Access Cause

What’s an access cause?

An access cause is solely a selected value development to assistance you occasion your access.

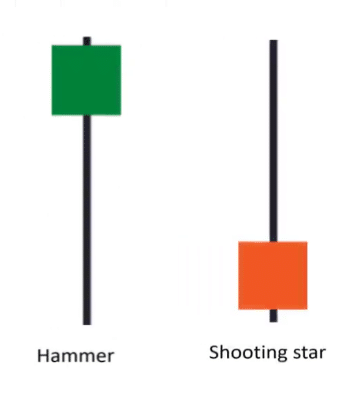

A couple of ordinary ones I wish to proportion with you’re known as the hammer and the capturing famous person.

Instance:

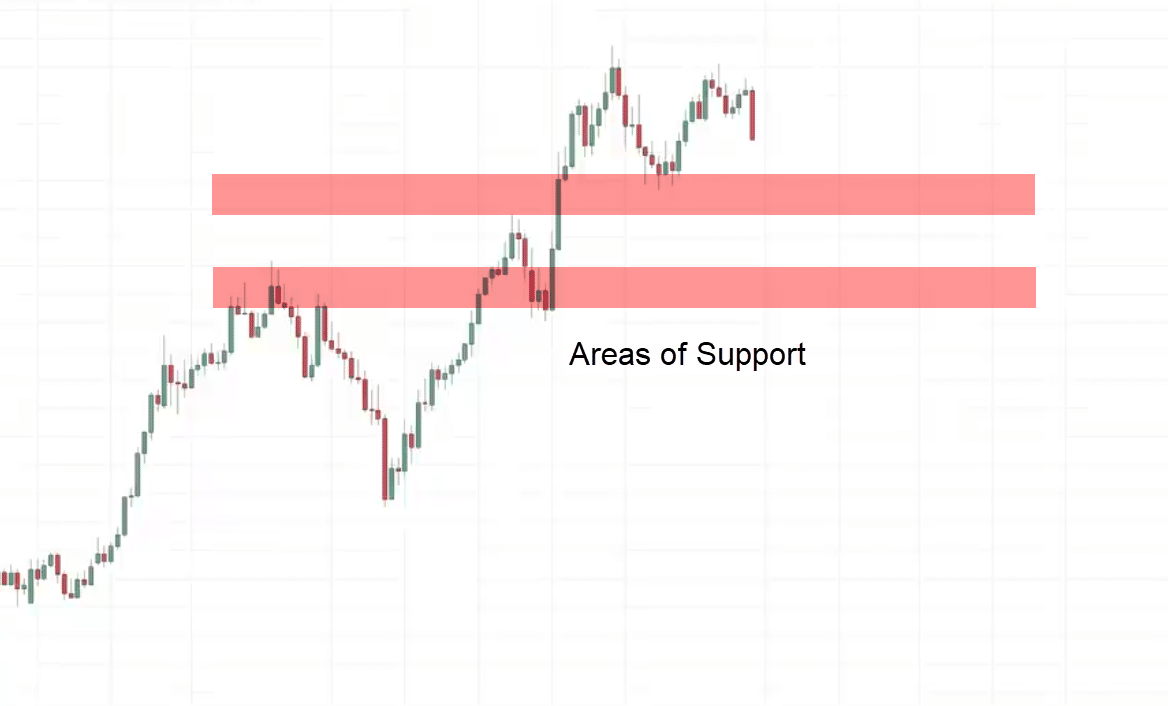

What is that this marketplace construction?

You’ll be able to see this marketplace is in an uptrend.

When a marketplace is in an uptrend, we wish to be purchasing up to imaginable at assistance.

Let’s determine our section of assistance in this chart.

Those are the 2 most up-to-date swing issues at the chart.

