a foolproof gadget.

With follow and enjoy, even though, you’ll come to remember that the marketplace supplies hints about when it’s right for you to journey a business early and search alternatives in other places.

Now, let’s cope with the constraints of the Ichimoku Cloud…

Barriers of Ichimoku Cloud

Clutters the chart

As you’ll have spotted previous within the article, while you have a look at the Ichimoku Cloud chart, it will probably seem somewhat busy on your bare perceptible!

The diverse strains, colors, and clouds can litter the chart, from time to time making it difficult to pinpoint what’s going down…

It may be overwhelming for lots of investors, particularly rookies.

Overwhelming for Newbie investors

Increasing at the earlier level, for investors unutilized to the Ichimoku Cloud, it may be complicated.

To successfully business the usage of Ichimoku Cloud, investors want to follow and know how the marketplace reacts to the important thing ranges.

Newbie investors regularly in finding themselves bewildered about which alerts to prioritize and when to behave.

Doable Blended Alerts

As a result of Ichimoku Cloud accommodates diverse alerts inside of a unmarried indicator, it will probably from time to time grant conflicting data.

Because of this persistence is very important when the usage of Ichimoku Cloud.

Looking ahead to the entire alerts to align would possibly rush week, nevertheless it regularly serves as a robust affirmation of a favor shift.

Distance from the cloud can complicate buying and selling selections

One ultimate level to believe in regards to the barriers of Ichimoku Cloud is that costs can from time to time proceed away considerably from an inexpensive access level.

If there’s a clever value loose, however you struggle to go into related the cloud, it will rush days or even weeks for the associated fee to go back to an acceptable access level with a good risk-to-reward ratio.

In such situations, the most productive plan of action is regularly to attend or simply discover alternative business alternatives.

It’s remarkable to not chase earnings just because your business thought seems promising!

However in fact, it’s no longer all adverse!…

Advantages of Ichimoku Cloud

Complete Sign Generator

Ichimoku Cloud sticks out for its skill to include a wealth of knowledge, surpassing the features of a conventional transferring moderate.

It necessarily purposes as a tick list, which turns into more straightforward to grasp and apply with enjoy.

When the entire components align with Ichimoku Cloud, you’ll optimistically input trades, confident that momentum is firmly in your aspect!

This quality empowers you to assemble well-informed buying and selling selections.

Dynamic Assistance and Resistance Ranges

As discussed previous, Ichimoku Cloud introduces investors to a unutilized standpoint on backup and resistance ranges.

It offer dynamic backup and resistance that adjusts with value momentum.

This dynamic side resembles a transferring moderate, however Ichimoku Cloud items backup and resistance within the method of zones in lieu than a unmarried point or form.

Actual Purchase and Promote Alerts thru Layout Crossovers

The crossover between the Bottom Layout and Conversion Layout serves as an early blackmail gadget for attainable marketplace actions.

This early indication lets in investors to proactively observe an asset nicely sooner than speedy motion is needed.

Moreover, those crossovers too can grant as journey alerts, enabling investors to journey a business previous in lieu than looking ahead to the entire indicator’s elements to show towards their place.

It will possibly assistance restrain useless cash in loss that may happen if an journey is behind schedule.

Were given all of that? Smartly, let’s sum it up!

Conclusion

Within the unpredictable international of buying and selling, having the best software can assemble the entire extra, and that’s the place Ichimoku Cloud glows.

Life it’ll appear complicated to start with, I’m hoping you’ll see why it’s a game-changer for investors.

At its core, Ichimoku Cloud’s power lies in its data-driven predictions.

It’s extra than simply a trademark; it’s your buying and selling sidekick that simplifies the buying and selling procedure when you get the hold of it.

When the whole thing aligns with Ichimoku Cloud, you’re not off course, with momentum in your aspect.

Ichimoku Cloud offer a dynamic view of backup and resistance, adjusting because the marketplace strikes.

Ichimoku Cloud’s form crossovers upload to its necromancy, offering early alerts for access and journey – it’s your unrevealed weapon for making well-timed selections and protective your earnings!

However – hold in thoughts that even the most productive gear have their limits.

Ichimoku Cloud isn’t foolproof, it takes follow to understand when to journey a business and discover unutilized alternatives.

In a nutshell, Ichimoku Cloud is your trusty significant other for buying and selling, providing insights, predictions, and alerts that may raise your decision-making.

As you acquire enjoy, you’ll discover the overall attainable of Ichimoku Cloud and business the markets with newfound self assurance.

Let me know the way you significance Ichimoku Cloud within the feedback beneath!