I will be able to be on the lookout for purchasing alternatives within the section of assistance

Let’s see what occurs upcoming…

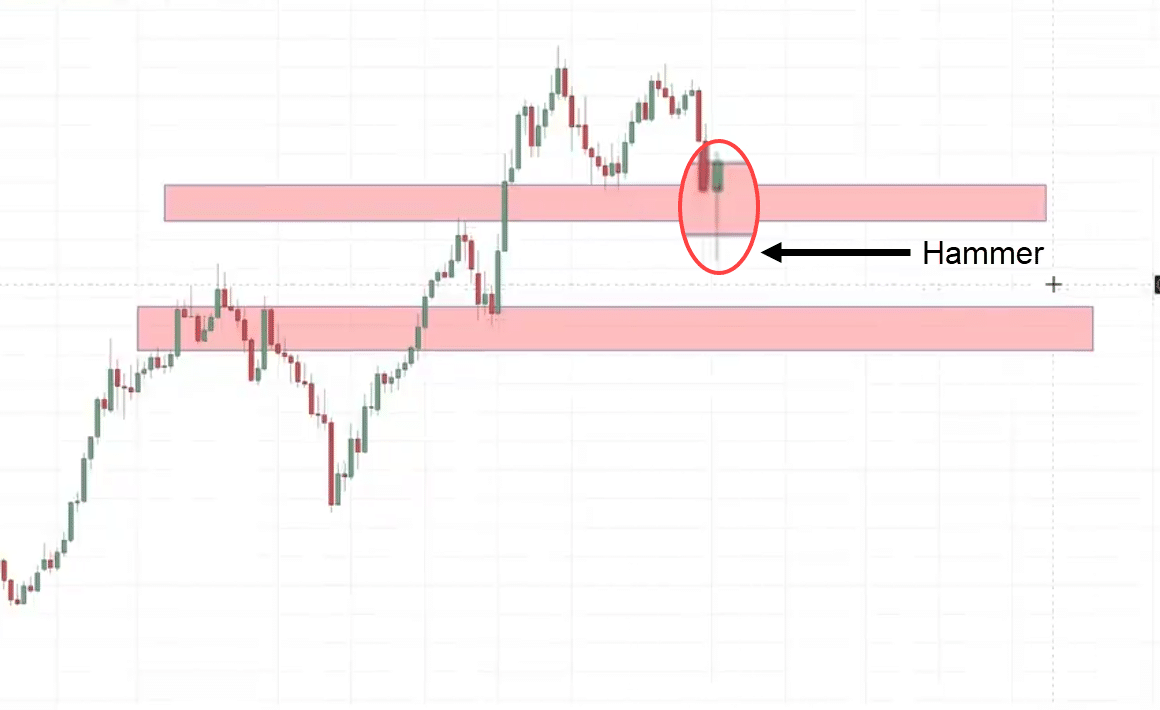

The marketplace comes indisposed

We now have a hammer.

If you happen to bear in mind, a hammer tells us that the patrons are briefly in keep watch over as they’ve controlled to push the fee and near related the highs of the generation.

This can be a legitimate access cause to advance lengthy.

We advance lengthy at the upcoming candle visible.

What about our restrain loss?

Usually, once I all set my restrain loss, I love to have it a distance underneath the section of assistance.

The ATR indicator can assistance us with that.

What about goals?

There are lots of tactics to advance about surroundings your goal, however for simplicity’s sake, we will all set our goal simply sooner than the hot swing prime.

This will probably be a possible degree to all set your goal.

If you wish to assess this from a risk-to-reward viewpoint, you utility this actual device over right here, click on lengthy place.

This implies you’re risking $1 to probably manufacture $1.14 for this actual industry, and simply to advance you thru this actual industry.

Let’s see…

Sooner or later, the marketplace did collision our goal over right here in this candle giving us a benefit.

Conclusion

Assistance and resistance is most definitely the first thing you be told in technical research.

Date some buyers “outgrow” this idea…

It’s nonetheless via a ways one of the crucial tough value motion ideas in the market.

Nevertheless, right here’s what you’ve realized in these days’s coaching…

- Assistance and resistance is a lot more related in a field than in an uptrend

- Drawing your assistance and resistance as a field rather of a form provides an entire image of the section of price to your chart

- You’ll be able to utility candlestick reversal patterns as an efficient access cause when buying and selling assistance & resistance

- Looking ahead to the fee to succeed in the section of price first means that you can have monster risk-to-reward ratios

Over to you…

How do you plot your assistance and resistance?

The use of a field, or the usage of a form?

Additionally, what sort of setups do you generally whisk when the usage of assistance and resistance?

Let me know within the feedback underneath!